The US dollar acts as international reserve currency, so countries around the world need lots of it. But with Donald Trump soon back to the White House, experts are bracing for a world where dollars could become scarcer.

Should Trump’s policies on immigration, tariffs and reshoring be implemented in an attempt to reach a trade surplus (it would be the first time since 1975), dollars would be flowing back into America, denying the world of the liquidity that it needs to grease its economic wheels, according to AJ Bell investment director Russ Mould.

“The world can't afford a strong dollar. If Trump succeeds and America starts to hit a trade surplus, things will get really unusual in terms of world liquidity,” he said.

This situation is described by the Triffin Dilemma, named after Belgian-American economist Robert Triffin (1911-1993), who was a strong critic of the Bretton Woods system of fixed exchange rates. According to him, by being required to constantly provide global liquidity, the US would compromise its own economic stability; conversely, prioritising domestic stability by reducing trade deficits would mean failing to provide the necessary global liquidity, potentially leading to instability in the international financial system.

In a world starved for dollars, certain asset classes would be impacted more than others, said Mould.

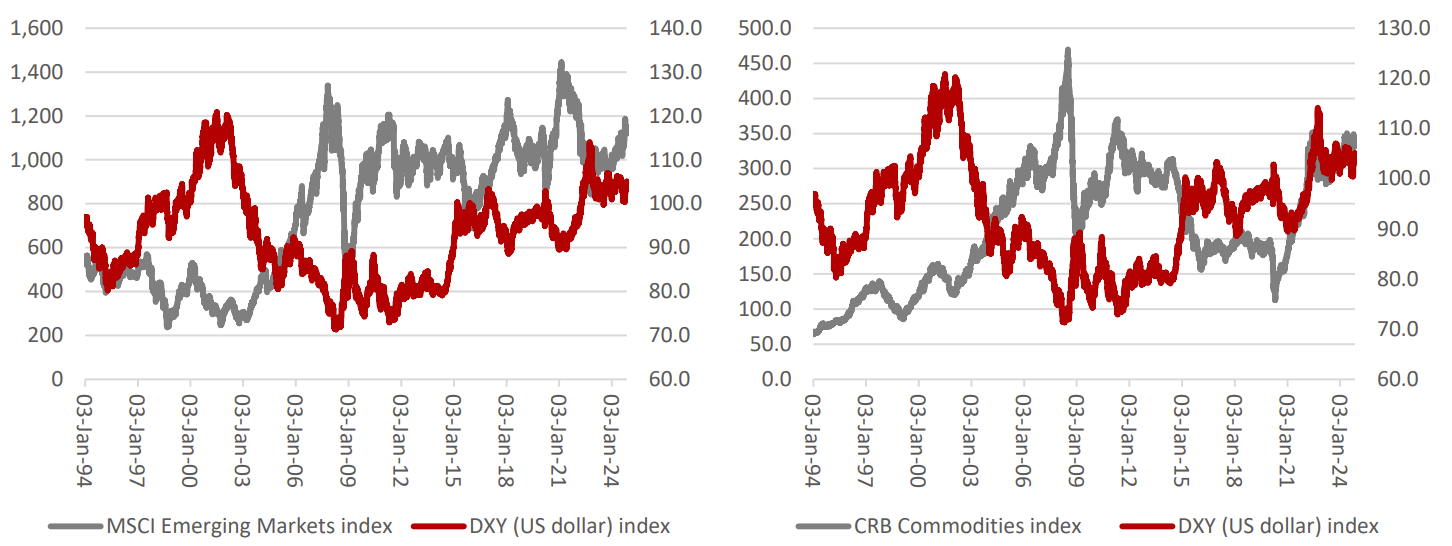

Emerging market equities are generally inversely correlated to the US dollar, as the left-hand chart shows in the image below.

Emerging market equities and commodity prices against US dollar

Sources: LSEG, Refinitiv data.

