For a deep value manager, calling a sector ‘uninvestable’ is like a red rag to a bull.

Yet that is precisely what Fundsmith’s Terry Smith did last year to banks, despite being a former banking analyst himself. “It is precisely because I understand banks that I never invest in their shares,” he told the Financial Times in March 2023.

Ian Lance, co-manager of the £756m Temple Bar Investment Trust, said if other investors avoid a sector, that only makes the area more attractive to him because he can pick up out-of-favour stocks at cheap valuations.

“We always like when someone sticks a line through an industry and calls it ‘uninvestable’ because it means that they have made up their mind and don’t care how low the value is. The more the market does that, the higher the likelihood that something is not being valued correctly,” he explained.

Thomas Moore, manager of the abrdn Equity Income trust, agreed. He thinks investors should be “licking your lips with excitement” when others refuse to buy something because it helps create valuation opportunities. “For those people who have reduced their risk to a handful of sectors, good luck”, he added.

Nevertheless, Lance understands why many investors shunned banks. The global financial crisis was “an unbelievably scary experience” when banks sometimes fell by 25% in a single day and investors do not forget that easily. However, banks are “fundamentally very different businesses than they used to be”, under new management and governed by extensive regulation, he noted.

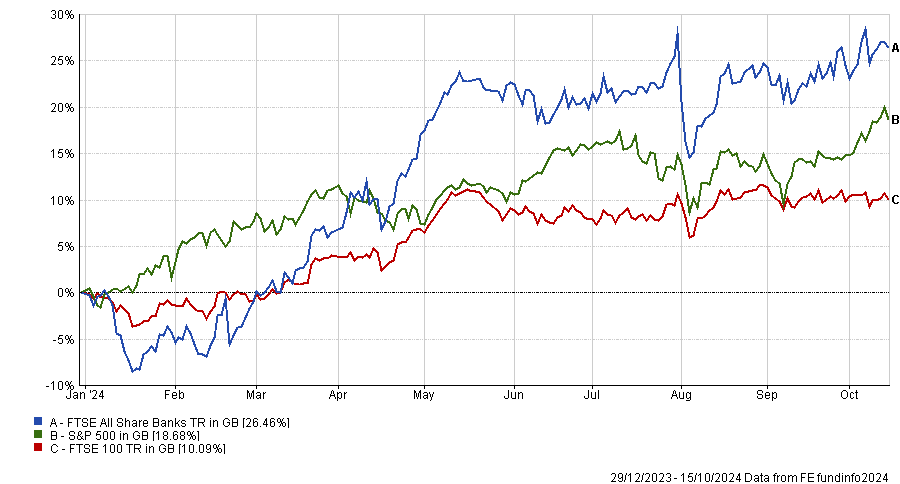

Banks have surged this year, with the FTSE All Share Banks index up 26.5% year-to-date, outperforming the mighty S&P 500 (which rose 18.7%).

Performances of indices year-to-date

Source: FE Analytics

NatWest and Barclays, which Temple Bar owns, have returned 65.3% and 57.3% so far this year, respectively.

Despite strong recent performance, European banks remain attractively valued with average price-to-earnings (P/E) ratios of about 6x.

Both Lance and Moore identified oil and gas as another area many investors shy away from, which offers significant opportunities.

The push to incorporate environmental, social and governance (ESG) criteria in recent years led some asset managers and investors to sell out of stocks such as Shell and BP. As a result, Shell and BP now have attractive valuations, with P/E ratios of around 7x, Lance said.

Demand for oil and gas remains extremely high globally, with research conducted by Goldman Sachs earlier this year predicting that oil demand will peak at 110 million barrels a day in 2034.

Moore said: “We’ve been talking about the end of fossil fuels for a very long time. But demand for some of the commodities that mining companies generate will continue for years.”

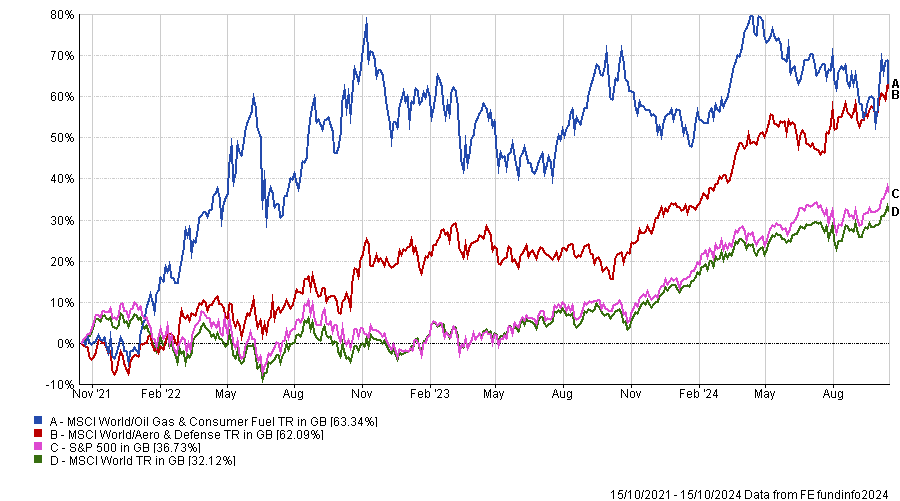

Contrarian investors willing to take a risk on oil and gas would have achieved strong results. The MSCI World/Oil Gas and Consumer Fuel index rose by 69.3% over the past three years, surpassing the broader global equity market, as the chart below shows.

Performance of indices over 3yrs

Source: FE Analytics

Another example of a supposedly uninvestable sector is defence. The MSCI World/Aero and Defence index was up by almost 63% over the past three years, just slightly behind its oil and gas counterpart.

The value of defence stocks such as BAE Systems has continued to climb following war in Ukraine, conflict in the Middle East and rising geopolitical tension. Investors who bought BAE Systems when it was out of favour would have seen the stock price surge by over 140% in the past year alone.

Moore concluded: “This word ‘uninvestable’ can create opportunities."