Majedie Investments has shot to the top of the performance charts since overhauling its investment strategy last year. After selling its homegrown investment boutique Majedie Asset Management to Liontrust in 2022, the trust appointed Marylebone Partners in January 2023.

Chief investment officer Dan Higgins introduced a tripartite investment strategy consisting of direct equity investments (24% of the trust), external managers (56%) and hard-to-access special investments (15-16%) with the remainder in cash and equivalents.

Marylebone Partners gave the trust a 7.5% stake in its business to replicate the partnership with Majedie Asset Management and a six-month fee holiday. It now earns a flat fee based on the trust’s market capitalisation to align its interests with shareholders.

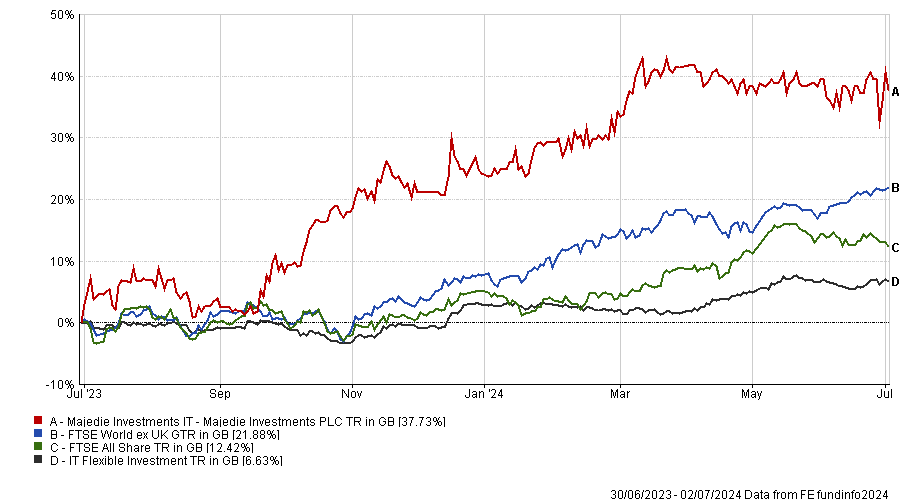

Returns thus far have been impressive. The trust topped the IT Flexible Investment sector last year, with total returns of 20.9%. It is the second-best performer of its peers so far this year, up 10.9% to 2 July 2024.

Performance of trust versus its two benchmarks and sector over 1yr

Source: FE Analytics

Its discount has narrowed substantially from the high twenties in 2022 to approximately 11% today, reflecting Marylebone Partners’ efforts to bring in new shareholders and stimulate buying interest. The trust has total assets of £163m and a market capitalisation is £129m.

Below, Higgins told Trustnet about his turnaround investment in the burger chain Shake Shack and why a quarter of the trust is invested in stressed and distressed credit.

What is your investment strategy?

We’ve coined the phrase ‘liquid endowment model’, which entails identifying differentiated opportunities sourced through a proprietary ideas network.

The endowment part involves finding alternative return sources, evoking the success of the great US university endowments. The liquid bit alludes to the fact we do not venture into private equity, venture capital, real estate, infrastructure, or any hard-to-value assets or those whose historic success is dependent on cheap leverage.

Over the course of nearly 30 years in the business, we’ve built up an extraordinary network of fellow investors, clients, advisors and former colleagues at institutions such as Fauchier Partners, Goldman Sachs and Wellcome Trust, through whom we source ideas that never get onto the radar screens of most other allocators.

What type of direct investments does the trust hold?

We own shares in 12 to 15 public companies that we believe can compound over the really long term. We try to find ideas that don’t feature in many other portfolios, for instance we only own two of the 50 largest components of the MSCI All Country World Index.

We have quality and growth criteria and a valuation discipline but we’re style agnostic and we have a mixture of stocks, some of which trade on a price-to-earnings (P/E) multiple of 20x while others have a P/E of 8x.

We own the life sciences company Thermo Fisher Scientific, which is widely regarded as being a high-quality growth compounder, as well as Breedon, which is an aggregates business that takes rocks out of the ground and is a beneficiary of infrastructure and the scarcity of its product.

What have been your best and worst calls since you took charge?

Our best-performing direct investment year-to-date has been Wabtec, the leading provider of infrastructure and services to the US rail industry. Earnings have consistently beaten expectations as the big rail companies have moved from relentless cost cutting to investing in productivity. Wabtec is the clear beneficiary of trends such as the electrification of rail and investment in rail infrastructure. Its share price is up 23.5% year to date as of 2 July 2024.

Our best performing fund by far is Helikon Investments, which is a European special situations manager that has shot the lights out in the past year or so because of contrarian positions they took in Greek and Turkish banks, property companies and gold miners in 2022.

The worst performing direct investment has been Alight, which enables companies to manage their human resources and employee benefits through a software platform. Its operating metrics are good but its share price has fallen 15.7% year to date.

Alight came to market in 2021 through a special purpose acquisition company (SPAC) and has been penalised along with a thousand other low-quality companies that used the SPAC structure to come to market a couple of years ago. We think that negative sentiment is completely misplaced. It’s a diamond in the rough.

Which other areas have done well?

Across the whole trust we have 25-30% in stressed and distressed debt and these investments are up 6-8% so far this year. The longer interests rates stay high, the better the yield we receive, so long as defaults don’t rise.

We think these strategies can continue delivering uncorrelated returns of 8-10% per annum for the foreseeable future even when interest rates come down. This is the engine room of the portfolio.

How have your special investments been performing?

We co-invested in the burger restaurant chain Shake Shack alongside Engaged Capital at around $80 and we have been taking profits at $110-120.

The turnaround story of cost savings, property efficiency and centralised buying has gone really well. Founder Danny Meyer has been receptive to Engaged Capital’s involvement and suggestions, such as standardising restaurant furniture instead of building tables from expensive reclaimed railway sleepers and installing a new senior management team.

We embarked on four new special investments in the past month, including another restaurant with Engaged Capital, a regulated business in Brazil and a large healthcare provider in the US.

We want to have 20% of the portfolio in special investments because they are exciting, high-conviction opportunities brought to us by trusted managers in our network and we typically don’t pay a management fee or the fee is very low. We’re at 15-16% and it is taking time because we have high standards: we need to earn an internal rate of return of at least 20% and to monetise these ideas within three years or sooner.

What do you enjoy doing outside of investing?

Beyond all the usual stuff like spending time with my family and playing tennis and golf, I am a decorated competitive vegetable grower.