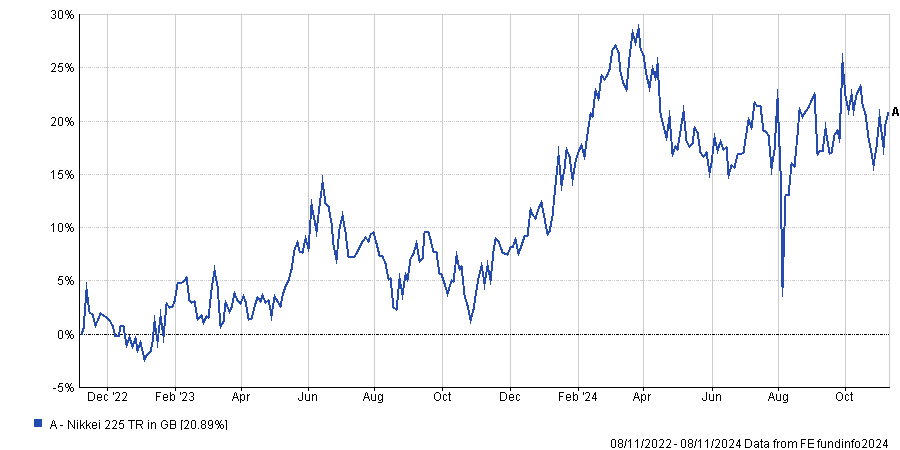

Japanese equities have enjoyed a comeback in recent years. Corporate governance reforms caused Japanese stock prices to surge upwards, encouraging many investors to increase their allocations.

This year has proven markedly more volatile. The Bank of Japan tightened monetary policy this summer at the same time as the major western markets started easing, making Japanese equities the epicentre of August’s painful downturn. But the Nikkei 225 has largely recovered and is up by 20.9% over the past two years.

Performance of Japanese equities over 2yrs

Source: FE Analytics

Jacob de Tusch-Lec, co-manager of the £1.5bn Artemis Global Income fund, is still overweight Japan but believes the country’s story has gradually become less compelling. “On a relative basis, the Japanese story has played out,” he said.

Japanese companies are far more expensive than a year ago. The share price of Mitsubishi Bank has swelled by almost 200% over the past five years, with most of that growth occurring over the past two years. Now trading at a price-to-earnings (P/E) ratio of 14.1x, with a dividend yield of 2.3%, it is more reasonably valued than a year ago and is no longer an underappreciated opportunity.

Share price of Mitsubishi Bank over 5yrs

Source: Google Finance

This time last year, it was trading at a book value of around 0.6x, but now it and many other companies are trading at about 1x book value – a key milestone for the corporate governance reforms.

Consequently, Tusch-Lec has been drawn to opportunities elsewhere, including China. “When China does well, Japan tends to do worse,” he said.

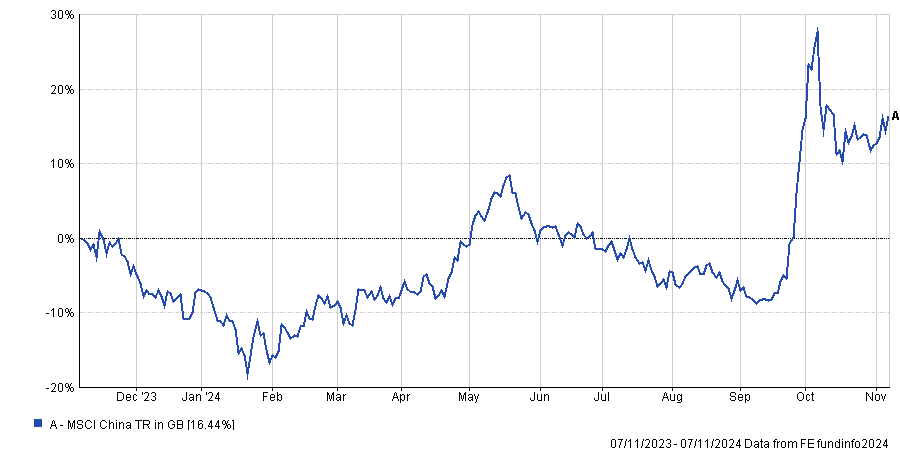

Indeed, following China’s stimulus package in late September, the MSCI China soared in value by over 30% between 19 September and 7 October. While the rally has somewhat faded, the index is still up 16.4% this year.

