Increasing interest rates, designed to combat inflation, meant a torrid time for fixed income assets. Defensive investors tend to be the largest holders of such assets and to make matters worse, the more duration a portfolio had, the more pronounced the price fall (although this of course can work both ways).

Over the past three years, global government bonds and investment grade credit have generally delivered negative returns.

Unsurprisingly, defensive portfolios have suffered as a result. A hypothetical defensive investor (say, one who is invested in a 20/80 portfolio of MSCI ACWI and Bloomberg Global Aggregate Bond index) would have achieved a total return that was only just in positive territory.

Where are we now?

While the journey has been painful – particularly 2022 – there is one silver lining, which is that fixed income is a much more appealing asset class at current levels. To put it another way, there is ‘income’ in fixed income again.

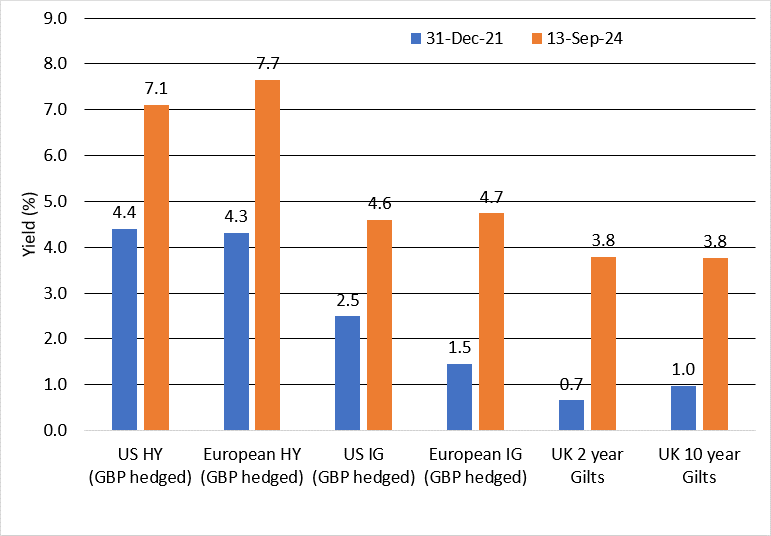

At the end of 2021, yields across the asset class were less than compelling and in areas such as developed market government bonds, less than 1%. Today things are different; gilts are paying out what high-yield corporate bonds were yielding less than three years ago.

Yields available across fixed income markets

Source: Bloomberg as at 13 Sep 2024; yields for US and European high yield and investment grade credit is yield to worst

That is undoubtedly a better starting point and in the absence of a sharp and significant bout of inflation (and associated rate rises), bodes well for a defensive investor’s return potential in the coming years.

Importantly, yields at these levels – coupled with the market’s apparent shift of focus from worrying about inflation to worrying about economic growth – should also mean much greater potential for diversification than bond holders have experienced in recent years.

What should we expect from here?

But why would you invest in a defensive portfolio at all if cash can deliver a reasonable yield without having to take market risk? This is where defensive investors can potentially have their cake and eat it.

Let’s compare cash to investment grade corporate bonds. At the time of writing, cash savings rates in the UK and the yield on European investment grade corporate bonds are both pretty close to the 5% mark (arguably cash rates are lower for those who would like to fix it for a few years).

The income from both assets should be quite similar given their very similar yields. However, what corporate bonds can do, and cash cannot, is benefit from interest rate cuts.

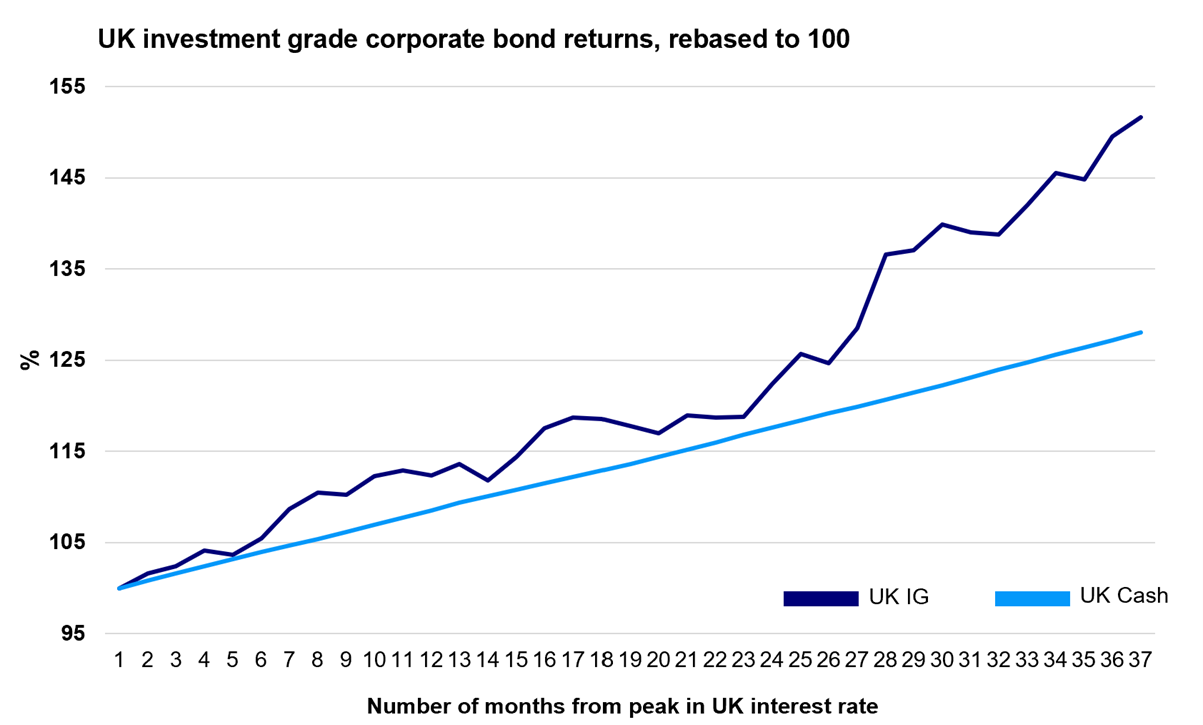

Source: Bloomberg, data to 31 Aug 2024

That should be an important consideration for investors today, and potentially a good reason for owners of defensive portfolios to hold firm for a while. The chart above shows the average historical returns for both sterling investment grade corporate bonds and for cash, assuming an investor had invested at the peak of interest rates (i.e. when cash theoretically looks most attractive).

The chart shows a three-year (36 month) period following the UK interest rate peak and in the early period the returns from the bonds and cash are quite similar, albeit the former are delivered with a little more volatility. That is because the returns from both assets are either largely or entirely coming from the income they are generating: the 5% interest rate on cash versus the 5% yield on the corporate bonds.

It is also clear that there is an inflection point on the chart where the bond returns start to pull away from the cash returns. And the result after three years is meaningfully different, with the bonds returning around double that of cash. That’s because over that timeframe, rates cuts have typically started (and usually a number of cuts have been made).

In that scenario, the best that cash can do is stay the same (assuming it has been fixed or locked in for the entire period, which we assume in the chart above) but bonds can continue to benefit by generating a capital return as rates fall.

That is positive news for a defensive investor. They can achieve income today, with the potential of added capital returns in the not-too-distant future.

David Aujla is a multi-asset strategies fund manager at Invesco. The views expressed above should not be taken as investment advice.