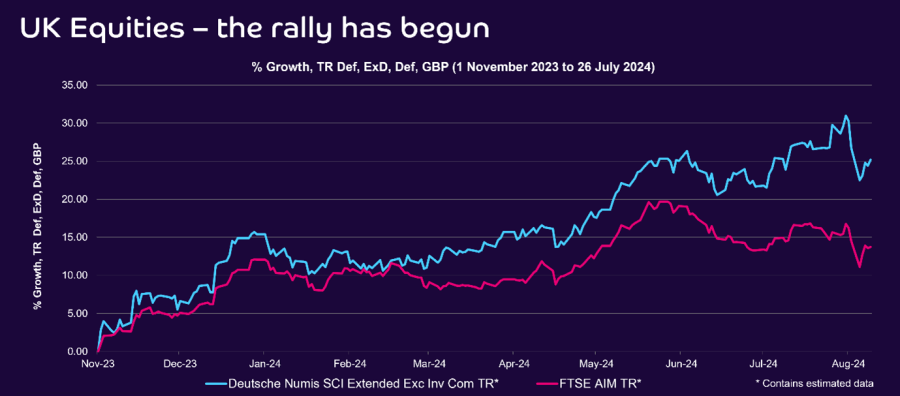

Following the market shakeout in October 2023, signs of recovery are starting to emerge. Even with the recent period of market volatility, it is worth noting that since the beginning of November 2023, the FTSE AIM index has recovered by 14%, whilst the Deutsche Numis Smaller Companies Index (excluding Investment Trusts) has increased by a very healthy 25%.

We can attribute this improvement to several factors positively impacting these markets, including steadying interest and inflation rates, the unexpected resilience of the UK economy, and the more recent political stability post-election.

So, while the recovery is in its infancy and the asset class remains cheap, the opportunity for investors is ripe.

Source: Lipper as of 9 August 2024

Whilst these returns over such a short period of time look excellent, they follow what has been a difficult period for the asset class.

We are increasingly of the view, however, that the market has seen the bottom and that we could be looking at an extended period of UK smaller company outperformance ahead.

UK smaller companies achieving significant long-term returns

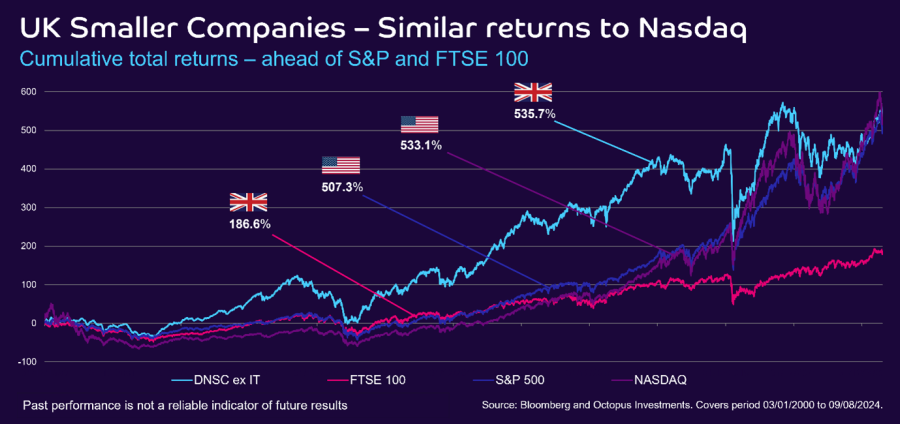

Over recent years, what has been stark, has been the global equity market’s fixation on the performance of Nasdaq, and on a relatively narrow number of high-profile companies in particular – the so-called ‘Magnificent Seven’.

Recent US-led market volatility should remind investors of the risks associated with such narrow asset allocation, and the benefits of diversification.

If we consider the mid-to-long-term time horizon, as we suggest that most investors should do, it is worth reminding ourselves that returns from UK smaller companies have been comparable to the Nasdaq, despite the recent period of UK market malaise.

In the chart below we can see that, since the millennium, UK small-cap returns have slightly outperformed that of the Nasdaq, and that it is only since the recent ‘perfect storm’ of a derating of UK growth equities, coupled with a significant rerating of Nasdaq stocks, that US index’s returns have caught up with UK growth equities over this period.

