Perhaps more than any other area of the market, those assets listed as alternatives have a crucial role in portfolios. In most cases they need to provide returns but also diversification away from the more vanilla equities and bonds. For some, such as those in retirement, income will also be a key priority.

A range of investment trusts with exposure to debt, property, infrastructure and renewable energy are ticking all the boxes – delivering top-quartile total returns over three years, a steady income stream and diversification away from investors’ equity and bond allocations. Below Trustnet reveals the best.

Debt strategies

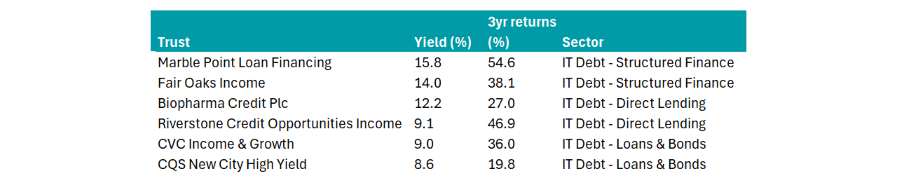

Six trusts across the three IT Debt sectors (Direct Lending, Structured Finance and Loans & Bonds) meet the criteria.

Marble Point Loan Financing was the best performer from a total return perspective, returning 54.6% over three years to 17 July 2024 and paying a 15.8% annual dividend yield (as of April 2024).

Total returns and yields of debt trusts

Source: FE Analytics, trusts’ factsheets

While falling interest rates should provide a boon for most debt strategies, QuotedData analyst Matthew Read singled out CQS New City High Yield as “the best-positioned of its peers to benefit” because it has locked in decent yields in advance of rate cuts.

The trust is “consistently one of the highest-dividend-yielding funds in its peer group and, over the longer term, is also one of its best-performing,” Read continued.

“It has benefitted from an uplift in capital values as the headwind of higher interest rates that weighed on bond valuations in 2022 and 2023 has turned tailwind.”

Leasing

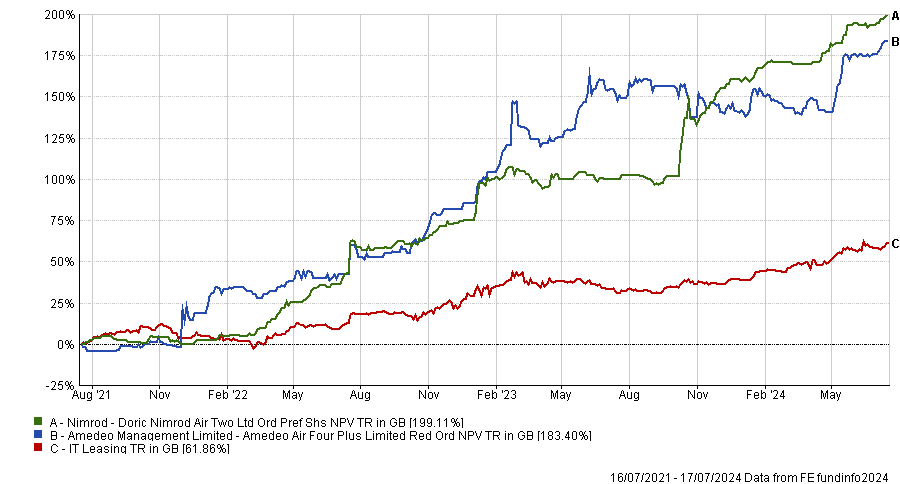

Two trusts in the leasing sector delivered impressive three-year total returns and high yields.

Amedeo Air Four Plus and Doric Nimrod Air Two are paying out 19.4% and 15.3% respectively, with three-year total returns of 99.4% and 119.5%. Amadeo has a market capitalisation of £125.4m and Doric is slightly larger with £145.6m.

Total returns of trusts vs sector over 3yrs

Source: FE Analytics

Both trusts acquire, lease and sell aircraft and they benefited from a strong recovery in air passenger traffic last year.

Amadeo’s chairman Robin Hallam said: “Demand for travel remains strong and constraining factors are related to capacity. Manufacturers cannot make up the shortfall in supply of aircraft, engines and parts which occurred between 2019 and 2022, which means lease rates and values for in demand aircraft are rising, especially if they are off lease and immediately available.”

Infrastructure

Four trusts investing in renewable energy infrastructure delivered top-quartile, positive returns for the three years to 18 July 2024 and yields above 4%.

The NextEnergy Solar fund had the highest yield of the group at 10.2%, followed by Bluefield Solar Income with an 8.8% payout, Greencoat UK Wind (7.4%) and Foresight Solar (6.3%).

The top performer over three years was Greencoat UK Wind, which returned 24.5% and is expected to benefit from the Labour government repealing the ban on onshore windfarms.

Performance of trusts vs sector over 3yrs

Source: FE Analytics

As Tommy Kristoffersen, manager of EdenTree Green Infrastructure, explained: “Last week, new chancellor Rachel Reeves arguably did more for onshore wind development in England in 72 hours than previous governments had done in over a decade by removing the restrictive clauses which had made onshore wind development nigh on impossible since 2015, marking a significant advancement in renewable energy support and opening up a pipeline of investment potential.”

Peter Hewitt, who manages the CT Global Managed Portfolio Trust, expects the value of Greencoat UK Wind’s assets to rise now the sector has a “clearer road ahead” and the government is making “positive noises”. The £3.2bn trust is trading on a 13% discount.

Real estate investment trusts

Three trusts in the UK commercial property sector and two property debt strategies delivered top-quartile, positive total returns over three years and yields above 4%.

The best performer was Starwood European Real Estate Finance, up 22.3% over three years. It pays a 6% yield. Next in line was Alternative Income REIT, which returned 17.5% over three years and yields 8.7%.

Cheyne Capital Management’s Real Estate Credit Investments had the highest yield of 9.8%, although its three-year total return was just 9.2%. AEW UK REIT yields 7.96% and returned 10.2% over three years.

The fifth trust on the list, Schroder Real Estate Investment Trust, returned 8.1% over three years and yields 8.2%.

Four more REITs were top-quartile performers in their sectors but they lost money over three years as the interest rate hiking cycle took its toll, so they have been excluded from this study.

Going forward, however, a range of tailwinds including imminent interest rate cuts and the Labour government’s housebuilding initiatives and planning reforms should boost the property sector.

Hedge funds

Gabelli Merger Plus was the best performing strategy in the IT Hedge Fund sector over three years to 17 July 2024 (up 46.1% whereas the sector was flat) and it has a 5% distribution yield.

The trust invests in cash-generating franchise companies, selling at a significant discount to Gabelli’s appraisal of their private market value. The trust generates returns when the prices of its investee companies rise due to corporate events such as mergers, acquisitions, takeovers or leveraged buyouts.