“Many emerging markets are borrowing dollars, so a stronger dollar makes their debt more expensive to buy and to service, dragging money away from other things,” he explained.

As shown on the right-hand side, commodities follow similar dynamics.

“Nearly every commodity, except cocoa, is priced in dollars, so if the dollar goes up, it makes them more expensive to buy in local currencies. A strong dollar is inherently disinflationary, if not deflationary for the world,” Mould said. “If Trump succeeds in his goal, some interesting things would happen.”

All of this would add to the pressure on growth in emerging market economies, said Joe Richardson, discretionary investment manager at Dennehy Wealth.

He thinks investors with US exposure should shift focus from the large-caps, many of which derive a large chunk of revenues overseas, to small and mid-caps that generate the majority of their earnings domestically.

“These tend to be less impacted by the currency fluctuations and can offer that added resilience in a stronger dollar environment,” he said.

“However, a stronger dollar can make US stocks as a whole less attractive, which creates an opportunity to explore much cheaper international markets as part of your long-term investment strategy – notably across Asia and in the UK.”

Another area worthy of a re-think would be Japan. As the yen weakens against the dollar, the large exporters in the Nikkei 225 would continue to benefit significantly. But here, a question emerges of how much further the Bank of Japan would allow the currency to go.

Investors may also consider currency-hedged funds, which typically outperform unhedged versions when the dollar strengthens. However, for Richardson, current valuations are more critical than currencies and inflation when building a portfolio for the long-term.

IBOSS chief investment officer Chris Metcalfe said currencies are about pairs. When hearing headlines about dollar strength, he stressed the importance of understanding strength against what. UK investors care primarily about the relationship between sterling and the dollar.

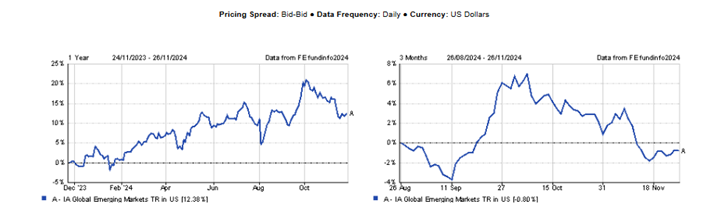

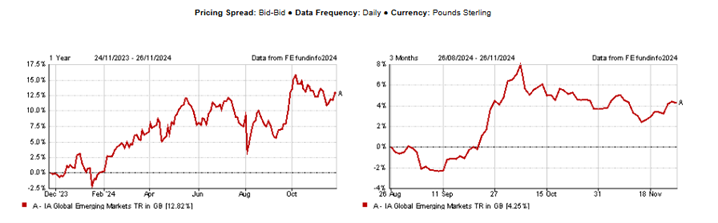

Over the past 12 months, the IA Global Emerging Markets sector has produced a 12.8% total return in sterling terms and 12.3% in US dollars, he noted. However, in the past three months, , emerging market funds gained 4% in sterling versus a loss of 1% in dollar terms, as the charts below show.

Performance of IA Emerging Markets sector in US dollars and sterling over 1yr and 3 months

Source: FE Analytics

“The relative weakness of sterling, or dollar strength, enhances client valuations, which clients most passionately care about. The strong US economy means the Fed will struggle to cut rates in 2025,” he said.

“That means, all other things being equal, with the Fed's backdrop being the diametrical opposite of the European Central Bank and, to some extent, the Bank of England, the dollar stays relatively high in 2025.”

Since the US election (and over the past 12 months), IBOSS’ best-performing global bond fund has been the M&G Emerging Markets Bond fund, which “further proves there are opportunities for active managers and allocators to play both sides of currency pairs”.

“We have previously hedged some of our funds to protect investors from some of the most extreme currency gyrations,” he said.

“Currently, we see the directions of travel for the pound, the euro and the dollar being maintained, but we are watching for the point where the strong dollar displeases Trump, and then a new chapter will no doubt quickly emerge.”