Now that the major central banks have all taken the knife to interest rates, fixed income managers are stepping into the limelight. Bonds’ relatively high yields have meant that investors were paid to wait for rate cuts, but henceforth as yields come down and prices rise, bond investors have the potential to make capital gains as well.

Even so, the past few years have been a rocky ride for fixed income managers, some of whom have fared better than others. Therefore, Trustnet asked experts to recommend a pair of complementary bond funds that should thrive in different market conditions, for investors who want to prepare their portfolios for a myriad of scenarios.

Janus Henderson Strategic Bond and Man GLG Sterling Corporate Bond

Jack Johnson, fund analyst at FE Investments, paired up Janus Henderson Strategic Bond and Man GLG Sterling Corporate Bond.

The Janus Henderson fund has a higher duration; in other words, it is more sensitive to interest rates. Managers John Pattullo (who will retire in March) and Jenna Barnard specialise in analysing long-term macroeconomic trends, which enables them to dynamically reposition their geographic exposures, said Johnson.

“We like the fund for the longer-term top-down focus it brings. In bear market periods where government bond yields fall (in the face of softening recent economic data, for example) the fund is likely to outperform,” he explained.

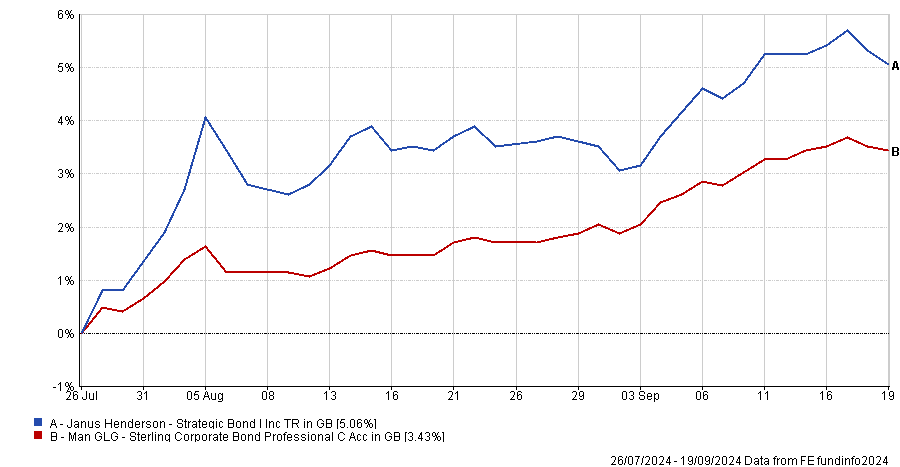

Performance of funds during bear market conditions since late July 2024

Source: FE Analytics

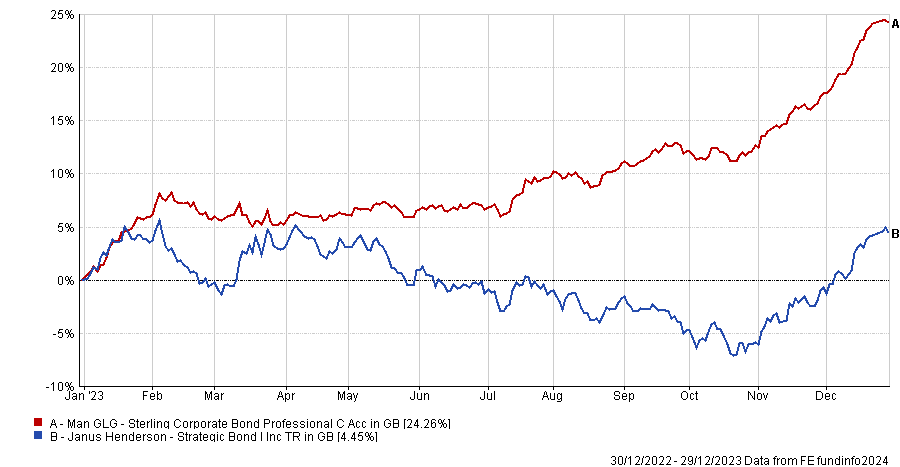

On the other hand, Janus Henderson Strategic Bond struggles during government bond sell-offs, such as in February and March 2023.

