The Jupiter India fund has been a favourite among investors in the Indian market.

It featured on Trustnet as part of the most-bought regional funds in the first half of 2024 and the most popular on the Hargreaves Lansdown and Fidelity International platforms.

Its popularity is easily explained – it has doubled investors’ money over the course of three years. Also, it invests in a region that Rob Burgeman, investment manager at RBC Brewin Dolphin, called “one of the success stories of global markets”.

India has a “stable, burgeoning” economy, which since the year 2000 has delivered a sterling total return of 1681.1% against 596.6% for the S&P 500 and 208.1% for the FTSE 100 index. It also won out against China, beating the Shanghai Composite index’s 201.9% over the same period.

But going all-in on a single market or fund would be a mistake, experts said. Below, fund selectors suggest what to buy to complement a holding in Jupiter India.

For Burgeman, India remains an attractive opportunity, but enthusiasm “should be tempered with an understanding of the risks involved”.

“The Bharatiya Janata Party (BJP)’s hold on power faltered at the last election and poverty has not improved markedly,” he said.

“Investment in infrastructure is ongoing, but extremely nationalistic policies mean that sometimes political decisions can be arbitrary. At the same time, the insistence that there must be a heavy Indian presence in most areas of business activity can stymie the investment needed.”

To that end, he recommended pairing Jupiter India with a fund that can smooth out some of the periods of heavy negative returns that India has delivered over the years, and he chose Fidelity Emerging Markets.

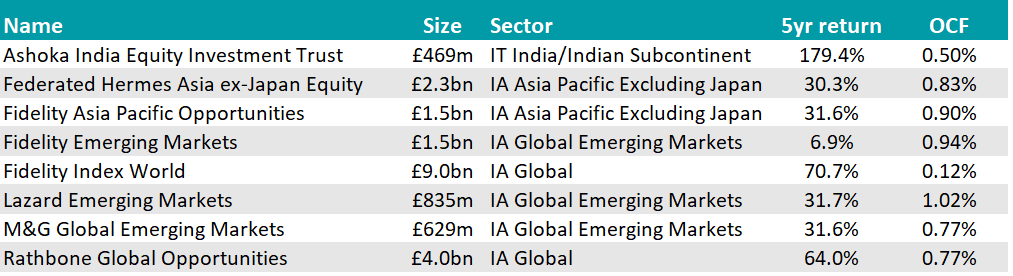

Performance of fund against sector and index over 1yr

Source: FE Analytics

Its exposure to India is currently 22.9%, but it is also invested in Taiwan, China and South Korea as well as South Africa, Mexico and some more “esoteric markets” such as Kazakhstan.

“If the pendulum swings in the other direction and China suddenly comes to the fore of investors’ minds, it seems likely that part of these funds would come from current Indian holdings, creating the reverse of what we have seen over the past few years, India’s positives notwithstanding,” said the investment manager.

Joe Richardson, discretionary investment manager at Dennehy Wealth, stressed how expensive India is. Its average inflation-adjusted earnings over the past 10 years (using the Shiller price-to-earnings ratio) make it the world's most expensive stock market, and it comes with “massive volatility”.

“We are finding better, more stable and cheaper opportunities elsewhere for direct allocations, for example Japan,” he said.

To balance Jupiter India's single-country focus, Richardson suggested looking at broader emerging markets or Asia Pacific funds.

This approach was also taken by Chris Rush, investment manager at IBOSS, whose dedicated India exposure was recently absorbed into broader emerging markets and Asia allocations.

“Considering the disconnect in valuation between India and other regions, we feel it prudent to buy active managers who can invest in areas of future opportunity wherever they may be,” he said.

For that reason, his current portfolios include four active holdings: Fidelity Asia Opportunities, Hermes Asia ex-Japan, Lazard Emerging Markets, and M&G Global Emerging Markets.

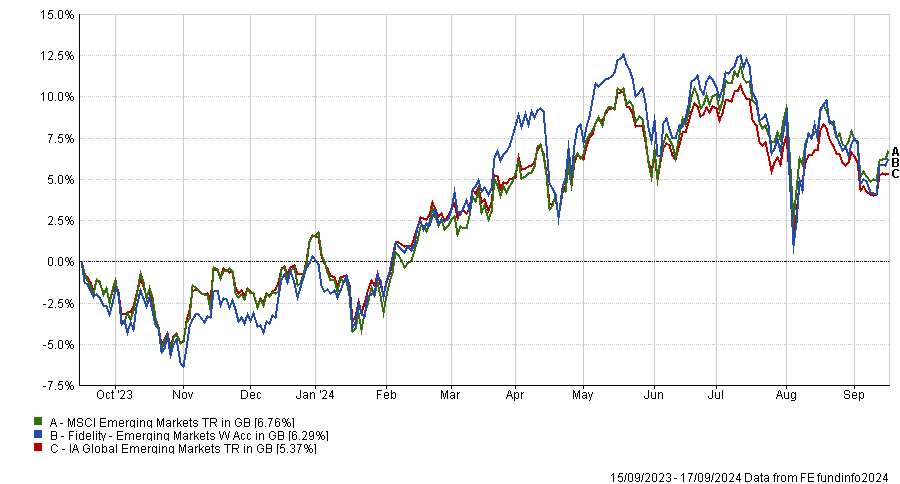

Performance of funds against sector over 5yrs

Source: FE Analytics

“Each fund has a proven track record of tactically positioning its regional exposure,” said Rush.

“While our overall allocation to India remains meaningful, we feel that a more flexible approach to the sector may be of more value here than a focus on short-term region-specific performance.”

