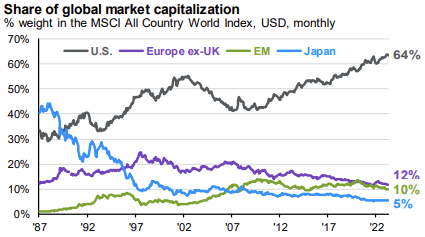

Investors buying global equity funds may not be getting the broad diversification they perhaps expect given that global equity indices have such a large allocation to the US equity market and within that, to a handful of tech stocks.

Against that backdrop, a dedicated allocation to UK equities can play a useful role in a portfolio by providing diversification – cushioning investors’ savings against volatility amongst the largest US names and the indices exposed to them, according to Henry Cobbe, head of research at Elston Consulting.

Source: JPMorgan Asset Management, data to 30 Jun 2024 in US dollar terms

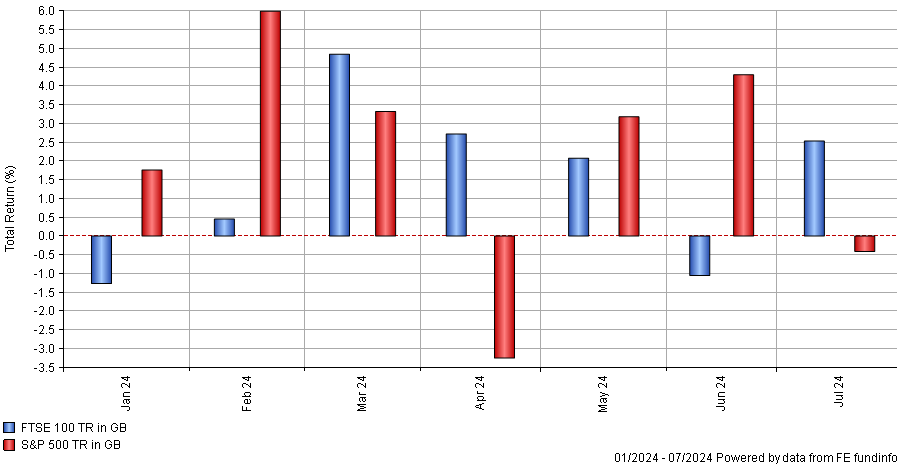

This dynamic has been in evidence this year, with the UK stock market moving inversely to US and global equities in January, April, June and July. As such, the UK “has actually been a source of portfolio resilience”, he observed.

Monthly performance of US and UK equities this year

Source: FE Analytics, data in sterling terms

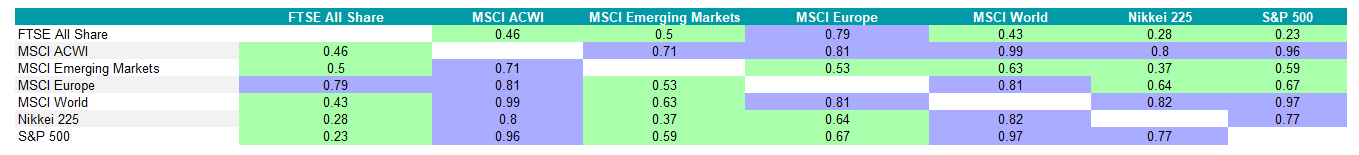

Of all the main regional stock markets, the UK was least correlated to global equities during the year to 29 August 2024, as the table below shows. “Whilst fund flows show deallocations from UK equities, presumably to chase higher returns elsewhere, those investors may be missing the point of what a UK allocation is useful for – genuine diversification,” Cobbe said.

Correlations between regional equity indices over 1yr to 29 Aug 2024

Source: FE Analytics, data in sterling terms. Green denotes low correlation while blue signifies positive correlation.

The UK has decoupled from world equities since 2015. Before then, UK and US equities were similarly correlated to world equities over the short run, Cobbe said. “We then see two clear periods of material disconnect, one following Brexit and the second following Covid, the subsequent inflation shock and the divergence between the tech-oriented US market and the value-oriented UK market.”

