With just five weeks to go until the US election, which arguably looks too close to call, asset and wealth managers are positioning their portfolios for a variety of outcomes.

Rather than trying to pick a winner, Daniele Antonucci, chief investment officer at Quintet Private Bank (Brown Shipley’s parent company), has been looking for policies that are common to both the Republicans and Democrats.

Whoever wins in November, he expects fiscal spending to be high, so the government will need to issue more debt, hence Brown Shipley has gone underweight US Treasuries.

But this is far from the only change to his portfolios. The wealth manager has adopted a cautious stance towards emerging market equity and debt because Antonucci is concerned about the ramifications of trade wars.

The bar for going overweight emerging market assets is “higher than normal” because if Donald Trump wins, he might bring about “a renewed escalation of trade tensions”. “With [Kamala] Harris it will become less predictable, but we wouldn’t expect much of a de-escalation,” he added.

Tariffs could have a detrimental impact on European equities, given the region’s trade links with Asia, so Brown Shipley has taken out downside protection in the form of a warrant.

Despite that, the wealth manager is slightly overweight European equities, with a 9% allocation in sterling portfolios and an 11% allocation in balanced portfolios denominated in euros. European equity valuations are in line with the region’s long-term historical average but look attractive compared to the US, he explained.

Brown Shipley has a neutral outlook for US equities but has another warrant as a form of insurance against any events that could cause volatility and drawdowns, from the forthcoming election to geopolitics.

Elsewhere, Janus Henderson Investors’ absolute return equities team is taking a different approach. The team usually prepares a ‘blueprint’ ahead of major elections and this time it is focusing on how tariffs could impact different companies and sectors, the potential for retaliation, and how Trump's current policies differ from his earlier presidency.

Luke Newman, co-manager of the £912m Janus Henderson Absolute Return fund, said: “We’ve been working through [companies] name by name, speaking to management teams where appropriate, to understand what their reliance on China is, either from a production perspective or from a sales perspective, to understand where the pressure points could be.”

The FE fundinfo Alpha Manager still has his 2016 spreadsheet of US-based companies’ exposure to China, although many companies have altered their supply chains since Trump’s first term. Companies that used to single source from China within technology, textiles or retail have introduced dual sourcing and businesses with sales exposure to China have diversified.

The morning after the 10 September debate between Trump and Harris, some industries that had been weighed down by tariff concerns, such as semiconductors, recovered.

Renewable energy names were “slightly buoyant, presumably on a better showing from Harris,” he noted. “That price action is confirmation that we're looking in the right areas.”

Going into the US election, Newman is taking a cautious approach. “If there's a known unknown that carries huge binary risk, you won't see us flipping a coin and picking a winner. We'd much rather wait, avoid a drawdown and then deploy capital quickly once we've got higher conviction and a clearer path,” he explained. “What we don't want to do is to hardwire the portfolio for any political outcome.”

For investors wondering how to position their own portfolios, Jason Hollands, managing director of Bestinvest, suggested different funds depending on whether the Republicans or Democrats prove victorious.

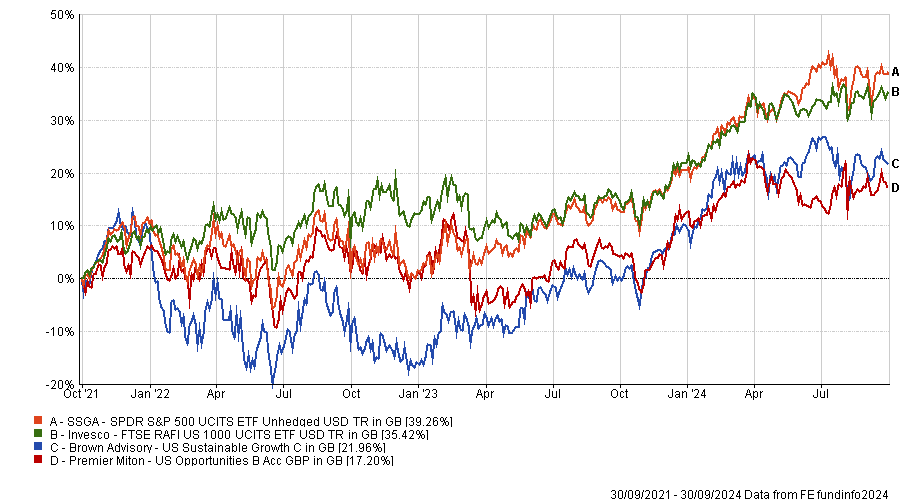

“If you are bullish on US equities and believe a Trump win will spur another leg up for the market, then the simplest way to capture this is by buying a low-cost index fund like the SPDR S&P 500 UCITS ETF, which has a tiny 0.03% [charge],” he said.

Another way to capture domestic growth would be through an actively-managed fund with greater exposure to small- and mid-cap companies, such as Premier Miton US Opportunities.

It invests in stocks with consistent cash flows that can compound returns over the long-term. “Such business typically have higher margins, recurring revenues, lower leverage and asset light business models,” he said.

If the Democrats win, large technology companies could face increased scrutiny under anti-trust regulations, so passive investors may prefer a strategy with less tech exposure, such as the Invesco FTSE RAFI US 1000 UCITS ETF.

It weights companies based on four factors: sales, cash flow, book value and average dividends over five years. “The outcome of this approach is broad exposure to the US market but with a tilt towards companies with attractive valuations,” he explained.

Performance of funds over 3yrs

Source: FE Analytics

Hollands also suggested the Brown Advisory US Sustainable Growth fund “if the Democrats prevail and it is full steam ahead with the green agenda”.