Lord Abbett Climate Focused Bond and the UBAM Positive Impact Equity have lost their responsible rankings at Square Mile in the July re-rating, the research company has announced today. In their place, M&G Positive Impact made an entry, together with the Colchester Local Markets Bond fund.

The rankings were lost due to changes internal to the funds. For example, the Lord Abbett strategy lost its Responsible Positive Prospect rating after manager Annika Lombardi announced her departure from the firm to pursue other interests.

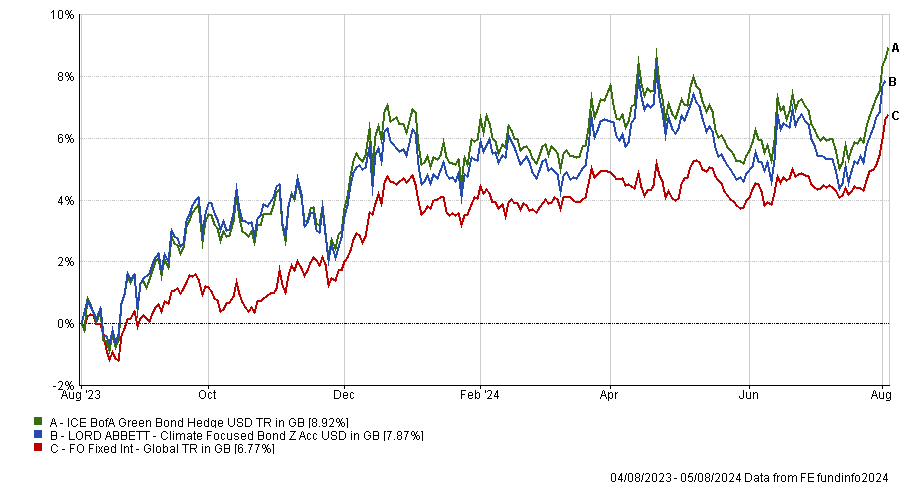

Performance of fund against sector and index over 1yr

Source: FE Analytics

“Whilst we acknowledge Lord Abbett’s strong resources and team approach, the rating was predicated on Lombardi's expertise and dedication to managing the strategy,” Square Mile analysts said.

The pan European UBAM Positive Impact Equity strategy left Square Mile’s Academy Of Funds and its ‘Responsible A’ rating on the table as it announced a merger with the UBAM Positive Income Global Equity fund, with effect from 31st July 2024.

Performance of fund against sector and index over 1yr

Source: FE Analytics

But the roster of sustainable funds didn’t deplete, with the M&G Positive Impact fund joining the Academy Of Funds fray with a Responsible A rating.

Manager John William Olsen and his supporting team aim to invest in companies that pass their ‘III’ framework, which scores companies across three factors: investment, intention and impact, the Square Mile note read.

“This process leads the fund to be highly aligned with the UN Sustainable Development Goals, while offering investors a relatively greater exposure to large-cap equities relative to other funds that invest in a similar manner.”

With a newly gained ‘AA’ rating, the Colchester Local Markets Bond reinvigorates Square Mile’s list of fixed income vehicles.

The rationale behind this was a “strong” track record over different market environments thanks to its “long-established, repeatable investment process from an independent asset manager dedicated to investing in global government bonds”.

Square Mile’s analysts believed this to be “an excellent option for investors looking to allocate capital to a strategy dedicated to emerging markets local bonds”.

This new entry took the place of the Baring EM Debt Blended Total Return fund, which was downgraded from an AA to a single-A rating on the back of a disappointing performance.

Performance of fund against sector and index over 1yr

Source: FE Analytics

After staying on top of many of its peers over five years, when the fund was in the second quartile for returns, it failed to keep up with the rest of the market and dropped to the fourth quartile over three years and 12 months.

While the analysts at Square Mile maintained their positive view on the strategy and its ability to deliver above-average returns across emerging debt markets, “its medium-term performance has not been in line with expectations”, with an A rating “more reflective of the current conviction”.