Beleaguered fashion brand Burberry Group, one of the UK’s most shorted stocks, will be relegated from the FTSE 100 index in the September quarterly rebalancing and replaced by insurer Hiscox.

Joining Burberry in the FTSE 250 is Raspberry Pi, which designs single-board and modular computers, and is ascending to the mid-cap index after a successful initial public offering in June.

On the way out is Diversified Energy Company, which will be removed from the FTSE 250 after the market closes on 20 September 2024.

Burberry was the fourth most-shorted UK-listed stock last month with 6.1% of its share capital in the hands of short sellers, including AQR Capital Management, Marshall Wace and Millennium International Management, according to disclosures made to the Financial Conduct Authority.

The maker of the iconic trench coat was the second-worst performing share in the FTSE 100 index during the three years to 12 August 2024, making a loss of 64.5%. Only Entain fared worse, down 69.1%.

Nick Train, whose Finsbury Growth & Income Trust holds Burberry, conceded that the luxury brand’s first quarter results, announced in July, were “dire”.

Disappointing earnings led to the departure of chief executive officer Jonathan Akeroyd and Burberry suspended its dividend payments for this financial year.

“We are supportive of the company’s decision to suspend the dividend and embark on a cost savings plan, which has eased concerns around the balance sheet,” Train said.

Burberry’s board has admitted to “strategic missteps” during the past five years, Train continued. “The company has pursued an overly ambitious strategy of brand elevation and inappropriately attempted to shift away from its traditional brand DNA towards an unsupportable ‘high fashion’ positioning. In doing so it has raised prices to levels that its customers or potential customers do not believe offer value.”

Dan Coatsworth, investment analyst at AJ Bell, agreed. “The decision to take Burberry more upmarket and then heavily discount products to shift unsold stock looks like a bad move. While shoppers love a bargain, discounting can tarnish a luxury brand as it is perceived to be less desirable,” he said.

China’s post-pandemic economic weakness has also been a major headwind, he added.

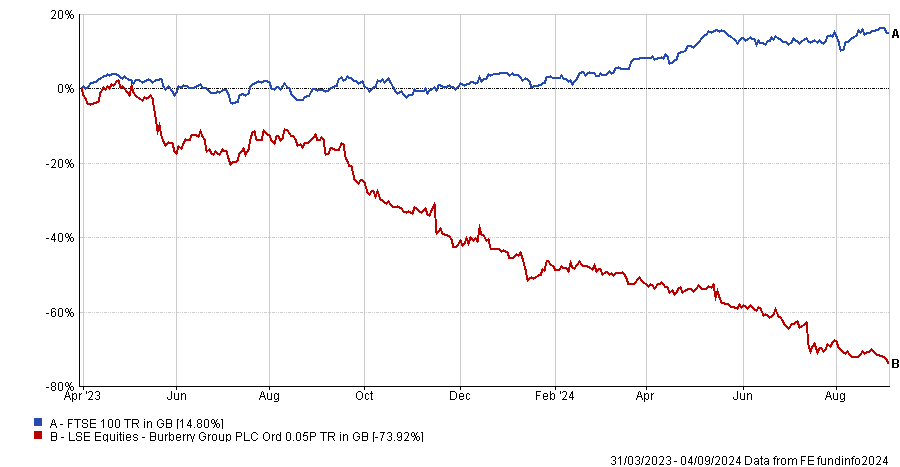

Burberry’s shares hit a 14-year low last month and have now fallen 70% from their recent all-time high in April 2023.

Burberry’s share price since April 2023 vs FTSE 100

Source: FE Analytics

This is the second time this century that Burberry’s share price has fallen 70% or more from peak to trough, the first being during the great financial crisis in 2007 and 2008. Train saw that as a buying opportunity and his decision to invest in Burberry back then was “a good call”.

Burberry’s share price in 2007 and 2008 vs FTSE 100

Source: FE Analytics

“From its late 2008 low to the 2023 peak its shares were up 16-fold (£1.60 to £26.00),” Train noted.

“Of course, with the shares now under £8, we wonder whether the recent collapse in Burberry’s shares offers a similar opportunity. And there is no doubt they would benefit from an improvement in consumer confidence, especially in Asia, over the next 18 months.”

Burberry’s share price from late 2008 to its peak in April 2023

Source: FE Analytics

Train still believes that “with Burberry, we have invested our clients’ capital in an enduring and unique brand that has generated attractive financial returns in the past and can do so again”.