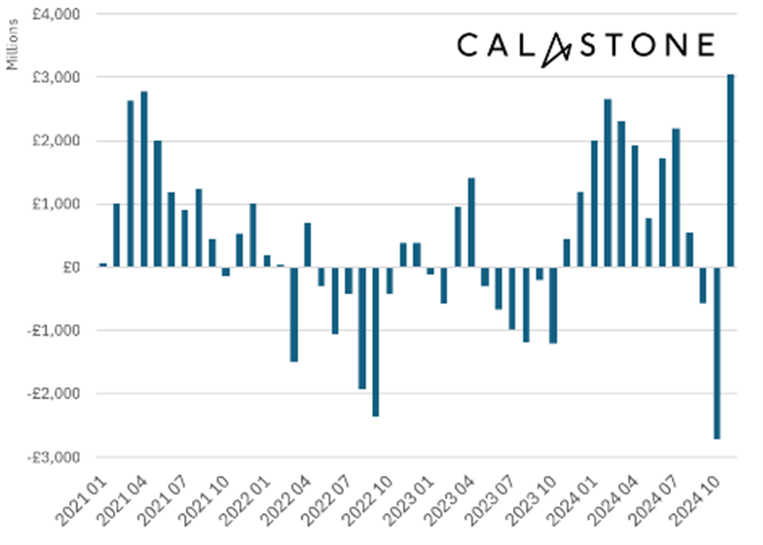

The tide might be turning for UK equity funds, which enjoyed their first month of net inflows in three years. This coincided with a buying spree for equity funds in general, which took in a record net inflow of £3.1bn in November, the latest data from Calastone has shown.

It was the first time equity inflows had breached the £3bn mark and was a reversal of the pre-Budget record outflow of the previous month, when investors banked their profits to avoid capital gains tax increases, as the chart below shows.

Net flows into equity funds

Source: Calastone

October’s £2.7bn record outflows were prompted by fears that chancellor Rachel Reeves would hike capital gains tax, which she did, but not by as much as some people had feared, and the money flowed right back into the market last month. The reason was not indecisiveness but rather minimising tax bills, according to Calastone head of global markets Edward Glyn.

“The biggest tax-raising budget since 1993 prompted a scramble to shield profits on funds from higher levies. But investors were keen not to be out of the market for long,” he said.

“Almost half of October’s outflows were poured back into equity funds in the first week of November, further evidence that these record flows were all about minimising tax bills.”

The greatest beneficiaries were global, North American and emerging market funds, which added £1.22bn, £848m and £426m respectively, as well as European funds.

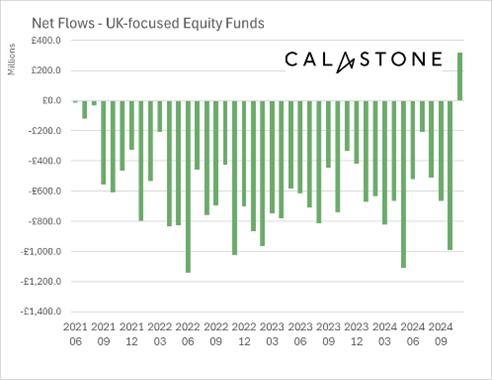

UK-focused equity funds saw their first inflows in 42 months, as the chart below illustrates. Investors added a net £317m to UK-focused funds in November, having withdrawn £25.3bn in the previous three-and-a-half years.

Net flows into UK funds

Source: Calastone

For Glyn, however, it’s too soon to be overly optimistic. “Time will tell, but the inflow to UK-focused funds is likely to be a hiatus rather than marking a break in the trend. There is no major catalyst on the immediate horizon to prompt a wholesale resurgence of interest in the much unloved UK stock market,” he said.

Investors also sought to lock into high yields through fixed income funds, which added £764m and reversed all the net selling Calastone recorded across its network in August and September.

Bond yields fell in the second half of November after rising from their mid-September low. August and September outflows from fixed income investments reflected profit-taking as bond yields decreased on expectations of rapid rate cuts, but yields rose again due to fears of increasing inflationary pressures.

It was these higher yields that tempted investors back into fixed income funds over the past few weeks, according to Glyn.

“Those who added to their fixed income holdings in the first half of November are already enjoying capital gains,” he said.

On the negative side, investors continued to sell Asia Pacific, income and specialist sector funds, albeit at a slower pace than in October.

Inflows into money market funds dropped to £131m, their lowest since April, mainly reflecting the allocation changes that have occurred around all the Budget activity.

Finally, investors withdrew a net £39m from property funds in November, the 14th consecutive month of outflows from the sector for a total of £7.84bn lost over the past six years.

“Property funds do not share the privileged position equities have. The asset class is more marginal in itself and prone to cycles of boom and bust, but investors are still pessimistic and the open-ended fund structure no longer has the confidence of many investors and so the outflows continue,” Glyn concluded.