Fees are among the top considerations when choosing funds, but they only give investors half the picture.

A cheap fund is only preferable to a more expensive option if its returns after fees have been better, but that is often not the case with the cheapest funds around (passives), which cannot beat the market by design, but only track it.

This is where paying a little more for strong performance can be worthwhile, according to FundCalibre research director Juliet Schooling Latter.

It is true, however, that higher fees will eat into the growth of portfolios.

“Keeping costs low is a crucial part of long-term investing success, but it's equally important to assess the potential returns a fund offers,” she said.

“In sectors where active management is likely to generate significant value, paying slightly higher fees could still result in net gains.”

Below, she highlighted the five cheapest active equity funds within the FundCalibre Elite Rated list that balance potential outperformance and cost.

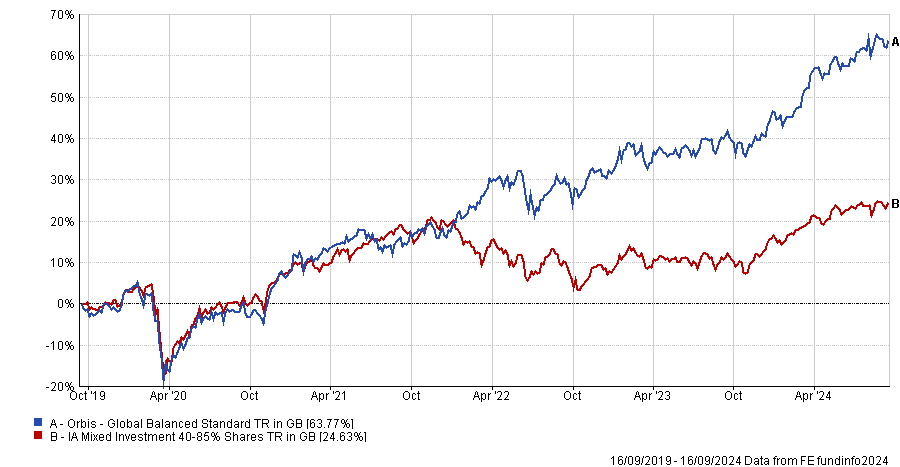

First up was Orbis Global Balanced, which stood out for its “unique” fee structure.

It has no ongoing fees, as Orbis charges a 40% outperformance fee if the fund beats its benchmark (a mix of 60% MSCI World Index and 40% JPMorgan Global Government Bond Index) hedged into sterling.

“Any performance fees are placed in a reserve fund that can be used to refund investors in case of future underperformance, at a rate of 40% of the underperformance,” Schooling Latter explained.

“The manager’s fee is then drawn from this reserve, capped at either a third of the reserve or 2.5% of the fund’s net asset value per year.”

Performance of fund against sector over 5yrs

Source: FE Analytics

Within the IA UK Equity Income sector, which houses some of the least expensive funds, VT Tyndall Unconstrained UK Income charges only 0.65%, well below the peer group average of 0.83%.

Schooling Latter praised its mid-cap focus as well as its high active share – or willingness to stray from the benchmark.

From the IA UK All Companies sector, the director chose the IFSL Marlborough Multi Cap Growth fund. With a 0.81% ongoing charges figure (OCF), it is only a few percentage points behind the sector average of 0.86%, but for that price, investors get Richard Hallett’s “excellent” track record of stock-picking in the almost-two decades that he has been in charge of this strategy.

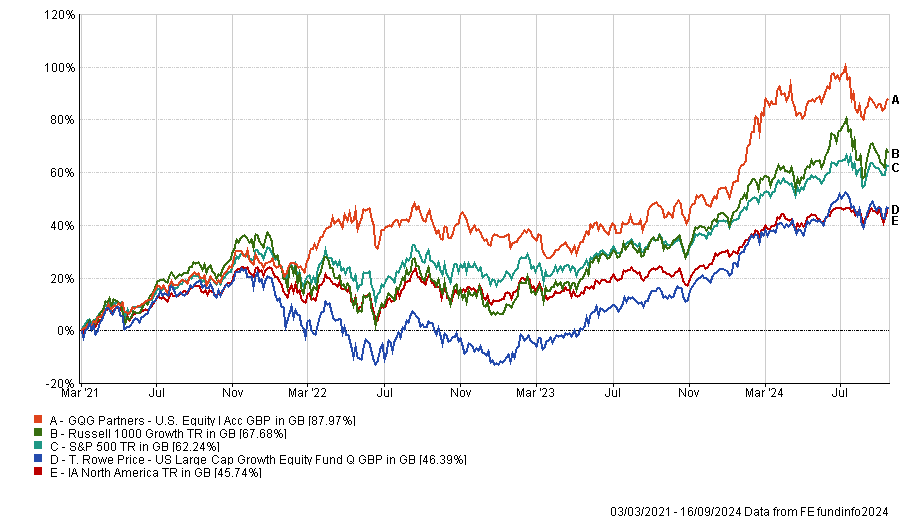

In the US, where investors are most likely to resort to a passive strategy, she chose the T. Rowe Price US Large Cap Growth Equity and GQG Partners US Equity funds.

The former has an OCF of 0.69%, “significantly less” than its average peer and it has delivered 94% for investors over the past five years, outperforming both the S&P 500 and the IA North America sector.

GQG Partners US Equity has returned 83.5% compared with 43% for the S&P 500 since its launch in 2021 (as shown in the chart below), charging only 0.55%. Its strengths include “the team's familiarity with thousands of companies and the fund's inherent flexibility”, which allows the team to be “nimble and respond quickly to market opportunities”, according to Schooling Latter.

Performance of funds against sector and indices since 2021

Source: FE Analytics

The higher the complexity of the market, the higher the fees, which is why emerging market funds have higher OCFs on average.

For India, that’s 1.25%, but investors would be better off with Schooling Latter’s picks – UTI India Dynamic Equity and Goldman Sachs India Equity Portfolio, charging 1.02% and 1.04%, respectively.

Despite its recent woes, China is also an expensive market, but the FSSA All China and FSSA Greater China Growth have protected capital better than the MSCI China All Shares index over the past five years.

The FSSA Greater China Growth fund “remains a firm favourite” for FundCalibre.

Run by manager Martin Lau for over two decades, the long-term performance of the fund is “commendable”, returning 81% for investors over the past decade during very challenging times (compared with just 35% for the MSCI China All Shares index) and that was achieved with an OCF of 1.09%, while the average peer group will set investors back as much as 1.18%.