August was a tumultuous month but overall funds were broadly flat, despite the volatility, according to data from FE Analytics.

The month started poorly, with headlines dominated by the sudden stock market drop on 5 August. Myriad reasons for the fall include the unwinding of the Japanese yen, fears of a US recession and concerns that central banks have not moved quickly enough to cut interest rates.

Yet by the end of the month, much of the losses suffered in the first week had been gained back. Ben Yearsley, director at Fairview Investing, noted that the “peculiar month” started with a near 20% fall in the Topix and Nikkei indices over two days but the Nikkei ended up in August.

Looking ahead, the Federal Reserve is expected to join the Bank of England and European Central Bank in cutting rates at its September meeting as the economic data looks sound, with a drop in annual US consumer prices index to 2.9% from 3%.

Yearsley noted: “Fed chair Jerome Powell reassured markets with the strongest hint yet that September will see the first US rate cut. With soft landings the order of the day in the US, will the UK’s October tax hikes mean the party soon ends here?

“Silly season is now out of the way and we can look forward to an autumn of party conferences, tax hikes and the US presidential election.”

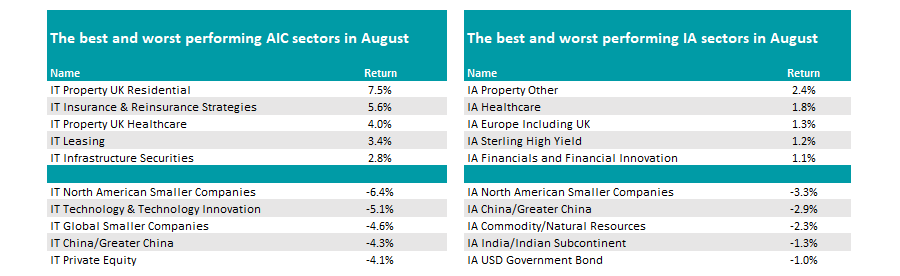

There were few trends to pick out from the data last month. Property led the way, with the IA Property Other sector up 2.4% and the IT Property UK Residential leading the trust space, up 7.5%. These sectors may be benefiting from the latest BofE rate cut, which should boost income payers such as property funds.

Source: FE Analytics

At the foot of the table, US smaller companies struggled as the dollar fell more than 2% against the pound. Currency weakness should impact minnow stocks more as they tend to be more domestically focused, meaning the cost of importing international goods rises while their domestic profits fall relative to other currencies.

On the open-ended side, the average fund in the IA North American Smaller Companies sector lost 3.3%, while the IT North American Smaller Companies peer group fared worse, down 6.4%.

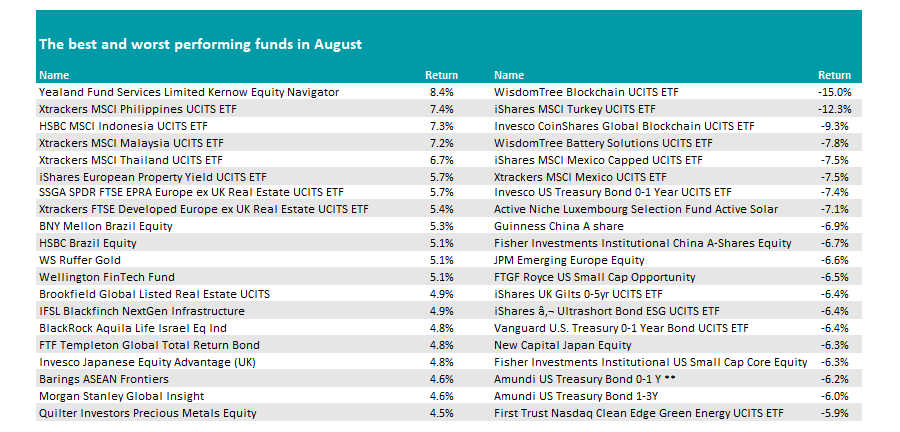

Individually, Kernow Equity Navigator was the top performer of the month up 8.4%. Yearsley said it is a long/short all-cap UK equity fund that is small but has had a strong 2024 so far.

It was followed by idiosyncratic emerging market countries, with Xtrackers MSCI Philippines UCITS ETF, HSBC MSCI Indonesia UCITS ETF, Xtrackers MSCI Malaysia UCITS ETF and Xtrackers MSCI Thailand UCITS ETF all making more than 6%, perhaps due to the weaker dollar.

Funds focusing on Brazil, such as BNY Mellon Brazil Equity and HSBC Brazil Equity, also performed well, up more than 5%.

Source: FE Analytics

On the downside, other emerging market countries were not so lucky, with the likes of iShares MSCI Turkey UCITS ETF (down 12.3%), iShares MSCI Mexico Capped UCITS ETF and Xtrackers MSCI Mexico UCITS ETF (down 7.5% each) making the worst performers list.

It was also a poor month for thematic funds, with the highly volatile WisdomTree Blockchain UCITS ETF down 15%. Invesco CoinShares Global Blockchain UCITS ETF (down 9.3%) and WisdomTree Battery Solutions UCITS ETF (-7.8%) also struggled last month.

“Looking at individual funds, the lack of trends was evident. Japan, Israel, gold and bonds all feature – it really feels like the most random top 10 seen in 2024,” said Yearsley.

“The worst performing funds were equally random with solar, Japan, US Treasuries, China, US small-cap and eastern Europe featuring.”

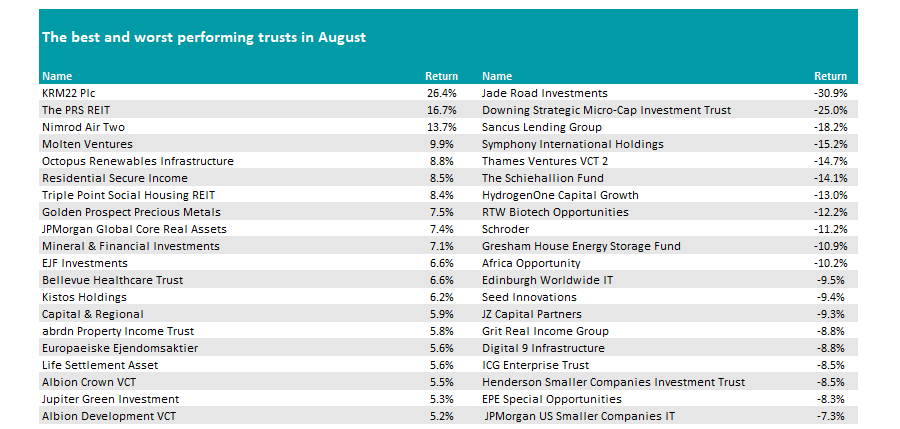

Investors will be used to the relative rankings of investment trusts being more mixed than the open-ended universe. Small trusts can be highly volatile and distort performances over one month.

Here, property sectors did well again, with the likes of The PRS REIT and Triple Point Social Housing REIT in the top 10 performing trusts of the month.

Alternatives were the way to go in August, with trusts specialising in renewable energy and environmental, social and governance (ESG), precious metals and real assets all among the top returners of the month.

Source: FE Analytics

Conversely, smaller companies trusts struggled, with Downing Strategic Micro-Cap Investment Trust, Edinburgh Worldwide, Henderson Smaller Companies and JPMorgan US Smaller Companies among the worst performers in August.

“August really did feel a bizarre month starting with the mother of all meltdowns in Japan only to see most markets up by month end. There was panic at the start of August, and undoubtedly some investors probably sold out, but sitting through periods of volatility is often the best approach,” Yearsley concluded.