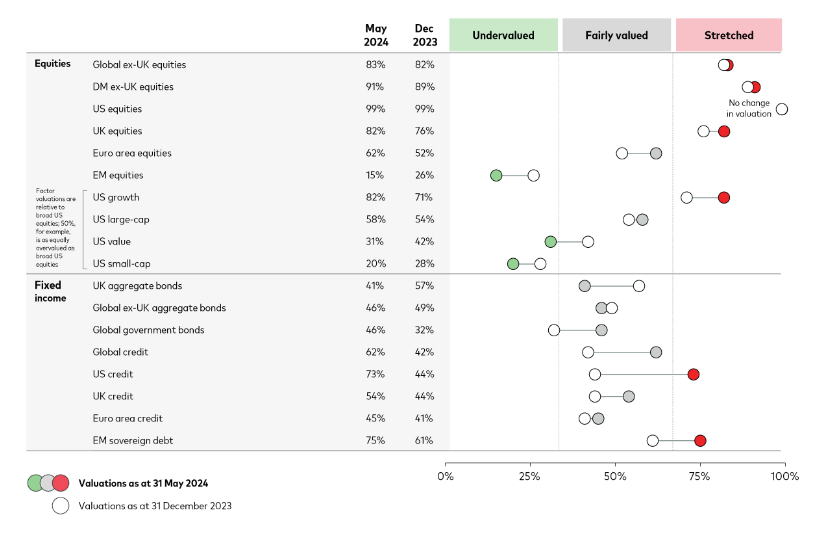

Equity valuations are still stretched in the US and the UK relative to companies’ earnings and to historical share prices and have become even more so this year, despite the recent market corrections, according to Giulio Renzi Ricci, head of portfolio construction, Europe at Vanguard.

Meanwhile, bonds are “significantly more attractive than in the past” due to the higher yields on offer and they also provide diversification, he said.

The equity risk premium has come down, so he suggested shifting 10-15% of a multi-asset portfolio from equities into bonds.

Investors with a long-term risk profile suited to a 60/40 portfolio might increase the bond component to 45-55% to “get the same returns with less risk”, Renzi Ricci proposed.

In general, bonds are fairly priced based on fundamentals, although valuations are more stretched for US corporate bonds in particular. He prefers government bonds to credit because spreads are still quite narrow and government bonds prove to be better diversifiers during equity market corrections.

Within equities, the UK is cheaper than the US, particularly US large-cap growth stocks, but domestic stocks are not attractively valued in absolute terms relative to the UK’s own history, he explained.

Across the English Channel, Europe has been attractively valued for some time. Although he does not expect European companies to attain the high productivity growth of the tech-dominated US market, the more important concern for investors is whether they are paying the right price for lower earnings growth in Europe, he said.

Elsewhere, emerging market equities look fairly cheap, he added.

How equity and bond valuations have changed this year

Source: Vanguard. May valuations are the most up-to-date because Vanguard revises its asset valuations twice a year.

Vanguard bases its valuations on an enhanced version of the cyclically-adjusted price-to-earnings ratio (CAPE), which considers current share prices relative to historical 10-year inflation-adjusted earnings per share. It proves to be a valuable metric to forecast annualized returns in the decade ahead, he explained.

Meanwhile, a debate is raging amongst academics and fund managers regarding whether they are missing something in the way they value companies. Are equities overpriced or will artificial intelligence (AI) impact the real economy in a way that is not reflected in fundamentals, future earnings and dividend expectations? Renzi Ricci asked. “Are we missing something in the measures that we’ve been using for a long time?”

Central to this debate is whether productivity growth (which has been fairly low for the past 15-20 years in developed markets) will be much higher due to AI – and how that will impact price-to-earnings ratios and dividends.

It is hard to assess in advance how a new technology will impact productivity in forthcoming decades, he admitted. For instance, mobile phones were a huge technological advancement and they made people more connected but not more productive. By contrast, computers and electricity made companies exponentially more productive.

“Will the beginning of the AI revolution impact productivity growth to an extent that is beyond the levels we’ve been seeing for the past 40 years? I think that’s the big question,” he mused.

In the nearer term, Renzi Ricci expects the US economy to slow down next year as the recent rate tightening cycle impacts the real economy.

He thinks the US Federal Reserve will probably cut rates in September and possibility again in December, then instigate front-loaded monetary easing next year, cutting rates several times during the first half.