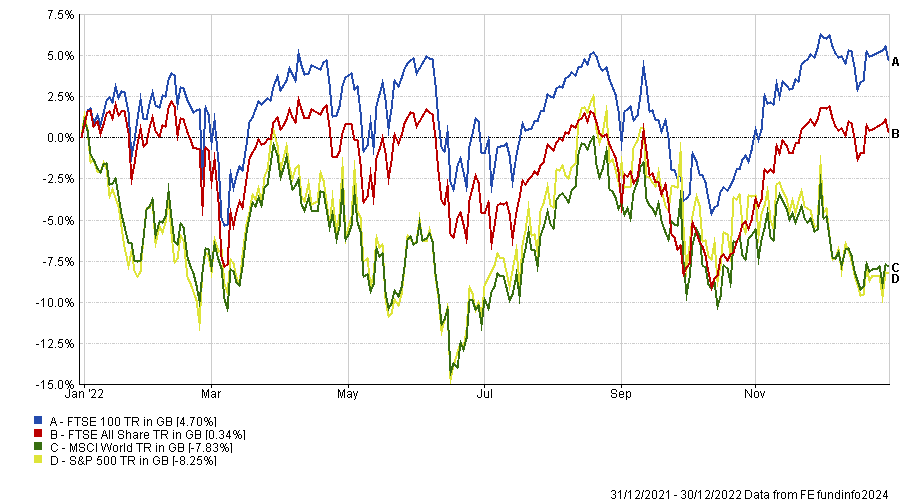

This has led to the UK dramatically underperforming the soaring US market and global mandates over the past decade, although a sizeable UK allocation would have protected portfolios during the downturn in 2022, highlighting the benefits of diversification.

Global and US equities suffered steep declines that year due to the inflation shock from the Russia/Ukraine war and related sanctions, followed by interest rate hikes. Weaker sterling also helped to prop up the UK stock market, which ended the year in positive territory, as the chart below shows.

Performance of UK vs global and US equities in 2022

Source: FE Analytics, data in sterling terms

Following July’s general election, the UK now offers a new diversification benefit, according to James Klempster, deputy head of the Liontrust multi-asset team. It has become “a relative haven of stability after nearly a decade of political uncertainty”.

“This reinforces our confidence in the UK stock market, which has been driven by valuations and the potential for capital flows,” he noted.

The UK’s role as a ballast within portfolios is partly due to its sector composition. The domestic market has more of a defensive, value tilt with higher weights to financial services, energy and healthcare, in stark contrast to the technology-heavy US market.

Furthermore, the power of dividend compounding in the UK equity market helps underpin returns, Cobbe pointed out. “Dividends are a major driver of total returns in the UK equity market given the slower earnings growth and lower multiples in the UK compared to the US, so for a defensive posture, a dividend-focused strategy such as the VT Munro Smart-Beta UK fund should prove an even more effective diversifier in challenging markets,” he said.

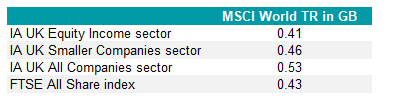

Equity income funds offer even greater diversification benefits than the broader stock market. The IA UK Equity Income sector has the lowest one-year correlation to the MSCI World amongst all of the Investment Association’s UK equity fund sectors, as the table below illustrates.

Correlations between UK equity sectors and the MSCI World Index over 1yr

Source: FE Analytics, data to 29 Aug 2024 in sterling terms

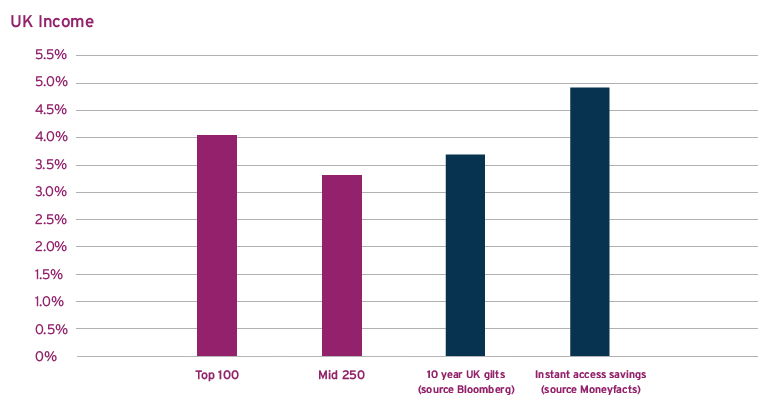

Dividend income from equities is set to become a more attractive source of income as the Bank of England cuts rates and yields on savings accounts and gilts falls commensurately. Computershare expects UK large-caps to yield 4% based on its forecasts for regular dividends in the year ending 30 June 2025, as the chart below illustrates.

Source: Computershare UK Dividend Monitor, Q2 2024 edition

While Cobbe argues that diversification is the main reason for an investment in UK stocks, Klempster is confident of the market’s potential to outperform. “We believe the UK could turn versus the other majors. It is hard to predict when, but to our mind it will not require a major catalyst. UK stocks have already had a relatively strong start to 2024 and its economy has surprised on the upside as the UK emerges from the shallow recession that started at the back end of 2023,” he explained.

Meanwhile, Ben Conway, chief investment officer of Hawksmoor Investment Management, thinks the most exciting aspect of the UK stock market is the level of valuation dispersion. “We find that the lower down the market-cap spectrum one goes, the cheaper stocks become,” he said.