Source: Bloomberg and Octopus Investments. Covers period 03/01/2000 to 09/08/2024

Looking ahead, we expect UK smaller companies to once again deliver superior returns from their current levels as subdued valuation multiples continue to recover.

Our reasoning for this confidence lies in the strong underlying earnings fundamentals, and the material disconnect between operational performance and share prices currently seen in many stocks within the UK smaller companies sector.

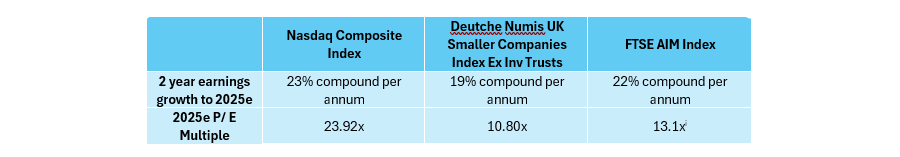

UK smaller companies vs Nasdaq – similar growth expectations but very different valuations

Source: Factset as of 6 August 2024

Looking at the earnings growth expectations of the respective indexes above, you can see a comparable, and attractive, earnings growth profile for all growth markets highlighted – a healthy 20% compound annual earnings growth per annum.

Despite the similar operational return expectations from the underlying assets, with over two years of capital flows away from smaller UK growth companies, and a market fixation on Nasdaq recently, there is currently a significant valuation rating differential between markets.

Nasdaq is trading on a 25x price-to-earnings (P/E) multiple, whilst the other two UK growth indices are trading on 11x and 13x respectively. We suggest that this extent of valuation disconnect is unlikely to remain.

A stable outlook for UK politics

Another major factor impacting markets has been the political fallout from the Brexit referendum and the period of political instability that ensued.

Ahead is the prospect of a more positive period of UK political stability following the commanding majority won by the Labour government in the general election. The message emanating from the party has been a focus on fiscal responsibility, and growth generation, both of which will be a further boost to UK equities.

This stability, when compared to recent history and developed market peers currently facing their own challenges, could serve as a catalyst for potential flows back towards the asset class.

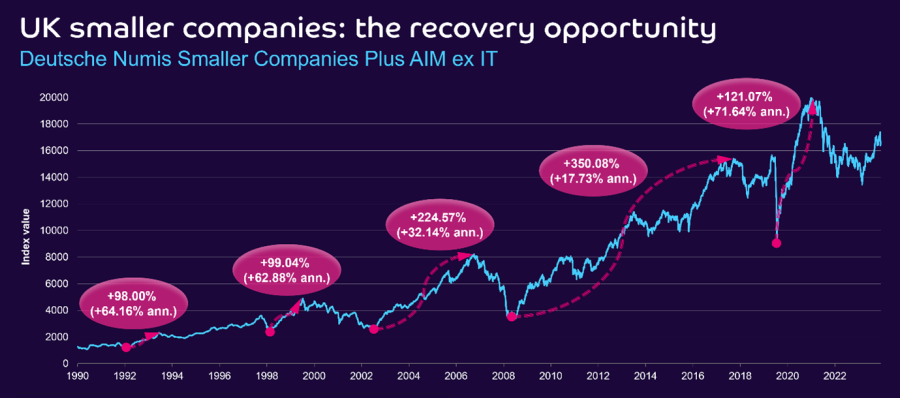

UK smaller companies – the recovery potential from here

The resilience of the UK economy has been underestimated and we expect UK GDP growth to continue to compound at a faster rate than many of its G7 peers.

Interest rates, and relatively sticky UK inflation, have been additional factors impacting markets. Thankfully we’re now seeing levels gradually return to historic norms.

With all these factors aligning, we believe we are in the early stages of a market recovery. Clearly, it is difficult to assess exactly how far the market will recover but it’s worth reflecting on previous market trough to peaks.

Source: Bloomberg, as of 8 August 2024

Looking back over the past 30 years, recoveries following similar market pull-backs have been substantial, as seen in the encouraging returns highlighted above.

With the key concerns holding back UK equities now behind us, we strongly believe that we are merely at the beginning of a significant recovery period for UK smaller company equities.

Chris McVey is deputy head of Octopus Quoted Companies. The views expressed above should not be taken as investment advice.