A well-diversified portfolio isn’t born overnight. Not only does it take effort, it also takes money – it’s no use finding a long list of great fund combinations if your investible pot is limited.

When time and money are scarce, investors must work with what they have got. One option would be to invest in a one-stop-shop solution, be it a multi-manager, multi-asset or index fund – but it doesn’t have to stop there.

Trustnet asked experts what other options are available for investors who want to go beyond one-stop-shop funds, but keep things simple. Below, they suggested two-fund portfolios with a core/satellite approach, whereby one fund bears the brunt of the heavy lifting while the second one complements and enhances it.

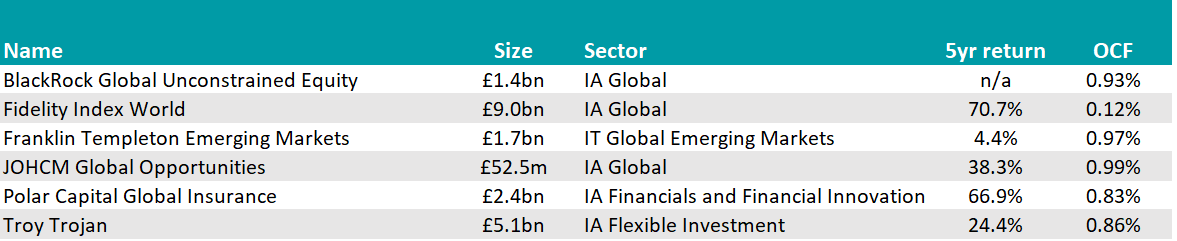

Fidelity Index World and Templeton Emerging Markets

Long-term, buy-and-hold investors might want to focus on equities rather than a multi-asset approach.

For them, a good pairing would be a core holding in a global developed market equities fund, coupled with a modest satellite position in emerging markets, according to Jason Hollands, managing director of Bestinvest.

His suggestion for global developed market equities is the Fidelity Index World fund, which tracks the MSCI World Index and has a low ongoing charges figure (OCF) of 0.12%. It provides “significant diversification across stocks at low cost,” he said.

For the satellite position in “less efficient” emerging markets, he proposed a selective approach through an actively managed portfolio such as the Templeton Emerging Markets investment trust.

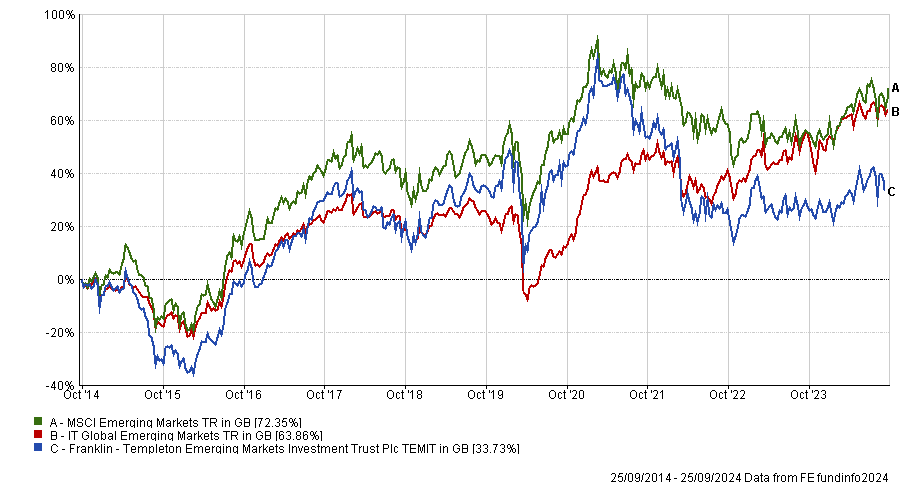

Performance of fund against sector and index over 10yrs Source: FE Analytics

Source: FE Analytics

This trust is “the grandaddy of emerging market investments”, having been launched in 1989. Since the departure of veteran investor Mark Mobius, it has been managed by Chetan Seghal and Andrew Ness, who “leverage a research team that is embedded across local markets”.

“The trust benefits from having a very pragmatic and patient philosophy, investing in companies with sustainable earnings power that are mispriced,” Hollands said.

Currently, nearly 81% of the portfolio is invested in Asia, with technology and financials being notable themes.

Polar Global Insurance and Troy Trojan

Director of Fairview Investing Ben Yearsley picked the satellite fund first – Polar Global Insurance.

“The satellite is easy. It’s one of my favourite funds, albeit a niche one; I use it for low and high risk,” he said.

“You’d be hard-pressed to find any of its stocks in most other portfolios, as it mainly focuses on reinsurance and catastrophe insurance companies.”

