Wizz Air became one of the UK’s most-shorted stocks last month after profits fell dramatically, pushing its share price off a cliff.

The budget airline grounded 46 of its aircraft in June due to issues relating to its Pratt & Whitney GTF engines. It then leased additional planes to fulfil its flight schedule and protect its market share during the peak summer season.

Due to lease fees and higher depreciation costs, Wizz Air’s operating profit for the three months to 30 June 2024 was 44% lower than the same period of 2023. Net profit for the quarter was 98% lower than last year and was also impacted by foreign exchange headwinds.

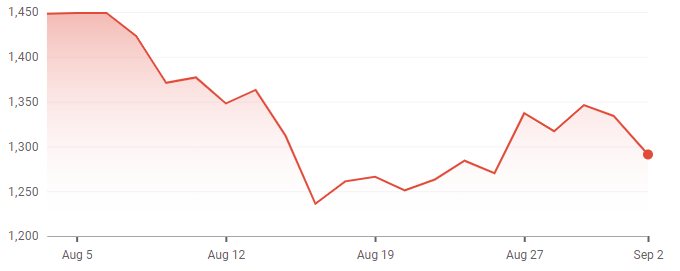

The low-cost carrier’s share price dived 15% when it announced its results on 1 August.

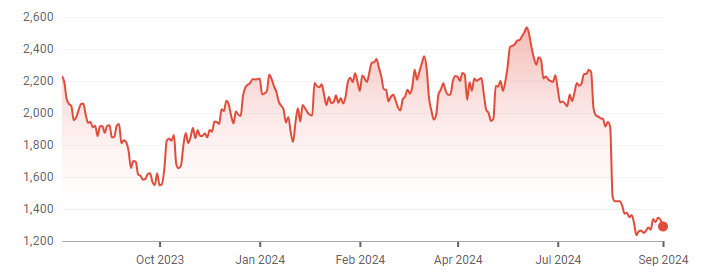

Wizz Air’s share price over 1yr

Source: Google Finance

Arrowstreet Capital was the first to report a short position in Wizz Air on 2 August followed by Squarepoint Ops on 9 August. AHL Partners joined them on 22 August, then Marshall Wace and Qube Research & Technologies followed suit on 27 and 29 August, respectively.

Wizz Air’s share price over one month

Source: Google Finance

Russ Mould, investment director at AJ Bell, said the poor set of results came hot on the heels of Wizz Air’s nomination as the worst airline for customer service by Which?.

Its engine-related issues are “the latest in a string of problems for the airline industry, including consumers waiting until the last minute to book flights, which has triggered a price war among airlines hoping to fill their planes”, Mould said.

Despite the drop in profits, Wizz Air’s management took an upbeat line and predicted that ticket and ancillary revenues would rise.

Chief executive József Váradi said: “Capacity is stabilising and we are focusing on further optimising our operations, with an emphasis on improving our most profitable bases and enhancing efficiency. We remain optimistic about the demand outlook, with both ticket and ancillary revenue per available seat kilometres (RASK) expected to be up year-on-year while load factor is maintained above 90%. We remain on track to return to annual capacity growth in 2026.”

Váradi’s optimism echoed the tone of easyJet’s results issued the week before, said Garry White, chief investment commentator at wealth manager Charles Stanley.

Ryanair, however, reported a sharp fall in profits, causing share prices across the airline industry to slide in July. “The post-pandemic boom in the airline industry is now clearly moderating,” White added.

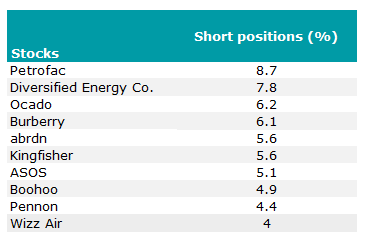

Wizz Air was the 10th most-shorted UK-listed stock last month with 4% of its share capital in the hands of short sellers, according to disclosures made to the Financial Conduct Authority. The rest of the top 10 was little changed from last month, despite the whipsaw in global equity markets.

The UK’s most-shorted stocks in August

Source: Financial Conduct Authority