US small-cap, financial and tech funds made the strongest returns in the days immediately after Donald Trump won the US presidential election, according to FE fundinfo data.

A Trump win is largely seen as a positive for the stock market, as shown by the reaction of US equities when the news broke: the S&P 500, Dow Jones and Nasdaq surged to record highs.

Johanna Kyrklund, group chief investment officer at Schroders, said: “Trump’s victory in the US presidential election has not changed our positive stance on global equities, with a preference for US shares. In his previous administration, Donald Trump was focused on the Dow Jones as a barometer of his success.”

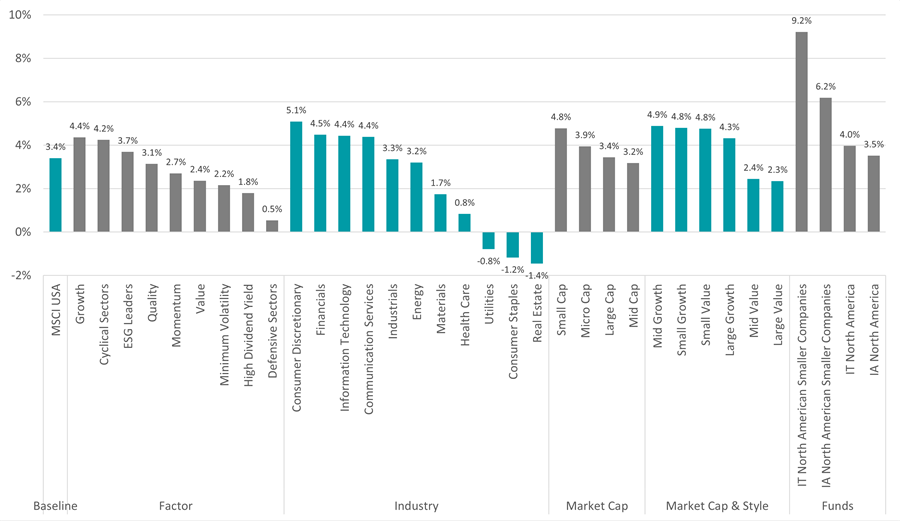

Performance of US equities on 6 and 7 Nov 2024

Source: FinXL. Total return in sterling over 6 and 7 Nov 2024

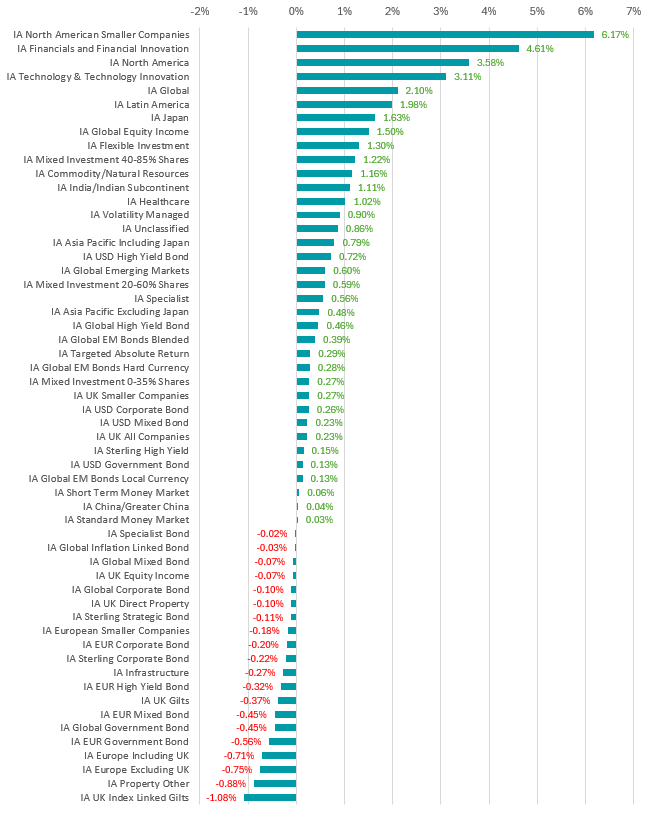

FE Analytics shows IA North American Smaller Companies was the best performing sector in the two days after the election, with its average member making a 6.2% total return.

It is followed by IA Financials and Financial Innovation (average fund up 4.6%), IA North America (3.6%), IA Technology & Technology Innovation (up 3.1%) and IA Global (up 2.1%).

Performance of Investment Association fund sectors on 6 and 7 Nov 2024

Source: FE Analytics. Average return in sterling over 6 and 7 Nov 2024

US small-caps are one of the areas of that analysts expect to outperform with Trump in the White House.

