The artificial intelligence (AI) frenzy has pulled up global benchmarks and bolstered the fortunes of growth funds and tech stocks, leaving many other sectors in the dust. On top of that, the wild moves in interest rates during the past few years have favoured some areas and punished others.

Against that backdrop, the list of unloved sectors and regions has grown long, said Edward Allen, private client investment director at Tyndall Investment Management.

“Latin America, commodities, Eastern Europe, infrastructure and property, small- and mid-cap companies … the list goes on. But the big one is, of course, China.”

The tide is beginning to turn, however. With interest rates coming down in most developed markets and enthusiasm for AI starting to cool, it might be time to revisit some of those out-of-favour areas.

Trustnet asked fund selectors to recommend strategies in beaten-up sectors run by experienced managers, so investors can dip their toes back into the water with a safe pair of hands.

Deep value

Deep value managers have been through a difficult period but their portfolios now offer compelling valuations and a margin of safety, said Ernst Knacke, head of research at Shard Capital.

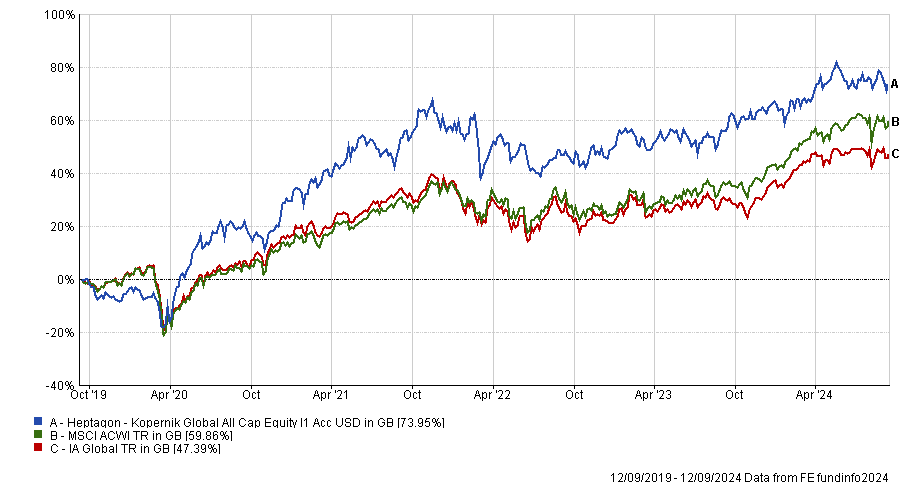

His top pick is Heptagon Kopernik Global All Cap Equity, managed by Dave Iban, who applies a high conviction, deep value, contrarian approach to stock selection. The fund “also maintains the necessary diversification for exposure to this often out-of-favour and unloved market segment, hindered by dark clouds”, Knacke said.

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

“The strategy continues to deliver solid returns with low correlations to traditional equity strategies and indices. The portfolio currently leans towards regions like South Korea and other emerging markets, along with sectors such as precious metals, energy, and uranium in particular.”

The portfolio is trading at single-digit price-to-cash flow levels and has a price-to-book ratio below 1x.

“We believe it offers significant optionality alongside strong downside protection and a margin of safety. Indeed, the potential and opportunity, especially in relative terms, are perhaps more compelling than ever,” he concluded.

‘Boring’ defensive stocks

Defensive stocks, which are prevalent in the financial, healthcare, real estate and infrastructure sectors, were “poorly positioned” to weather the AI boom, said Lorenzo La Posta, a portfolio manager at Momentum Global Investment Management.

“Some people call them boring: they have nothing to do with the exciting world of technologic innovation, they rarely surprise investors with great earning revisions and rarely make the front page.”

Defensive stocks have low volatility due to their bond-like characteristics of stable returns, low reliance on the business cycle and predictable growth rates. Yet those bond-like characteristics meant they were punished during the rising rate environment from mid-2022.

Thereafter, their “absence of any relation to AI has made them even less attractive, leading to a substantial underperformance and a significant relative discount,” he noted.

“Now that the tides are turning, with rates coming down and excitement around AI dissipating, we think this is a very attractive part of the market that should outperform if things continue on this trajectory, especially as global growth slows.”

