Schroder Investment Solutions is massively overweight emerging markets, entrusting Fidelity, Polar Capital and Artemis with about a third of its highest risk portfolios. The model portfolio provider is also bullish on small-caps, which it expects to benefit from rate cuts.

Its highest risk model portfolio, level 10, has 36% in emerging market equities from a combination of Asia and emerging market funds plus exposure within global funds. By way of comparison, emerging markets constitute 10.9% of the MSCI All Country World Index.

Emerging market exposure is then scaled back in accordance with risk appetite; Schroders’ medium-risk portfolios have about 50% in equities and of that, 11-13% is in emerging markets.

The firm favours emerging markets because they are less efficient than the US and fewer sell-side analysts cover them, so active managers have a greater chance of outperforming their benchmarks and uncovering hidden gems, said Rob Starkey, a multi-asset portfolio manager.

This is a high risk, high reward asset class, he continued. “If you're willing to risk the volatility, you should get the return in the long run.”

By contrast, US large-cap managers usually only manage to beat their benchmarks by 0.2% to 0.3% “if you’re lucky”. Because the alpha is so low, “we need to hammer them on fees,” he said. “But if we go to emerging markets, we don’t have the same hurdle to step over.”

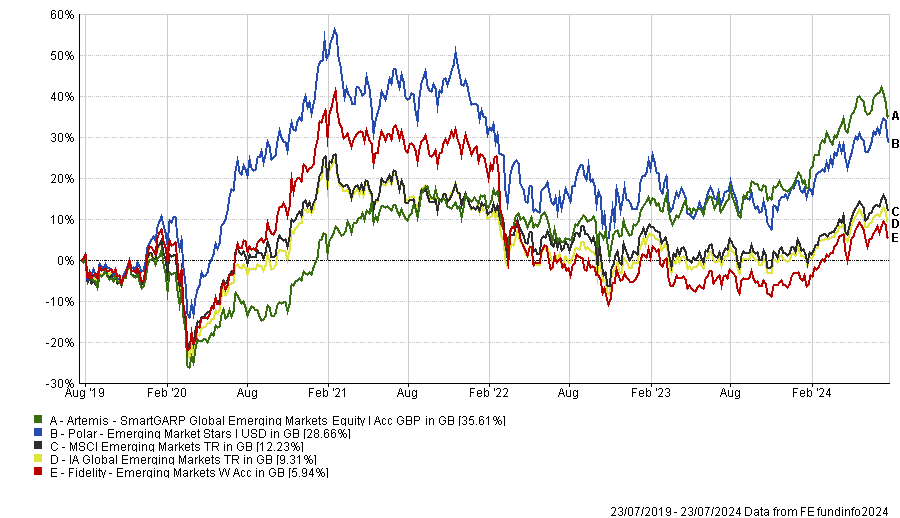

Schroder Investment Solutions has chosen a range of emerging market equity managers to gain exposure to a variety of factors, styles and market capitalisations. It holds Artemis SmartGARP Global Emerging Markets Equity, Fidelity Emerging Markets and Polar Capital Emerging Market Stars.

Artemis SmartGARP is “a phenomenal franchise and they've just done extremely well combining the human element and the quantitative element,” Starkey said.

The fund’s co-manager Peter Saacke recently left the investment industry to become a maths teacher. Raheel Altaf, who has co-managed the strategy since inception, remains at the helm.

Nick Price’s Fidelity Emerging Markets fund has suffered recently due to its copper exposure and slightly cyclical style, but it has performed strongly throughout the cycle, Starkey explained.

Polar Capital Emerging Market Stars is managed by Jorry Rask Nøddekær, Naomi Waistell and Jasper Wright. They invest in high-quality businesses and although the fund has a growth tilt, they also pay close attention to valuations. They look for a catalyst to enable them to invest at the right time, Starkey explained.

Nine months ago, Schroders moved out of emerging market small-caps and invested in Polar Capital’s fund instead, just at the right time. “That’s been an exceptional trade for us,” Starkey said.

Performance of funds versus sector and benchmark over 5yrs

Source: FE Analytics

Schroders also has a range of sustainable model portfolios, which hold Robeco Sustainable Emerging Stars Equities for core/value exposure, Stewart Investors Asia Pacific Sustainability and UBAM Positive Impact Emerging Equity.

Robeco has an impressive track record and a strong investment process, he said. It is highly rated by Schroders for its sustainable credentials, having invested significantly in this area, which is a priority for the firm.

Stewart Investors has a quality focus and a bias towards India, away from China, which has been a tailwind for performance.

On the other hand, the UBAM Positive Impact fund, which is managed Union Bancaire Privée, has faced headwinds recently. Its mid-cap growth style has been out of favour and it is overweight China, he noted.

Performance of funds vs MSCI Emerging Markets over 5yrs

Source: FE Analytics

Starkey’s second asset allocation tilt is towards small-caps, which have had a tough couple of years but should recover on the back of interest rate cuts. Small-caps are so cheap that they are “primed for any upside surprise,” he said.

Indeed, US small-caps have outperformed large-caps significantly in the past couple of weeks in reaction to inflation data, with investors anticipating that the US Federal Reserve will soon begin to cut rates.

Starkey prefers to use active small-cap managers who have a proven track record of picking winners because so many small companies are unprofitable. He thinks regional specialists have an edge because the global small-cap universe is too vast.

Schroders uses Fisher Investments Institutional US Small and Mid-Cap Core Equity, River Group’s R&M UK Listed Smaller Companies, Morant Wright Japan and Morant Wright Nippon Yield.

Schroders’ model portfolios rebalance quarterly so Starkey wanted to find a core, nimble manager who could be pragmatic and react quickly to changes in the macro-economic outlook, which is why he chose Fisher Investments.

Meanwhile, River made some changes to its team in 2022 with George Ensor becoming the small-cap fund’s lead manager, but the investment process behind the strategy and its alpha potential remained strong, so Schroders’ conviction in the strategy held firm.

In Japan, the Tokyo Stock Exchange’s reforms are targeting companies with a price-to-book value below one and many of these companies are mid-caps, which is Morant Wright’s “hunting ground”, he said.