Defensive stocks have not looked as attractive as they do today in the past 15 years, according to James Cook, co-manager of the JPM Global Growth and Income trust.

This £1.6bn unconstrained portfolio contains 50 ‘best ideas’ stocks, selected purely for the team’s conviction in their fundamentals, with no bias towards growth, value or other style constraints.

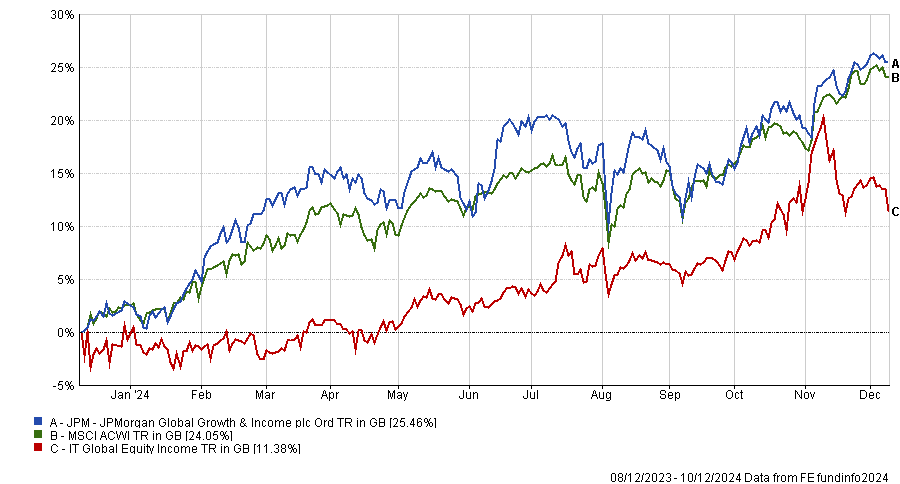

The trust was the winner of a Trustnet ‘fund battle’ against a rival trust this summer and was recently chosen as a good option for a two-fund portfolio; with a 22.5% return over the year to date, it was the second-best performer among the 37 funds for 2024 that experts highlighted on Trustnet last year.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Co-managed by James Cook and FE fundinfo Alpha Managers Helge Skibeli and Timothy Woodhouse, JPM Global Growth and Income has been the best trust in the IT Global Equity Income sector over the past three, five and 10 years, and the second-best over the past 12 months.

Below, Cook explains how he combines exposure to cyclical sectors with cheap defensive stocks, how he is playing the semiconductor and technology arena and the most recent investments.

How would you describe your process?

Strong investment results are best achieved through bottom-up stock selection with minimal exposure to market style or factor risks. We take advantage of the mispricing of stocks to build a portfolio of our 50 best ideas by looking beyond near-term issues and understanding a company’s long-term ‘normalised’ earnings power. This philosophy has been in place for over three decades and has proved successful in both positive, negative, growth and value market environments.

Why should investors pick your trust?

This trust is ideal for investors looking to access some of the highest-quality franchises in the world in a style-agnostic manner. It has a dividend policy of 4%, offering both capital growth through stock selection and an attractive income component.

Why is it important to be style agnostic?

It allows us to focus purely on companies’ fundamentals rather than conforming to a pre-defined style.

Right now, defensive stocks are at their most attractive valuations in 15 years and our defensive tilt is achieved through consumer names such as McDonalds and Yum Brands, and infrastructure-style plays through the US utilities sector, for example the Southern Company.

We are balancing that with high-growth cyclical stocks related to the semiconductor cycle. While companies in this sector have faced high capital intensity as they expand capacity to meet AI [artificial intelligence] demand, we see this normalising, leading to improved free cash flow generation. The combination of pricing power and higher volumes makes these stocks highly attractive for the long term.

Is there an area you’re particularly excited about going into the new year?

Our focus remains on identifying long-term growth opportunities, from the rapid advancement of technologies such as AI and cloud computing to the transition to renewable energy.

We have added exposure to companies providing memory capacity for computers and smartphones. An example is SK Hynix, a Korean-listed market leader in leading-edge memory services.

The transition to renewable energy sources and electric vehicles will provide further impetus to this growing demand for semiconductors and related tech, and we see many attractive structural investment opportunities in this arena. For example, our holdings in the US utilities providers which are leaders in the energy transition and use of renewables, we hold NextEra Energy. It has benefitted from a supportive regulatory environment in the US, but regardless of the policy backdrop, the transition will continue to present opportunities for investors.

What was the best call of the past 12 months?

Beyond the semiconductor and technology sectors, US insurance-based group Progressive has contributed to returns overall throughout the period, having initiated the position at a compelling valuation point.

With concerns around inflation having heightened since 2022, the stock has performed incredibly well against a backdrop of elevated interest rates. As such it became more expensive in our stock selection framework and we fully exited the position earlier in the year, taking profits and allocating them to more attractively valued opportunities. The overall return the stock achieved in the portfolio over the 12 months ending 30 September 2024 was almost 50% appreciation (in sterling terms).

And the worst?

Slowing demand from China for luxury goods has weighed on LVMH this year, which has seen the share price depressed following a period of strong performance. That said, we believe the company remains of incredibly high quality, with an unparalleled portfolio of luxury brands across a range of sectors. We continue to hold the name and have added to it during periods of weakness throughout the year despite it costing us 48 basis points from our excess return.

What do you do outside of fund management?

I enjoy cycling and swimming, used to do triathlons until kids came along and now spend more time standing still and coaching our under-8s football league.