Man GLG Corporate Bond, which is less sensitive to interest rate changes, held up better last year. However, it does bring an additional element of credit risk.

Performance of funds in 2023

Source: FE Analytics

FE fundinfo Alpha Manager Jonathan Golan at Man GLG is an experienced investor running a high-conviction strategy with a “dynamic approach”, Johnson said.

Golan and his colleagues monitor the corporate universe with highly detailed cashflow analysis. “This allows the team to decide which issues look truly attractively priced and act accordingly, giving them an edge in bottom-up bond investing that is reflected in the long-term returns,” Johnson explained.

Jupiter Strategic Bond and M&G Emerging Markets Bond

Dzmitry Lipski, head of funds research at interactive investor, believes strategic bond funds are well positioned to navigate the current environment as they have the flexibility to hunt for the best opportunities globally.

Short-dated, high-quality government and corporate bonds look compelling at present given their attractive yields, against a backdrop of cooling inflation and interest rate cuts, he added.

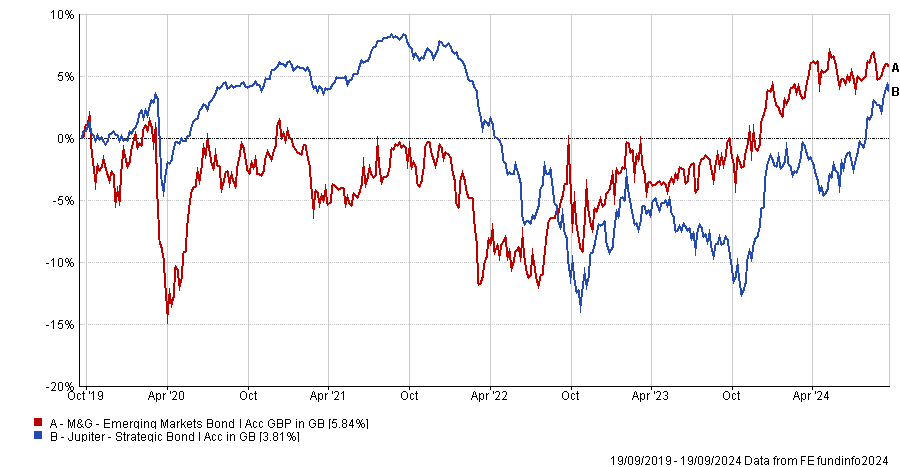

Lipski rates the £2.3bn Jupiter Strategic Bond fund, a “go anywhere”, high-conviction strategy led by Alpha Manager Ariel Bezalel and Harry Richards.

“The currently yield is over 5% and the fund has shown strong performance and resilience over the long term,” Lipski said. “Given the fund’s flexibility and focus on downside protection, this makes it a strong core option.”

For more adventurous investors, emerging markets bonds offer attractive yields and good diversification benefits. “The outlook for the asset class is improving as emerging markets are expected to benefit from the Fed monetary easing cycle and a weaker US dollar,” he explained.

The $2bn M&G Emerging Markets Bond fund, helmed by Alpha Manager Claudia Calich, has the flexibility to invest in government and corporate bonds across emerging and frontier markets, denominated in local currencies or in the US dollar.

With a yield over 6%, this is an “adventurous satellite holding” that will increase portfolio income and diversification, Lipski said.

