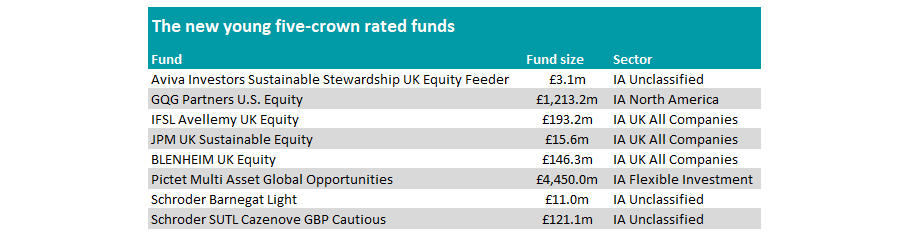

Eight young funds with around three years of track record have been given a coveted five FE fundinfo Crown Rating at the first time of asking, following the latest rebalance.

Meanwhile, a further 82 incumbent funds improved their ratings to the top of the ladder, taking the total number of five-crown-rated portfolios to 354.

There were clear preferences for technology stocks, with many of the top-rated funds benefiting from high exposure to ‘Magnificent Seven’ names such as Nvidia.

However, there were some opportunities elsewhere too. For example, funds with low interest rate sensitivity and high credit exposure benefited from fewer interest rate cuts than expected, while cyclical investment strategies, driven by the global economy largely avoiding recession, also did well.

Charles Younes, deputy chief investment officer at FE fundinfo, said value investing has “proved its worth” in the equity bucket, while the lack of interest rate cuts from the Federal Reserve and the Bank of England meant many of the top-performing bond funds were low duration.

“Many of the standout performers in this rebalance, such as GQG, were strategic in this volatile market, adapting to changing forecasts and finding consistent returns for clients - especially in AI [artificial intelligence] stocks,” he said.

“And they were not alone, with the AI boom driving investors to the haven of ‘Magnificent Seven’ stocks, amidst choppy waters in the bond markets at the start of 2024.”

Among the new entrants, the most popular among investors has been Pictet Multi Asset Global Opportunities, which has raked in £4.5bn since its launch three years ago. The only other fund on the list with assets under management (AUM) of more than £1bn is GQG Partners U.S. Equity, which took in £1.2bn.

Source: FE fundinfo

The latter is also the only top-quartile performer in its sector over three years, returning 60.6%.

Recommended by FE Investments analysts, the fund buys exclusively large and mega-cap quality-growth stocks in the US, but is flexible based on macroeconomic factors – meaning turnover can be high but so can its potential for outperformance.

“The macro ‘switch off’, whereby entire sectors can be exited quickly in the event of new risks emerging, has been highly successful at limiting damage in falling markets,” the analysts said. The cost – it has an ongoing charges figure (OCF) of 55 basis points – is also “incredibly competitive”.

Three IA UK All Companies funds gained the top crown rating at the first time of asking, while there were three from the IA Unclassified sector.

There were also some big movers among funds with longer track records. On the downside, WS Ruffer Total Return slipped from five crowns to one. It resides in the third quartile of the IA Mixed Investment 20-60% Shares sector over three years but has been the worst performer over 12 months, losing 0.1%.

Oasis Crescent Global Income and Threadneedle Index Linked Bond were the only other names to suffer the ignominious drop, while others such as BlackRock US Mid-Cap Value, Dodge & Cox Global Stock and Dodge & Cox US Stock dropped from five to two crowns.

Popular fund Fundsmith Equity meanwhile dropped down a crown, from two to one, as Terry Smith’s flagship portfolio continues to struggle to beat the MSCI World index, while all four Lindsell Train portfolios are now rated with one crown after WS Lindsell Train North American Equity was downgraded from two crowns, joining the firm’s other three portfolios at the base of the rankings.

On the upswing, Nedgroup Contrarian Value Equity leapt from a one-crown rating at the previous rebalance to a five-crown rating this time around. It was the only one to make such a leap after the fund’s recent run moved it into the first quartile of the IA Global sector over one, three and five years.

Epworth UK Equity For Charities and IQ EQ Defensive Equity Income moved from two crowns to five, while VT Price Value Portfolio moved from one to four – marking the other big movers.

Overall, in sector terms, the top performer was IA Specialist, with 23.8% of the peer group gaining a five-crown rating, followed by the IA Sterling Strategic Bond and IA Japan sectors, both scoring an average of 21.5%.

Going the other way, the IA Infrastructure sector – a leading peer group a year ago with six of 21 funds (29%) five-crown rated – continued its long-term decline in fortunes and now has no five-crown-rated funds.

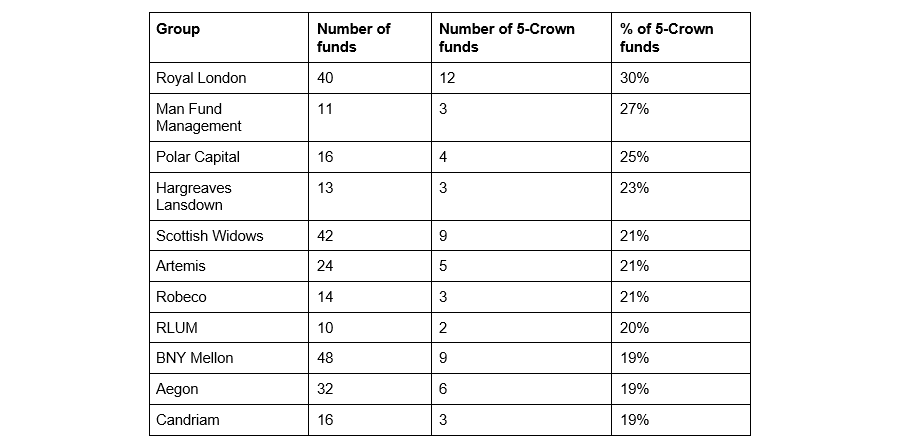

In terms of fund groups, among those with more than 10 portfolios, investors have the best chance of owning a five-crown-rated fund from Royal London, where almost a third of its funds have the top ranking.

Source: FE fundinfo

In the latest rebalance, big winners included Evelyn Partners, which gained three top ratings, and GQG Partners, which added two five-crown-rated funds. All of its funds are now five-crown rated.

On the other side, M&G lost four top ratings and Lazard lost three. There were 15 other groups that lost multiple five-crown ratings.