FE fundinfo Alpha Manager Terry Smith has ditched Diageo, axing the stock from the £23.9bn Fundsmith Equity portfolio, according to the fund’s latest monthly factsheet.

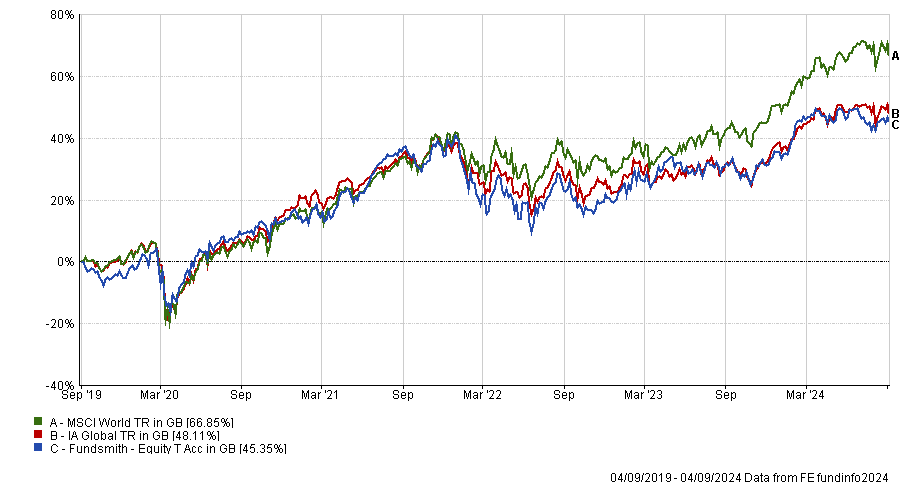

The fund has been through a tricky period in recent years, registering a below-average return in the IA Global sector over one, three and five years, although it remains the fourth-best fund in the sector over the past decade.

Performance of fund vs sector and MSCI World over 5yrs

Source: FE Analytics

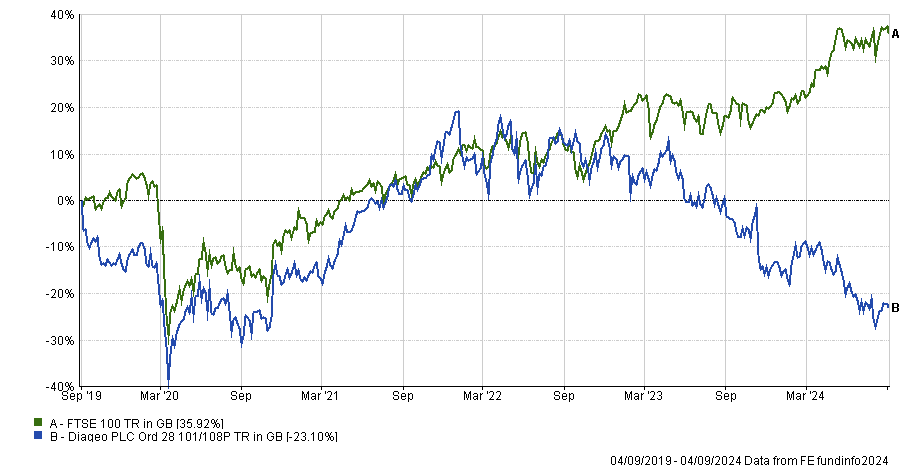

During this period, the position in Diageo would have been a drag on performance. The stock is down 23.1% over five years at a time when the FTSE 100 has risen 35.9%. Meanwhile, the MSCI World index has gained 82.3%.

Short-term performance has also been poor, with the stock down 20.4% over the past year and almost 15% in the past six months.

Managers have been losing patience with the stock. In April, Liontrust Alpha Manager Anthony Cross told Trustnet the “jury was out” on the stock, after it was the biggest detractor to his Liontrust UK Growth fund over the previous 12 months.

“The jury is still out with Diageo. It performed well during the successive lockdowns but since then people are drinking less and there has been a cost-of-living crisis,” he said.

“Diageo also had a stocking problem in Latin America, where the wholesale market was overstocked and demand was not pulling through. This led to a profit warning with a brand new set of management.”

Performance of stock vs FTSE 100 over 5yrs

Source: FE Analytics

However, the stock is not entirely unloved. It is a 6.7% position in the Lindsell Train Global Equity fund. In the fund’s July factsheet, manager Nick Train said Diageo’s full-year results for 2024 were “in line with expectations” but investors were offput as it was “unable to give an indication of when its current period of poor trading will end”.

“This, coupled with the challenging outlook for consumer spending, contributed to its shares falling another 3%” over the month.

But it is not all doom and gloom, with Train noting there are “bright spots” for long-term investors.

“The company ended the year with 75% of its brands gaining or holding market share. Two of its big long-term growth drivers – Guinness and Tequila outside the United States – grew their revenues at a double-digit pace,” he said.

“The company generated $2.6bn of free cash flow, up $400m on the previous year. Despite this, the latest earnings forecasts for Diageo’s 2025 results would suggest the company is currently trading at below 20x earnings. We continue to believe this is too low for a company with brands of Diageo’s calibre, and with half of its earnings generated in the world’s biggest and most dynamic economy, the United States.”

Chris Rossbach and Katerina Kosmopoulou, who are in charge of the $252.4m J. Stern & Co. World Stars Global Equity portfolio, are also Diageo backers.

It is the only UK stock in their fund and was described as a “screaming buy” in May.

“Covid massively disrupted consumption and generated excess inventory throughout the supply chain. This is in the process of being corrected now, but the market hates that, so the stock is trading at more than 10% discount to its historical levels,” they said.

“Now if you could tell me that you and I will never drink again, I'm going to sell my Diageo position. But if you tell me that tonight we are likely to have a nice glass of whiskey, then to me that is that is basically a screaming buy.”

There was also good news for drinks makers such as Diageo, Rémy Cointreau and Pernod Ricard last week, according to AJ Bell investment director Russ Mould, after China’s Commerce Ministry said it would not impose a provisional anti-dumping subsidy on brandy imported from the EU.

“Back in January, shares in Rémy Cointreau, Pernod Ricard and Diageo fell on news of a potential investigation into the market by China, representing another point of tension between the Asian country and the West. These tit-for-tat trade disputes have centred upon accusations of unfair competition and protectionism.

“Anti-dumping is an import duty charged in addition to normal customs duty and can be levied when a foreign company sells an item significantly below their normal price.

“Asia is a big market for spirits and European companies should welcome the latest development as it effectively removes a key sales risk,” he concluded.