Investors should be aware that gold can be more volatile than they might assume and consider if they need an allocation at all in their portfolio, according to Hargreaves Lansdown strategists.

Gold is seen as a classic safe haven, offering the potential to protect portfolios during times of market and economic stress. Investors have been flocking to the yellow metal recently, driving its price to new record highs and causing it to outperform other major asset classes.

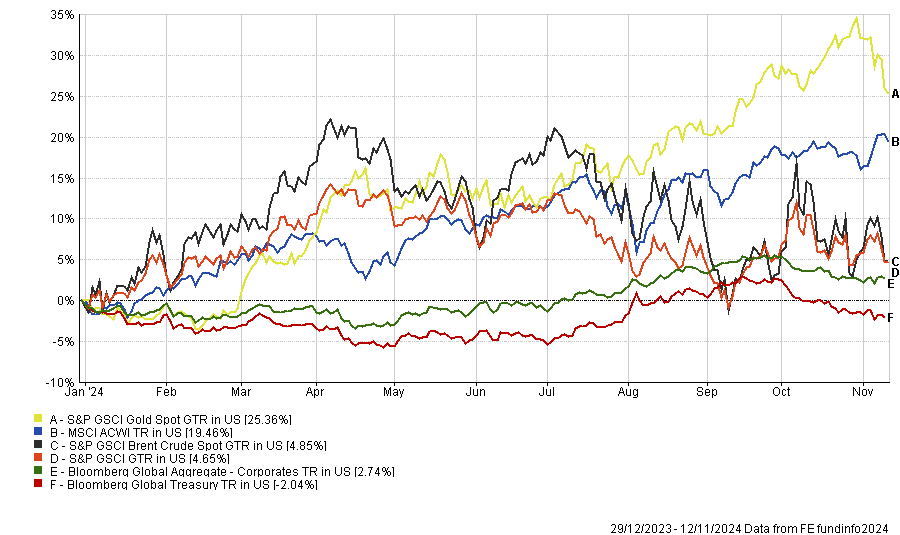

Performance of gold over 2024

Source: FE Analytics. Total return in US dollars between 1 Jan and 10 Nov 2024

Victoria Hasler, head of fund research at Hargreaves Lansdown, said: “Gold has historically been popular during times of uncertainty because it has a reputation for holding its value when other assets are falling.

“In reality this relationship isn’t quite as straightforward as most people think, not to mention potentially self-fulfilling, but gold continues to attract investors during times of uncertainty.”

Data from FE Analytics illustrates this. The annualised volatility of the S&P GSCI Gold Spot index over the past 10 years has been 13.4% (in US dollar terms) while the maximum drawdown has been 18.7%; this is better than the MSCI AC World’s 14.8% volatility and 25.6% maximum drawdown, but not to the extent that some might think.

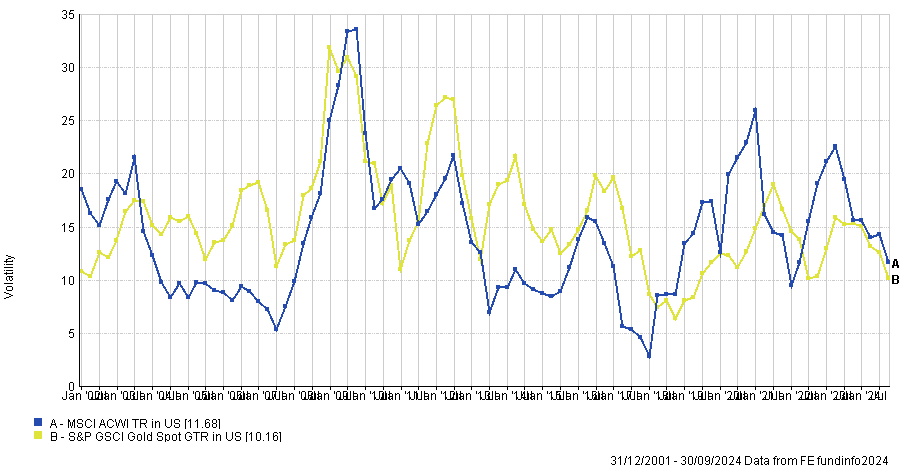

The below chart, which shows the rolling annualised volatility of gold and global equities, reveals the ‘safe haven’ has been more volatile than stocks at times during the past two decades.

