Small-cap funds dominated in July while those heavily skewed to the tech behemoths took a bit of a battering, according to data from FE Analytics.

It was a news-packed month on the political front with elections in the UK and France, while in the US Republican candidate Donald Trump survived an assassination attempt and president Joe Biden formally withdrew from the upcoming general election, replaced by his vice president Kamala Harris.

In markets, the UK led the way, with the FTSE All Share up 3.1%, while the next-best major index (the Japanese Topix) rose just 50 basis points.

At the other end of the scale, the MSCI Emerging Markets index was the worst performer, down 1.3%, while there was a rare loss for the US S&P 500, which retreated 0.4%.

But at a fund sector level there were some big shifts. The seemingly unstoppable tech behemoths were held in check last month, with the IA Technology & Technology Innovation and IT Technology & Technology Innovation leading the worst-performing sectors over the course of the month in the Investment Association (IA) and Association of Investment Companies (AIC) universes.

Source: FE Analytics

A wobbly earnings season has hit the sector hard, with a number of the ‘Magnificent Seven’ failing to match glittering expectations. Last week, the S&P 500 Index suffered its worst day since December 2022 and the Nasdaq experienced its biggest fall since October 2022 following underwhelming earnings reports from mega-caps Alphabet and Tesla.

A late surge from Nvidia, which added a record $331bn in market capitalisation yesterday, was not enough to save the monthly performance figures.

Dan Coatsworth, investment analyst at AJ Bell, said: “Euphoria around AI [artificial intelligence] is now at risk of spluttering if more people ask when companies are going to generate positive returns from the significant investments made to support artificial intelligence technology. It’s no longer good enough to simply say AI will be deployed.”

Taking their place at the head of the table were smaller companies, with the IA North American Smaller Companies (5.3%) and IT North American Smaller Companies (12.3%), the biggest gainers.

UK smaller companies also appeared on the top five sectors in both the investment trust and open-ended fund lists. With interest rates expected to come down in the coming months and signs that the tech stocks could be due a dip, investors may be looking for formerly unloved areas of the market to put their cash.

Elsewhere, property did well as the prospect of lower interest rates bolsters the relative yield on offer from the sector, while broader UK sector also appeared in the top five.

Ben Yearsley, director at Fairview Investing, said: “It’s like a trip down memory lane with boring and forgotten sectors doing well.”

At the foot of the table, joining tech funds and trusts were China specialists, with the country continuing to lag the rest of the world. An increased likelihood of Trump returning to the White House could exacerbate US-China tensions. This dragged both Asia and emerging market funds down too, as the country is the largest market in both regions.

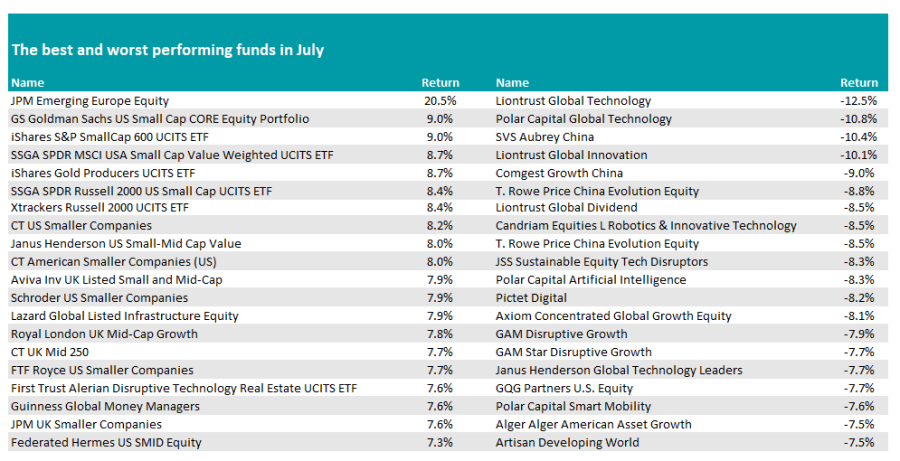

Turning to individual funds, the trend above was borne out in the list below, with US smaller companies dominating the top-returners list in July.

Leading the way among this group were passive and benchmark-aware funds, including GS Goldman Sachs US Small Cap CORE Equity Portfolio and iShares S&P SmallCap 600 UCITS ETF, which both made 9%.

Eight of the top 10 were US small-cap funds, with CT US Smaller Companies, Janus Henderson US Small-Mid Cap Value and CT American Smaller Companies (US) making up the active part of the list.

Source: FE Analytics

UK small-caps also surged, with the Aviva Inv UK Listed Small and Mid-Cap leading the domestic funds over the month, up 7.9%.

The top spot however went to JPM Emerging Europe Equity, which continued its strong run from last month (up 20%) with another 20.5% gain. The fund plummeted after Russia’s invasion of Ukraine and is slowly regaining the losses over the past few years.

At the foot of the tables, technology funds were the dominant theme. Yearsley said: “Poor old Liontrust had three funds in the bottom 10 performers in July with Liontrust Global Technology propping the tables after losing 12.5%.

“James Dowey and Storm Uru manage that fund as well the Liontrust Global Innovation and Liontrust Global Dividend that also made the worst 10 performers last month.”

Elsewhere, China was the other notable theme last month with many Chinese equities funds having a tough time, with four names in the bottom 20, headlined by SVS Aubrey China, which made a loss of 10.4%.

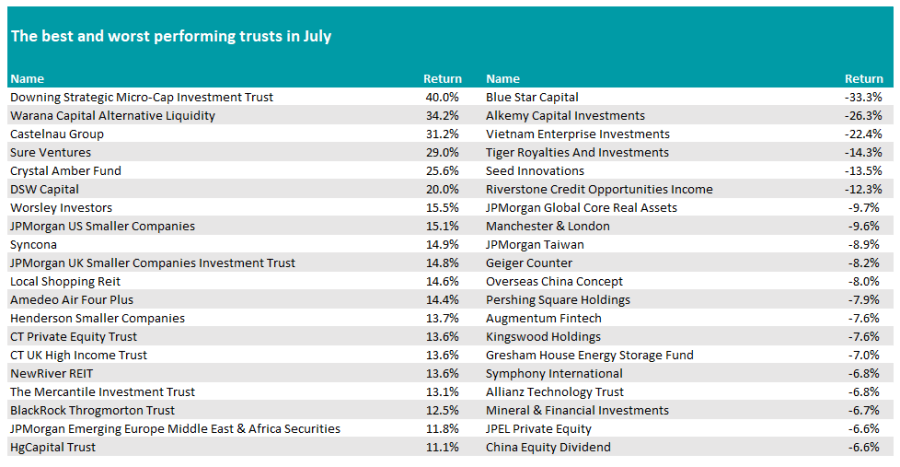

It was a mixed bag as ever in the investment trust space, however, where Downing Strategic Micro Cap officially topped the tables with a gain of 40%, although the trust is winding up and paying back capital to shareholders.

Yearsley said: “That trust hasn’t been a happy ride for shareholders as there haven’t been many takers for micro-cap value stocks since that trust launched.”

Source: FE Analytics

On the other end, Blue Star Capital was the biggest faller of the month, down by a third, while Alkemy Capital Investments (-26.3%) and Vietnam Enterprise Investments (-22.4%) made up the bottom three.