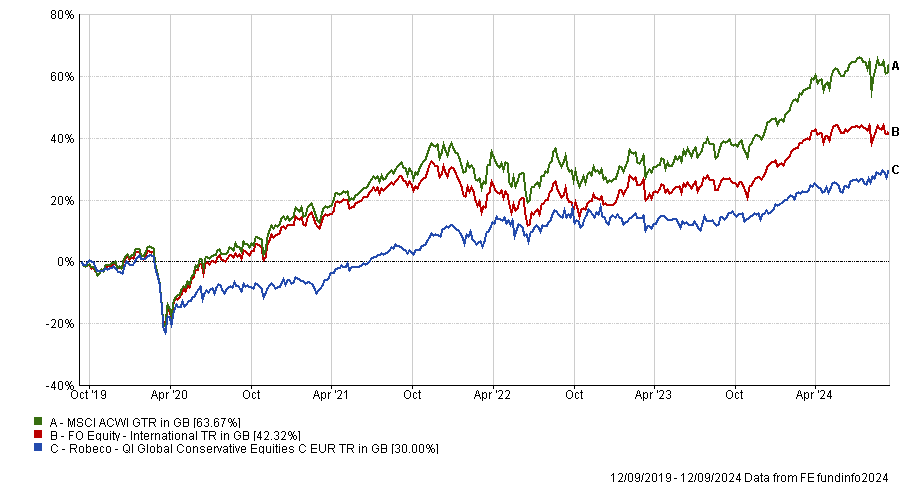

La Posta highlighted the Robeco QI Global Conservative Equities fund, which employs a quantitative process to invest in low-volatility stocks across developed and emerging markets.

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

Robeco looks for a combination of high dividend yields, low downside risk, high earning stability and good quality, he explained. “These factors, coupled with a secondary (but still relevant) search for attractive valuation, strong momentum and positive analyst revisions, result in a diversified, low turnover portfolio of defensive stocks aiming to achieve stable equity returns and high income.”

China

China is arguably the world’s most-shunned equity market, reeling from an extended lockdown and lacklustre reopening, an economic slump, a property sector mired in the doldrums and a host of geopolitical risks, which has led to capital flight from China to India.

Allen said: “Speaking to Indian speciality fund managers, I hear tell of frothy markets and excessive local stock market speculation. At the same time the China specialists are pulling their hair out, citing world class companies trading for a song and investor apathy, indifference and disinterest.

“Call me crazy, but it looks like there’s an opportunity here. The tricky bit is getting the timing right, particularly amidst election fever in the US, a property-led balance sheet contraction in China and soaring markets in India. However, if the property market is ‘fixed’ and domestic investment reboots, the Chinese economy could soar and the equity market with it.”

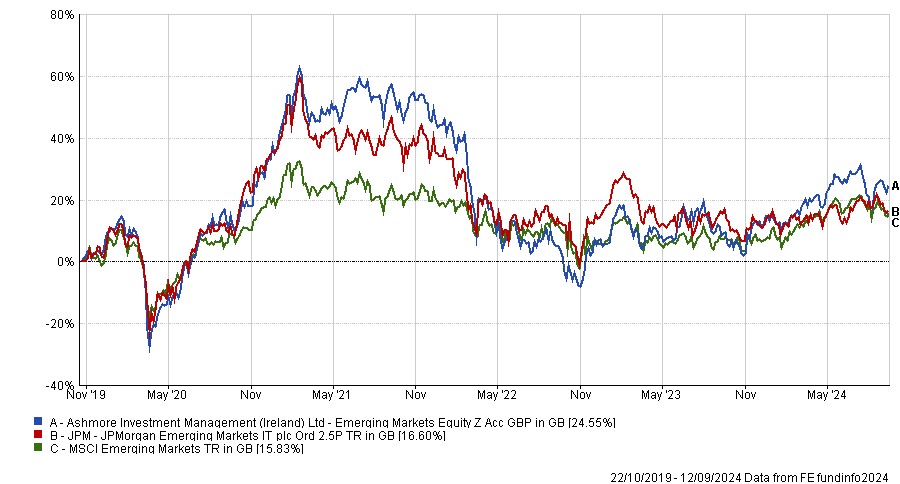

Few funds are overweight China so Allen suggested two strategies that have a market weight allocation to the country: JPMorgan Emerging Markets and the Ashmore SICAV Emerging Markets Equity fund.

Performance of fund and trust vs benchmark over 5yrs

Source: FE Analytics

JPMorgan Emerging Markets was 5% underweight mainland China but has added a 4% overweight allocation to Hong Kong and it also has a 17% market-weight allocation to Taiwan. Meanwhile, Asian specialist Ashmore is finding plenty of bottom-up opportunities in China, he said.