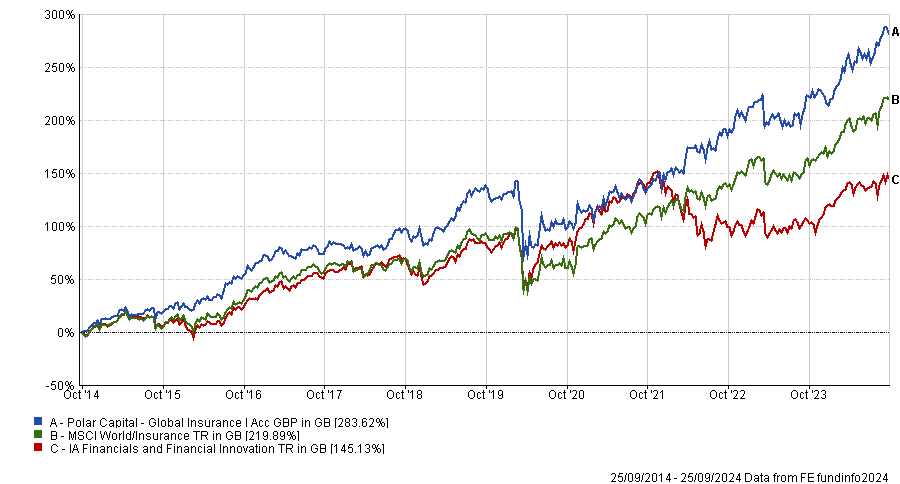

The £2.4bn strategy has achieved a maximum FE fundinfo Crown Rating of five and has been “very consistent over the long term”, having delivered 10% per annum over a very long period.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

For core exposure in a small portfolio, he wanted to avoid excessive volatility, so he also went with Fidelity Index World. It offers “cheap, broad-based coverage” and is suitable for higher-risk investors.

Those who would rather keep risks at a minimum might prefer Troy Trojan, managed by FE fundinfo Alpha Manager Sebastian Lyon and Charlotte Yonge. It seeks to protect wealth from inflation through exposure to quality companies, gold and inflation-linked government bonds.

JOHCM Global Opportunities and BlackRock Global Unconstrained Equity

Finally, Rob Morgan, chief analyst at Charles Stanley Direct, opted for two global equity funds – JOHCM Global Opportunities for the core allocation and BlackRock Global Unconstrained Equity as the satellite.

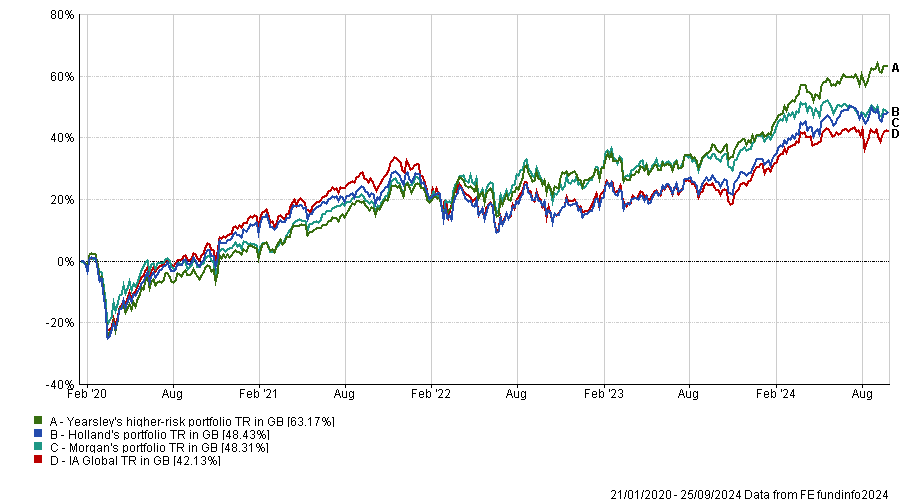

Performance of portfolios (with 70% in core and 30% in satellite) against IA Global sector over 3yrs

Source: FE Analytics

The JOHCM fund can be considered for “part of an investor’s core allocation to global shares, especially for those wishing to keep their portfolio anchored by characteristics of quality and value”, he explained.

The fund is neither growth or value biased, instead exploring what the managers refer to as the ‘forgotten middle’ where quality, growth and value styles intersect.

“As well as a concentrated portfolio, where stock picking has a significant impact, the approach emphasises capital preservation,” Morgan said.

“If insufficient attractive opportunities are identified, the managers are prepared to hold some cash.”

This all-weather fund is paired with BlackRock Global Unconstrained Equity, a “punchy, growth-orientated option” that is likely to be “more volatile, given the very high-conviction approach”.

It is managed by Alistair Hibbert, best-known for his success in unconstrained European equity funds. The manager searches for the “growth compounders” of the coming decade and beyond, with no regard for any benchmark.

“This is a pure stock-picking fund with a very defined approach and style in the hands of an accomplished manager,” said Morgan.

“It makes for a good complement to a broader equities fund or a tracker.”

Source: FE Analytics