A vast global investment firm with a large array of funds, Fidelity is a name that almost all investors will recognise.

On top of its popular platform business, Fidelity offers 84 funds within the Investment Association universes, seven of which are managed by established fund managers with a FE fundinfo Alpha Manager title; 30 more strategies are Luxemburg-based.

But while some of these are flourishing, others are struggling and the success of an area might even jeopardise the outcomes for another, as some suggested is happening with Fidelity’s index trackers, which are possibly compromising the active management business.

In this series, Trustnet is looking at the sectors where fund houses are excelling and struggling by looking at their five-year performance. Today, it’s Fidelity’s turn.

While it may not be easy for large fund groups to excel in all departments, Fidelity is doing well in lots of areas, said Rob Morgan, chief investment analyst at Charles Stanley.

The UK business is best known through star manager Anthony Bolton, who managed the Fidelity Special Situations fund from December 1979 to December 2007 and the Fidelity China Special Situations trust until his retirement in April 2014.

Alpha Manager Alex Wright stepped in on the former fund in January of the same year and has been doing “a good job with Bolton’s legacy”, sharing much of his trademark contrarian style, according to Morgan.

Fairview Investing director Ben Yearsley agreed: “Wright has been smashing it out of the park as his value style has been in vogue”.

Fidelity Special Situation, which Wright co-manages with Jonathan Winton, is one of the five Fidelity funds that never fell below the first performance quartile against its peers, remaining ahead of the competition over the past 10, five and three years as well as 12 months.

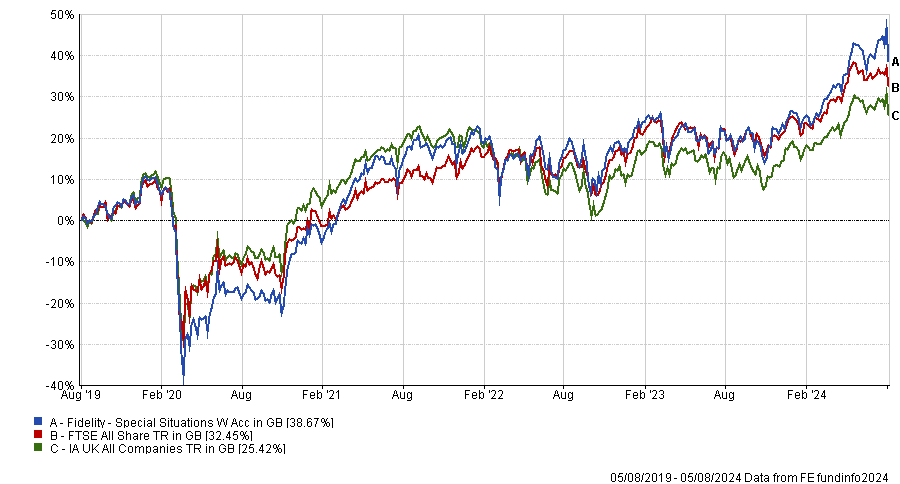

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Winton is also in charge of the Fidelity UK Smaller Companies fund, which is in the top quartile of the IA UK Smaller Companies sector over 10, five and three years.

The global range of funds is also performing solidly. Fidelity Global Dividend was a standout for Morgan, offering “a low volatility portfolio of solid dividend payers” in the hands of the “experienced” Dan Roberts.

The £97m Fidelity Sustainable Global Equity Income strategy managed by Aditya Shivram (who has been in charge since 2021) is another of the five top performers across all main timeframes, as is Fidelity European.

Europe is one of the main areas that Yearsley associated with Fidelity, having been “a definite high spot for several years”, particularly thanks to the European fund and its “excellent” manager Samuel Morse, whose “core” approach is paying off.

The other funds in the European range aren’t living up to the same standard, however, and spend a substantial part of their life span in the fourth performance quartile. Examples are Vincent Durel’s Fidelity Sustainable European Equity and Fabio Riccelli’s Fidelity European Dynamic Growth.

Another well-known area of strength for Fidelity is Asia, with a suite of funds that have performed well partly thanks to strong resources in the region, according to Morgan.

Darius McDermott, managing director at FundCalibre also applauded Fidelity Asia as “a market leader” thanks to its “substantial on-the-ground presence and dedicated research teams”.

“By cultivating deep relationships with local companies, the firm has positioned itself to capture the region’s significant growth potential,” he said.

Other than China Special Situations, today managed by Dale Nicholls, McDermott highlighted Fidelity Asia Pacific Opportunities and Asian Smaller Companies (both in the first quartile over five years), as well as Asian Dividend (which fell to the second performance quartile over five years but was at the top over one and three).

