It’s no secret that the new Labour government wants private investors and pension funds to put more of their money into domestic assets and is trying to figure out ways to stimulate inflows.

The latest rallying cry is a report published today by the Capital Markets Industry Taskforce, led by Sir Nigel Wilson, chairman of the property development firm Canary Wharf Group and former chief executive officer of Legal & General.

Wilson said: “Mathematically we need to invest around an additional £100bn of productive capital per annum for 10 years, so £1trn in total, to deliver 3% annual growth in real wages and real GDP per capita.” Capital markets have the capacity to supply that demand, he argued.

The taskforce suggested several ways to encourage retail investors to put more of their savings to work in domestic assets, including lowering or abolishing stamp duty, amending the cost disclosure regime for investment trusts and improving financial education.

The report also proposes giving financial services companies leeway to nudge investors with a large amount of money held in cash and ask if they might consider investing some of their dry powder.

The UK’s $6trn pensions and insurance industry is also firmly in the taskforce’s sights.

For private investors however, the decision of how much of their hard-earned savings to invest in UK equities and other domestic asset classes should remain theirs and theirs alone. Investors need to look away from the political dialogue and consider what makes sense for them in light of their risk appetite, return aspirations and goals.

The UK amounts to just 3.8% of the MSCI World and 3.4% of the MSCI All Country World Index (which includes emerging markets). This explains why private and institutional investors who use global indices as a benchmark have such a small piece of their pot on home soil.

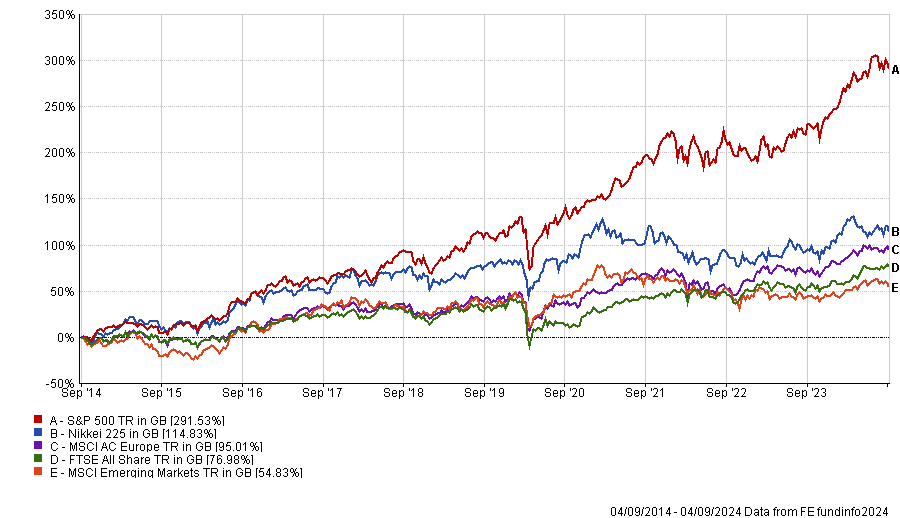

Many experts feel that is too low an allocation, but there has been an opportunity cost to patriotism. Anyone who chose to have a home bias since the global financial crisis – which is when the UK stock market started to really fall behind the US – would have lost out on potential gains, as the chart below shows.

The UK has lagged all major regions except emerging markets in the past decade

Source: FE Analytics

Terry Smith, the well-known and outspoken manager of Fundsmith Equity, told Trustnet that the biggest mistake investors can make is having a home bias. “Why should investors in the UK invest in the FTSE 100? The UK is under 3% of global GDP. There is a whole world to choose from,” he argued.

But just because the US has outperformed during the past decade does not mean it will do so again.

Simon Evan-Cook, a fund manager at Downing, believes the artificial intelligence (AI) frenzy and tech boom will give way to a new commodity super cycle as the next trend in global markets, driven by decarbonisation and the need to build renewable energy infrastructure (which is something the Capital Markets Industry Taskforce report covers at length).

He believes the UK stock market, with its higher exposure to commodities, will be a better place for investors’ capital than the US going forward.

Furthermore, for investors who are concerned about high valuations in US large-caps, an allocation to the UK’s more value-oriented market can provide diversification.

This year in particular, UK equities have often moved in an opposite direction to the US, providing some ballast to portfolios whenever the American juggernaut has come unstuck. Henry Cobbe, head of research at Elston Consulting, said the UK has been “a source of portfolio resilience”.

Without a crystal ball or perfect foresight, we can’t say with certainty whether the UK’s stock market – and other asset classes such as private equity and gilts – are a better bet than their international equivalents but what we can say is that every investor should ignore the political noise, do their own research, speak to a financial adviser if they prefer, and come to their own conclusions.