Victoria Hasler, head of fund research at Hargreaves Lansdown, took an even broader approach, pairing Jupiter India with “well-diversified funds that invest in more mature markets”.

One solution would be to go for a global tracker such as the Fidelity Index World.

However, for those who prefer to have the chance to generate excess alpha through an active manager, the Rathbone Global Opportunities fund could fit the bill.

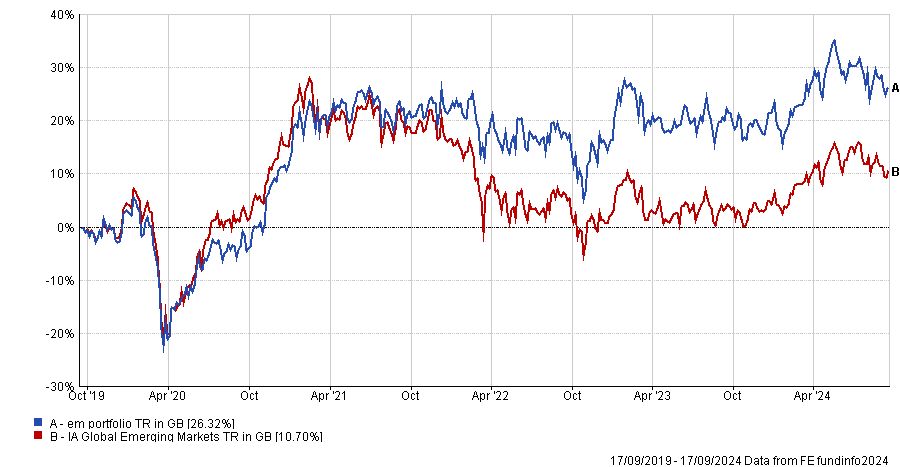

Performance of fund against sector and index over 1yr

Source: FE Analytics

James Thomson, who manages the fund, is “one of only a few global fund managers to show they can pick great companies and perform better than the broad global stock market” over the long term.

“The geographical diversification as well as the focus on investing only in exceptional companies marks the fund out as being a little different to Jupiter India, and leads us to believe that the two should pair well,” Hasler said.

Finally, EQ Investors’ Ben Faulkner would replace Jupiter India with the Ashoka India Equity investment trust.

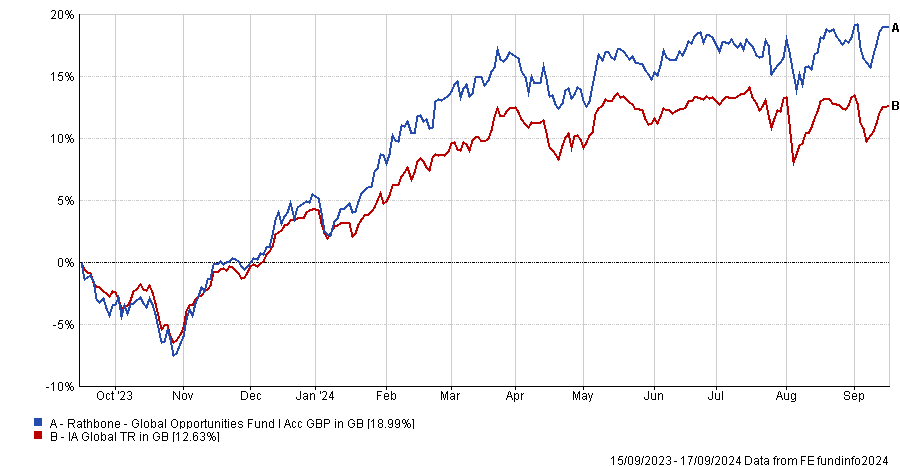

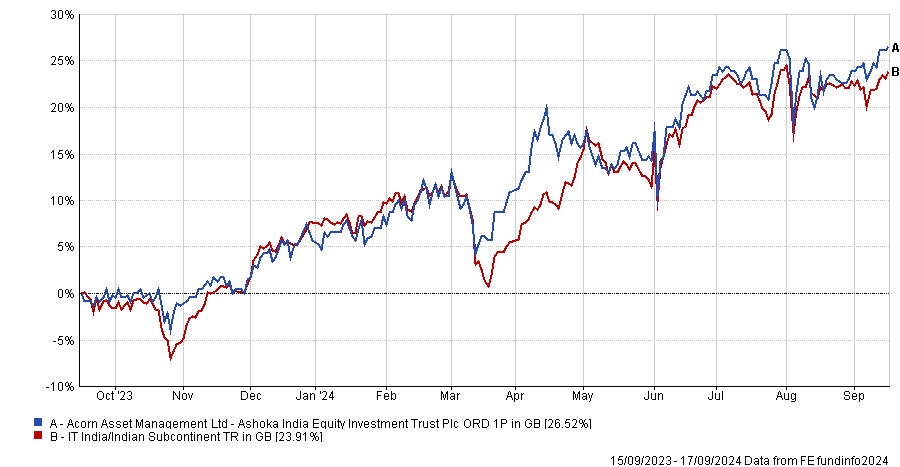

Performance of fund against sector and index over 1yr

Source: FE Analytics

It has a bias towards small and mid-cap companies, a “very experienced” team in emerging markets and “best-in-class” relative performance.

The trust doesn’t charge an annual management fee but levies a capped performance fee instead, meaning the team is only paid if the trust outperforms. (Fees equate to 30% of the trust’s outperformance measured over three-year discrete periods.)

Investors can tender their shares once a year at a price to close to the net asset value (NAV) and Ashoka will buy back all or part of their holding, which has been “very successful” in managing any discount risk.

“The trust also has a high active share, offering a distinctive portfolio that differs from its benchmark,” Faulkner concluded.