Morgan went beyond the core range and highlighted the Fidelity Asian Values investment trust as “an interesting complement to more mainstream Asian funds”. It has been managed by Nitin Bajaj since April 2015, applying a value-based stock selection approach to the deep Asian smaller company universe.

The other strategy to always rise above the competition was Fidelity Multi Asset Allocator Adventurous by Chris Forgan, the best-performing fund of the whole multi-asset desk. Yearsley said he “quite likes” the range despite having only come lately to that conclusion.

“That was a surprise. They aren’t an out-and-out growth house, so many of their funds either struggled or treaded water for much of the past decade,” he said. “However this decade has seen a resurgence as core and value has returned.”

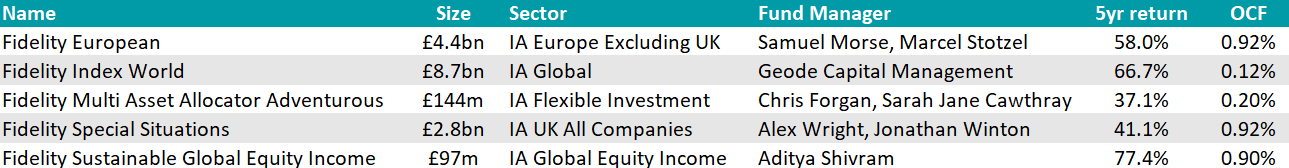

Fidelity funds in the first quartile of their sectors over 10, 5, 3yrs and 1yr

Source: FE Analytics

Another successful area, and less heralded than others according to Morgan, was the passive range of low-cost index trackers which are “competitive and have deservedly gathered assets”.

But this is where Yearsley started to raise questions: “The success of the index business is a big problem for Fidelity”, he said. “If it continues taking big money and tracking appropriately, it does put pressure on the active side.”

To this point, a Fidelity spokesperson said: “While active management remains at the heart of our business, we know that investors want choice and value, whether that’s through an active fund, an index tracker or an exchange-traded fund (ETF).

“Our philosophy is centred around offering differentiated client solutions which leverage Fidelity’s active heritage of providing unique insights through research to deliver specific investment outcomes.”

The main question mark raised by all three experts was around the US desk – given the firm’s roots in the US. Yearsley said he “always felt they should be stronger there”, although the US business is separate from the UK’s.

McDermott also noted the “relatively weaker performance of the North American offering compared to Fidelity’s other franchises” and Morgan blamed the value approach of Fidelity American Special Situations for its weak performance in recent years.

A Fidelity spokesperson drew attention to the ongoing investor preference for growth and momentum and the fund’s limited exposure to the Magnificent Seven stocks.

“In 2021, we changed the portfolio management team looking after the fund and reduced the charges on the fund so that it was comparatively cheaper than the peers,” they added.

Another weaker area is bonds, which “were a strong point for Fidelity” under Ian Spreadbury, who retired in 2018, but have been “lacklustre” since, according to Yearsley.

The Fidelity Strategic Bond fund, for example, managed by Tim Foster, has a long track record of underperforming, never rising above the fourth quartile over 10, five and three years.

“Then again many other big names (Janus and Jupiter) have also been lacklustre,” Yearsely noted, suggesting that this might be the reason why they “have taken a gamble” and appointed Mike Riddell to the team, although he is “someone who has also struggled recently”.

Fidelity disagreed and saw its fixed income business as “a real bright spot”, particularly in the past 12 months, with inflows of £5.2bn year-to-date and its money market, short-dated, US/Global aggregate bond and Sterling credit strategies “resonating most strongly” with investors.

On Riddell’s appointment, Fidelity remained “confident that his top-down macro insights will enhance and complement our extensive bottom-up credit and quantitative research resources”.

Finally, Yearsley noted how Fidelity never had a popular UK equity income fund, which “for a house with their resource, was a surprise.”

“I never understood why it struggles in this area, especially when it has always had good contrarian managers such as Bolton and latterly Wright,” he said.

It makes up for it with a “pretty good” global income fund, however.

Fidelity stated: “A diverse range of funds is important for client portfolios but that does mean funds of differing styles and asset classes will perform differently across various cycles and timeframes.”

“However, we take extended periods of underperformance very seriously and constantly monitor, review and take action to ensure we meet the needs of our clients.”

Asset managers previously covered in this series: Jupiter, Schroders, Liontrust, and Artemis.