Markets have paused for breath this morning after days of indiscriminate sell-offs across the world. Most Asian markets nudged higher overnight and in Japan, the Nikkei 225 surged back 6% as the country was given priority negotiation rights with the US.

In early trading, the UK’s FTSE 100 and German DAX both were up between 1.6% and 1.9%, while other European markets were trading in a similar band at the time of writing.

But this does not discount the bloodbath that has occurred since US president Donald Trump announced his wave of punitive tariffs on the rest of the world.

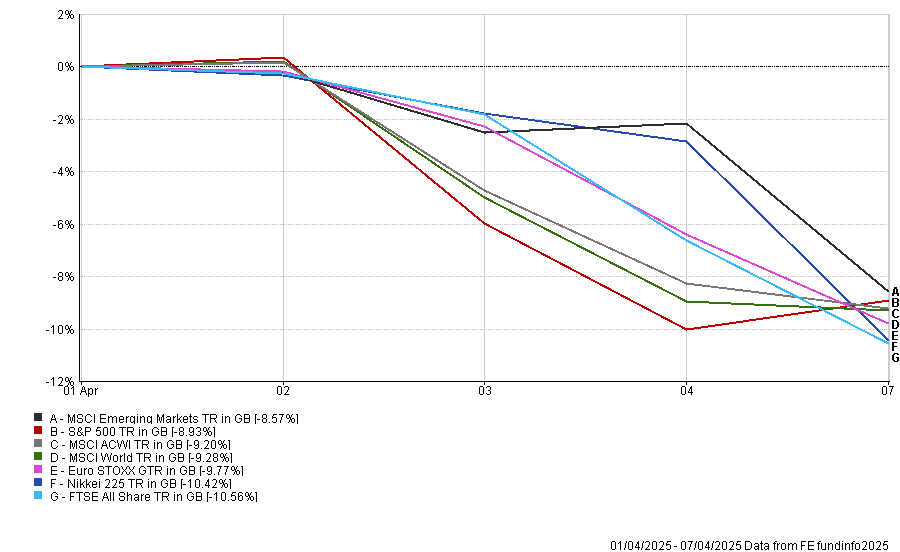

As of last night, every major market index was down between 8.6% and 10.6% in sterling terms, as the below chart shows. In local currencies, the figures are even worse.

Performance of indices since Liberation Day

Source: FE Analytics

Russ Mould, investment director at AJ Bell, said: “After multiple punishing sessions, stock markets appear to have started their road to recovery.”

Part of this was due to a “brief flutter of excitement yesterday” when rumours suggested the president may impose a pause on tariffs (excluding those on China). This caused a rally in US shares, although the White House was quick to deny speculation.

“It was enough of a window into what might happen with markets if Trump were more accommodating,” said Mould, as the Nasdaq ended the day with a very small gain, while the S&P 500 was only down 0.2%.

“It suggests investors are slowly regaining confidence, perhaps in the belief that an actual breakthrough on tariffs – either a temporary pause or positive negotiations – could unleash the mother of all rebound rallies.”

But things can move quickly and with Trump standing pat on his market-capitulating agenda, investors may wish to know what has worked and failed in the most recent sell-off.

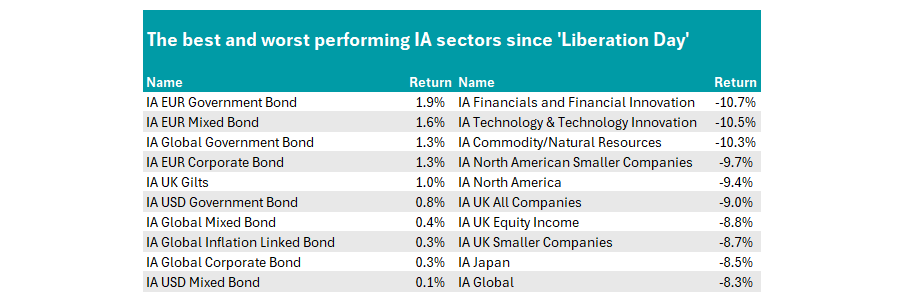

As of last night, the best place to be has been bonds. The top-performing Investment Association sector in the few days post-Liberation Day was IA EUR Government Bond, up 1.9%. The 10 sectors to make more than 10 basis points all invest in bonds, as the below chart shows.

Source: FE Analytics

On the opposite side of the equation, financials, technology and commodity stocks all got hammered as investors began to forecast dire futures.

For financials, the main risks are that tariffs could cripple the global economy and force central banks to cut rates sooner than expected. Markets are already pricing in more rate cuts than they had at the start of the year.

Meanwhile, tech stocks could get caught up in retaliatory measures from the US’ trading partners, as the sector is dominated by large US corporations.

At a country level, American funds were the worst hit, followed closely by the UK, although most equity regions were down heavily.

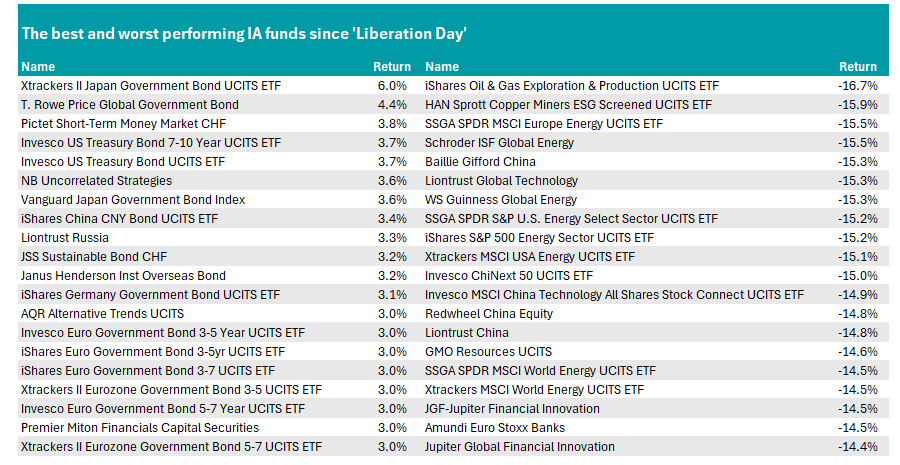

Turning to individual funds, oil specialists were hit hard during the sell-off after the Organisation of Petroleum Exporting Countries (OPEC) decided to increase daily output by 400,000 barrels. Some also feared tariffs would lead to weaker global demand as economies faltered.

iShares Oil & Gas Exploration & Production UCITS ETF was the worst affected during the sell-off, down 16.7%, but was joined by a host of peers and other broader commodity funds.

China funds also dominated the bottom 20 performers, as well as financial specialists and technology names.

On the positive side, much like the sector analysis, the best performers were bond funds, with the Xtrackers II Japan Government Bond UCITS ETF at the top of the tree, up 6%.

Source: FE Analytics