Performance of index over past year

Source: FE Analytics

For Tusch-Lec, this has encouraged a shift in his portfolio toward mispriced domestic names in China, such as healthcare insurance provider Ping An, the fund's current largest Chinese holding. It is appealing from a valuation standpoint, at just 59.12 CNY per share and trading at a P/E ratio of 9.14x. Despite this, it has an attractive dividend yield of roughly 4.1%.

The money for this, Tusch-Lec admitted, has come from reducing his allocation to Japan.

“The Japanese story of corporate reform was one of the most interesting Asia stories two years ago when there wasn’t much of a story in China and when it wasn’t clear what was happening in Taiwan or Korea,” Tusch-Lec said.

“We’ve made good money in it and now for us, it’s time to look at what the next big thing is.”

However, Shuntaro Takeuchi, portfolio manager and Japan specialist at Matthews Asia, disagreed and argued that Japan’s potential is still underestimated.

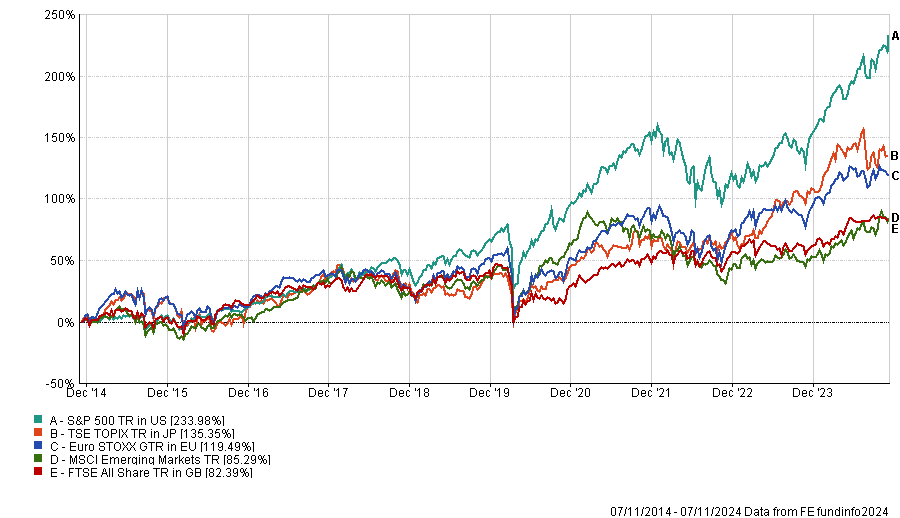

The Japanese equity market has been one of the best-performing non-US asset classes over the past decade, consistently surpassing Europe and emerging markets, but he believes there is plenty still to play for.

Performance of global market indices over 10yrs

Source: FE Analytics, data in local currency terms

Over the past 10 years, the TSE Topix was up by 135.4% in local currency terms, outperforming all major global indexes except the S&P 500.

Yet despite this strong rally, Japanese companies remain attractively valued, with the average company trading at around 14.2x earnings compared to a 10-year average of 15.1x.

Looking to the future, Takeuchi suggests that dividend growth could rise to a peak of 18% over the next few years, and share buybacks could grow even higher than that, while share prices are still trading at below-average valuations.

“You don't see that many markets that actually meet those criteria”, Takeuchi said.

Despite this, there is still a large “perception gap” between the actual data from the Japanese market and the views of many professional investors, he stated.

“There are veteran fund managers who have made their name by not owning Japan. So even though that strategy has not worked over the past 15 years, these perceptions still exist, and people's positionings have not changed,” he said.

As corporate reform persists and company fundamentals continue to improve, Takeuchi believes that Japan will remain a region with great long-term growth potential at reasonable valuations.