Performance of funds over 5yrs

Source: FE Analytics

TwentyFour Strategic Income and Capital Group Global Corporate Bond

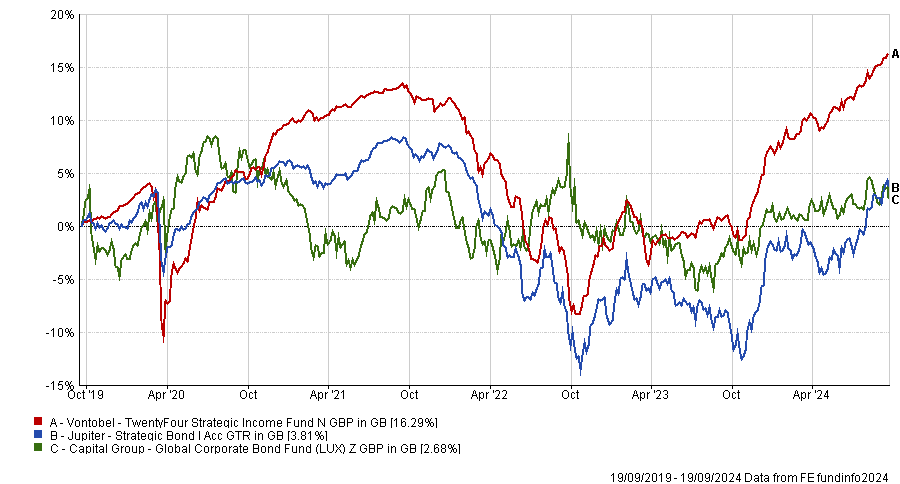

Conventional wisdom dictates that corporate bonds are higher risk than sovereign debt, but for the past couple of years, corporate bonds have been “stable and strong”, while sovereign bonds have been volatile, said Tom Hibbert, a multi-asset strategist at Canaccord Genuity Wealth Management. “Our portfolios, with a credit bias, have outperformed by earning higher yields and benefiting from a consistent tightening of spreads.”

That opportunity no longer exists to the same extent because spreads have come in a long way, especially in the US, where investment-grade spreads are within 100 basis points and US high-yield spreads are slightly above 300 basis points.

There is better value elsewhere, however. “European spreads are wider, alternative credit areas offer attractive value, and European and UK bank credit present relative value opportunities,” Hibbert said.

One fund that is taking advantage of these opportunities is TwentyFour Strategic Income. It has a high allocation financials, predominantly European banks, where spreads are wider. “European banks are also extremely well capitalised, delivering an attractive risk/reward profile,” Hibbert added.

About 20% of the fund is in asset-backed securities, “an area where spreads are wider due to a perceived complexity premium”.

Canaccord Genuity Wealth Management is currently shifting its multi-asset portfolios from a carry-focused strategy towards a more diversified approach, due to the deteriorating macroeconomic backdrop, monetary easing and the tightness of spreads.

“This involves a preference for high-quality, blue-chip global credit and some duration to complement equity risk, especially as stock/bond correlations turn negative once again,” Hibbert explained.

Capital Group Global Corporate Bond and the aforementioned Jupiter Strategic Bond fund are both well suited to this approach.

“Jupiter is more of a duration play. It has 10 years of duration with exposure across the curve mostly through futures. This is valuable in a multi-asset context if we go into a recession and we see more aggressive rate cuts and a flight to safety,” he explained.

“Capital Group is a conservative pure blue-chip, global investment grade fund with a strong credit selection pedigree. We like high-quality investment-grade when spreads are tight; additional compensation for going up the credit curve is limited.”

Unlike Jupiter, Capital Group does not make macro bets and instead focuses purely on delivering alpha through careful credit selection.

Performance of funds over 5yrs

Source: FE Analytics

Invesco High Yield and iShares UK Gilts ETF

Paul Angell, head of investment research at AJ Bell, suggested combining a core government bond fund with a high-yield fund for income.

The iShares UK Gilts ETF could act as a “defensive anchor”, providing low-cost exposure to gilts across the maturity spectrum.

Performance of funds over 5yrs

Source: FE Analytics

“Invesco High Yield would play a more aggressive role, aiming to boost the blend’s overall income through its exposure to high-yield debt across issuers that the manager perceives as higher quality, subordinated financials, and those deemed to be more speculative special situations,” he explained.

“Manager Tom Moore’s positioning in financials has been particularly beneficial to relative returns over the years, and he continues to seek good opportunities in the sector.”