Richard de Lisle, manager of the VT De Lisle America fund, said: “Trump’s rhetoric around both protectionism and de-regulation will be positive for smaller companies that have more US revenue exposure and that are advantaged by reduced regulatory burdens, allowing them to grow faster.”

Justin Onuekwusi, chief investment officer of St. James’s Place, said US smaller companies might be more affected by any post-election volatility but “we believe this to be a short-term concern”.

“In our view, the valuation case for global small companies is currently strong and expect over the medium-term US small caps will do well,” he added. “We will continue to watch this space with interest as Trump’s campaign promises materialise.”

Financials are also expected to benefit under Trump thanks to his deregulation agenda and higher-for-longer interest rates should his policies prove inflationary.

Nabeel Siddiqui, analyst in Polar Capital’s global financials team, said: “He is clearly positive for US financials and we have been arguing for some time that investors should consider diversifying away from growth exposures, while the relative valuations of financials remain compelling compared to the wider market.”

Tech is another sector that would benefit from deregulation, through actions such as the removal of many of the anti-trust restrictions and litigation currently blocking tech mergers. In addition, reshoring of manufacturing in the US could boost domestic demand for robotics and automation technology.

Anthony Ginsberg, fund manager for the HAN-GINS Tech Megatrend Equal Weight UCITS ETF, added: “We should also bear in mind that Trump has gained significant support from the tech sector – most notably from Elon Musk.

“The multi-billionaire is hoping that the president-elect’s promise of ‘the lowest regulatory burden’ will benefit electric vehicle maker Tesla – especially if Musk is put in charge of Trump’s US government efficiency drive. We also expect more government outsourcing to Silicon Valley, particularly with cybersecurity, AI and cloud technology.”

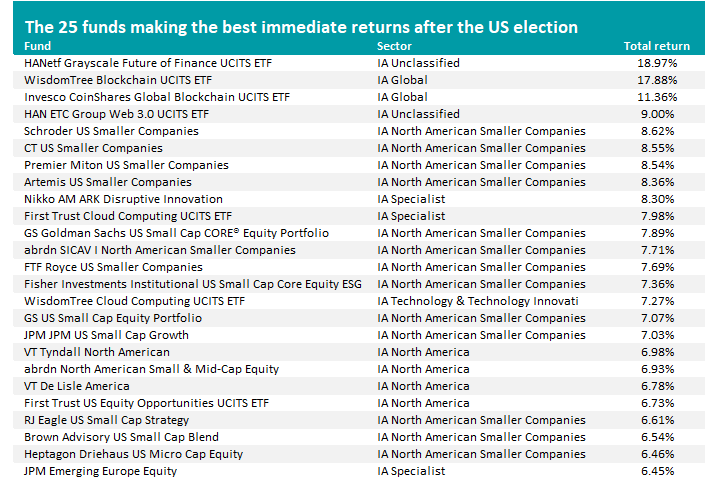

Turning to the individual funds that made the highest returns in the two days after Trump won the election, the table below reflects how strong the above trends have been.

Source: FE Analytics. Total return in sterling over 6 and 7 Nov 2024

The three funds focus on investing in areas such as blockchain and fintech (financial technology). Cryptocurrencies are another area that has been identified as a likely beneficiary of a Trump administration.

Danni Hewson, head of financial analysis at AJ Bell, said: “Bitcoin sailed to a new record high as traders considered how America might now become the ‘crypto capital of the planet’, with the once sceptical Trump now a paid-up believer after launching a family crypto business earlier this year.”

Of the 25 funds listed in the table, 13 of them reside in the IA North American Smaller Companies sector – backing up the view that US small-caps are seen as a key area to watch. The best performer among these was Robert Kaynor’s £800m Schroder US Smaller Companies fund with its 8.6% total return.

The presence of funds like HAN ETC Group Web 3.0 UCITS ETF, First Trust Cloud Computing UCITS ETF and WisdomTree Cloud Computing UCITS ETF demonstrates the view that tech will benefit from a Trump administration.

The worst performing funds over the two sessions under consideration were those focused on clean energy, reflecting Trump’s support for the oil and gas industry and lack of emphasis on the green agenda.

Active Niche Luxembourg Selection Fund Active Solar fell 11% on 6 and 7 November, while other funds making the biggest losses include Invesco Solar Energy UCITS ETF, WisdomTree Renewable Energy UCITS ETF, iShares Global Clean Energy UCITS ETF and Schroder Global Energy Transition.