Rolling 12-month volatility of gold and global equities over 20yrs

Source: FE Analytics. Total return in US dollars between 1 Jan and 10 Nov 2024

However, Hasler noted how 2024 has been a good example of when gold is an attractive investment. “With tensions rising in the Middle East, a war still simmering in Europe and the equity markets being led by a small handful of stocks, many investors have turned to gold as something of an insurance policy,” she explained.

Figures from the World Gold Council show retail investors now hold 45,000 tonnes of gold in bars and coins, or around 22% of the gold mined throughout history. But actual retail ownership is likely to be far higher than this as physical gold is just one way to take exposure, alongside owning it through an exchange-traded fund or through digitally tokenised gold.

Another driver of the high gold price has been the freezing of Russian assets by governments around the world in response to the invasion of Ukraine. This prompted some emerging market central banks to diversify their currency reserves into gold, as this is something they can physically hold onto without the concern that another party can freeze.

While these two factors have pushed the gold price to new highs this year, investors can never be sure that its “inexorable march” can continue.

“If you are looking to hold some gold, it should only form a small part of a well-diversified portfolio,” Hasler said. “That’s because investing in gold isn’t for everyone. It’s a specialist market area so investors should be prepared to take a long-term view and accept the associated volatility.”

For those interested in holding gold, she gave three investment ideas.

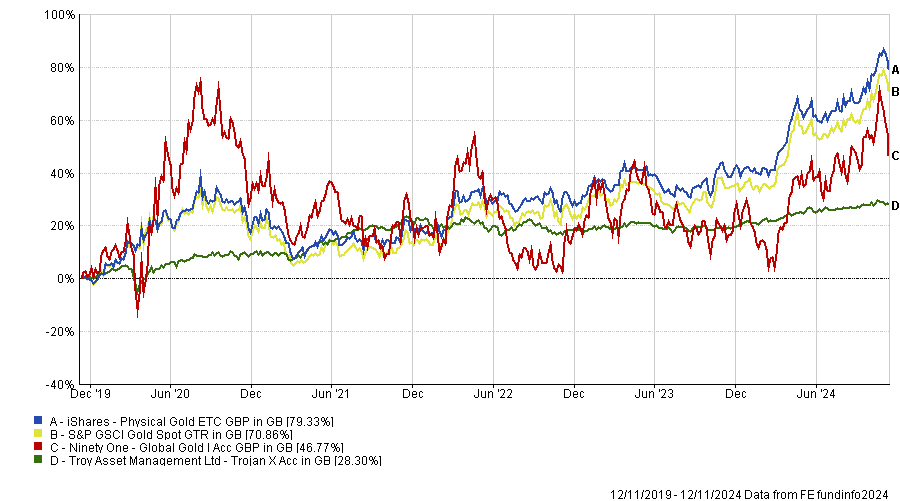

First is taking exposure through an exchange traded commodity (ETC), which tracks the price of a commodity or commodity index and is traded on a stock exchange. Hasler highlighted the iShares Gold ETC, which tracks the gold spot price (the current price at which gold can be bought or sold for immediate delivery).

“It could be a good way to benefit from any potential moves in the gold price, without having to own the physical commodity,” she explained.

Performance of funds vs gold over 5yrs

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Nov 2024

Another way to benefit from a rising gold price is to invest in gold miners. Because the cost of mining the gold doesn’t change, miners’ profits grow when gold prices rise, although there is often a lag between increases in the price of gold and the share prices of gold miners.

Hasler pointed to George Cheveley’s Ninety One Global Gold fund as a good option. The bulk of the portfolio is in gold mining companies with a small amount in the miners of other precious metals like silver; around half of the assets are invested in Canada, which is home to almost half of the world’s publicly-listed mining and mineral exploration companies.

“We believe that funds like this could stand to benefit if the demand for gold, and the gold price, remain high,” she said.

Finally, Hasler said Sebastian Lyon and Charlotte Yonge’s Troy Trojan fund could appeal to investors who prefer to use multi-asset strategies but still want exposure to gold.

Trojan is built around four pillars: large, established companies that can grow over the long run, government bonds, cash and gold-related investments, including physical gold. It tends to hold around 10% in its gold pillar.