Sausage rolls, Mr Kipling cakes and supermarket snacks have proven to be rewarding treats for consumers and shareholders alike, propelling Greggs, Premier Foods and Tesco into the ranks of companies whose share prices have beaten the FTSE All Share over one, five and 10 years.

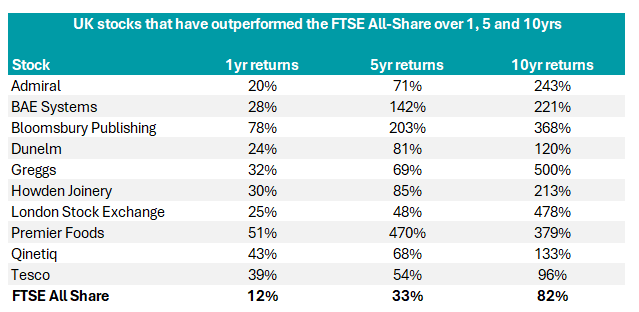

Research by AJ Bell found that 51 stocks in the FTSE 350 index (excluding investment trusts) have outperformed the market across these time periods, led by the London Stock Exchange, Harry Potter’s publisher Bloomsbury and car insurer Admiral.

Additionally, 26 stocks investment trusts have beaten the FTSE All Share over the past one, five and 10 years.

Dan Coatsworth, investment analyst at AJ Bell, thinks this is an opportune time to revisit “Britain’s depth and breadth of quality businesses”.

One of the catalysts for performance this year has been the undervalued UK market’s current status as a “hotspot for takeovers”, with bids pushing up share prices, he added.

Furthermore, the UK is starting to look more attractive in relative terms, compared to the US.

“A gloomier US economic outlook and rich equity valuations that side of the Atlantic suggests it might be time to add a stronger British flavour to an ISA or pension as the London market is full of stocks on attractive valuations,” he said.

“The run-up to the presidential election battle between Kamala Harris and Donald Trump could lead to renewed volatility in the US stock market, providing a further reason to look at UK shares as investors might find less drama this side of the Atlantic.

“The UK may not have the glamour of the big tech names in the US, but having exposure to more steady-as-she-goes type companies can work wonders for portfolio returns, given a bit of patience.”

Below, Coatsworth singles out five stocks with a particularly strong track record.

BAE Systems

Governments around the world have been increasing their defence spending ever Russia invaded Ukraine. “Greater cybersecurity spending has also been a tailwind for the UK defence champion as it has the strength to flex both its physical and digital muscles,” Coatsworth said.

BAE Systems has returned 28% over one year and 221% over the past decade. Funds that hold it include Artemis Global Income and Aviva Investors Global Equity Income.

Bloomsbury Publishing

From the Harry Potter franchise to Sarah J. Maas’ ‘romantasy’ novels, “Bloomsbury is a dab hand at spotting talent”, he noted. “It is good at making money from new and old titles, reworking books via new editions and capturing new generations of readers.”

Bloomsbury has also diversified its revenues by moving into the education market, with a focus on arts subjects, such as drama.

SDL Free Spirit and Martin Currie UK Smaller Companies hold the publisher, which is up 78% and 368% over one and 10 years, respectively.

Greggs

Greggs excels at selling affordably priced food and beverages. “It continues to innovate and launch new products, keeping existing customers interested and enticing new ones into its stores,” Coatsworth explained.

“Greggs is earning more from existing stores by having them open for longer, while at the same time it continues to open new sites. Behind the scenes, it is reinvesting cash flow into manufacturing, distribution and logistics to support its growth.”

The IFSL Church House UK Equity Growth fund and Montanaro UK Income own Greggs, which has shot up 500% over 10 years and 32% in one year.

Premier Foods

Premier Foods has a strong portfolio of household brands but it has not always been a good investment. “At one time this was a zombie business thanks to an onerous debt pile,” Coatsworth recalled.

However, it has resolved its debt problems and has become more competitive and innovative by making astute investments.

Chelverton UK Equity Growth, Tellworth UK Income & Growth and Tellworth UK Smaller Companies are backing the food conglomerate, which has risen 51% in the past year and 379% in 10 years.

Tesco

Tesco’s secret weapon is the vast amount of data it harnesses through its loyalty card.

“Clever use of data analysis via the information collected from Clubcard transactions means it has valuable insight into shoppers’ tastes. It can tailor promotions and push products that have a strong chance of shoppers placing them in their basket,” Coatsworth explained.

Rathbone UK Opportunities, Artemis Income, Henderson Opportunities Trust, Lowland and Law Debenture all own Tesco, which has rallied 39% in the past 12 months and 96% in 10 years.