Investment in the UK has become increasingly unattractive, according to business owners at the Confederation of British Industry last week. Despite enthusiasm earlier this year, UK equities have yet to experience their predicted resurgence, leaving experts

However, Gervais Williams, manager of Premier Miton UK Multi-Cap Income, could not disagree more. For him, the UK remains home to several underappreciated market leaders who are worth being proud of.

Williams said: "Some companies have been working quietly under the radar, doing the right thing for many years. I think those businesses lead the world, and we have a lot of them."

These undervalued businesses will be responsible not just for the UK market’s return to form, but could help the UK become the most “successful stock market in the world” over the next decade, he said.

Below, Williams and two other fund managers highlight underappreciated domestic companies with huge potential.

Concurrent Technology

Williams identified defence company Concurrent Technology, responsible for the maintenance and production of computer boards in armoured cars, as one of the UK's best undervalued businesses.

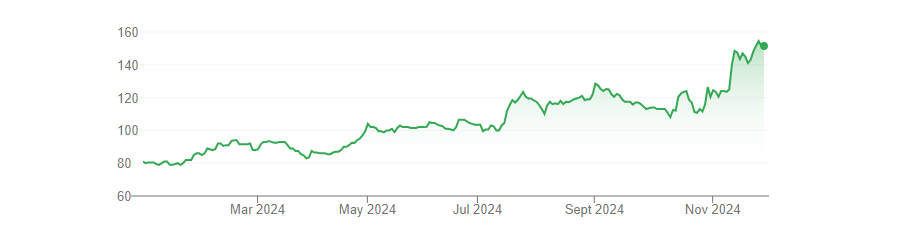

The share price has risen 87%this year but he believes the stock has further to go and is poised to “take on the world”.

Share price performance of Concurrent YTD

Source: Google Finance

For Williams, Concurrent has solid fundamentals and an in-demand product that plays well with global megatrends.

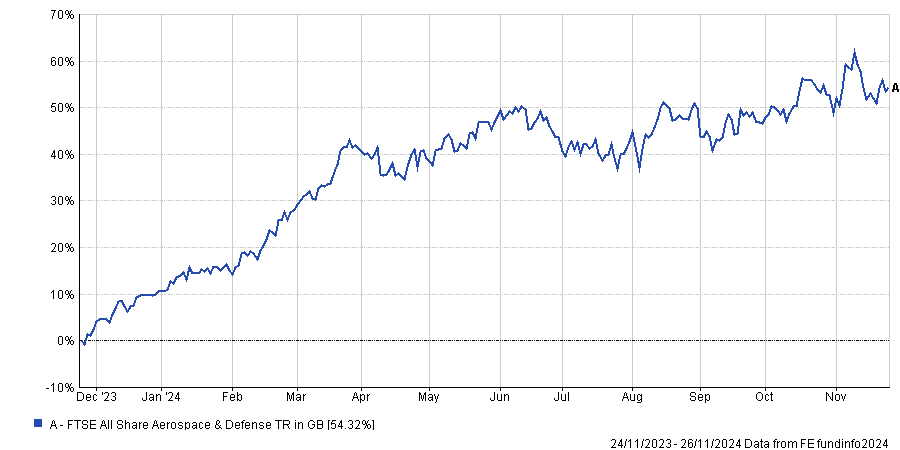

Globally, it’s been a positive market for defence investment, with the FTSE All Share Aerospace and Defence index up by 54% in the past 12 months, as increased geopolitical conflict has continued to make defence companies more appealing.

Performance of FTSE All Share Aerospace and Defence index over 12 months

Source: FE Analytics

As an AIM listed stock, Concurrent was one of a handful of indirect beneficiaries of the Autumn Budget.

AIM stocks are now subject to 20% inheritance tax, compared to the 40% on main market stocks, so they continue to be an attractive way of minimising tax.

Because Concurrent has a relatively low market cap of around £130m, even small surges of investment can lead to enormous long-term growth, he concluded.

“As these companies succeed, it is not just their share price that goes up, but as they get bigger, you will begin to see a wider institutional range of interest.”

Cohort

Henry Lowson, manager of Royal London UK Smaller Companies, highlighted another defence and technology stock, Cohort, as an underappreciated market leader.

While its price-to-earnings (P/E) ratio has already grown this year to 18x from 13x, Lowson remains convinced that the stock has further potential for growth.

Share price performance of Cohort YTD

Source: Google Finance

“It's a strong environment for defence spending, with most governments now set to increase their defence contributions,” he explained.

Indeed, the Autumn Budget promised a further £2.8bn in investment to the defence sector over the next year and a renewed push for 4% of UK GDP to go to defence spending, both of which will provide tailwinds for stocks such as Cohort.

Additionally, the company has developed a broad global scope and is partnered with the UK and international governments on new contracts. It is still growing and acquiring new businesses, such as the Australian naval communications company EM Solutions, which it purchased earlier this year.

As a result, Lowson said that Cohort is constantly scaling its earnings, giving it a long-term growth potential that the market is still underestimating.

“It’s a great example of a little gem that was not as well-known as it should have been,” he concluded.

IMI

Meanwhile, Tom Wildgoose, manager of Sarasin Thematic Global Equity, pointed to the FTSE 100 constituent IMI as another example of the best the UK had to offer.

He said: “IMI is a company that has fallen back quite a long way recently and it is a shame because there seems to be no obvious reason for it.”

Indeed, the stock has endured a volatile year and is only just recovering from large slides in April and October. However, he remains confident in the stock's long-term value and believes it has significant room to develop.

Share price performance of IMI Technologies YTD

Source: Google Finance

Despite being based in the UK, IMI is continuing to develop its exposure to international markets, with a growing percentage of its revenue coming from the US.

However, since it is listed in the UK, it gives investors access to the US market at a valuation of just 18x P/E, far lower that if it was based in the US, making it a great play on global opportunities with solid long-term growth potential.

Wildgoose said: “It is the kind of great quality UK company which we should be proud of as a country”.