Markets outperformed expectations yet again in 2024. For most of the year, the big game in town was the ‘Magnificent Seven’, with companies like Nvidia having delivered supranormal returns.

However, the ‘Magnificent Seven’ were not the only investments worth discussing. While some experts certainly favoured tech funds last year and were rewarded for this decision, investors who were willing to look further afield could find a range of other opportunities in sectors such as multi-asset, private equity and even renewable energy.

Below, Trustnet asked fund selectors for their favourite fund or investment trust in 2024.

Troy Trojan

Sticking with his “go-to” choice, Ben Yearsley, director at Fairview Investing, identified the £5bn Troy Trojan, led by FE Fundinfo Alpha Manager Sebastian Lyon and co-manager Charlotte Yonge.

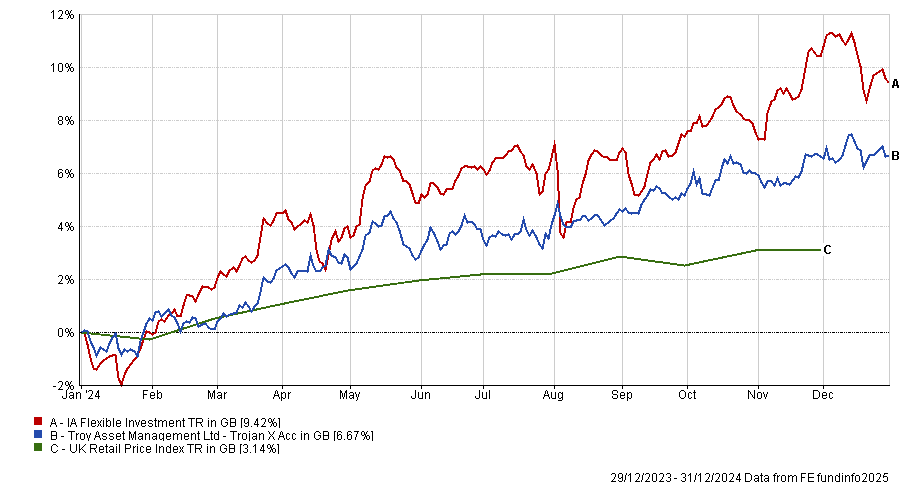

Yearsley observed that the fund had faced a "relatively tough few years", as its quality investment strategy fell out of favour. In 2024, the fund delivered a bottom-quartile performance of 6.7% compared to the IA Flexible Investment peer group average of 9.4%.

Moreover, in 2023, the fund was up by just 2.9% versus a sector average of 7.1%. As a result, the fund has languished in the third quartile in three and 10-year periods.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

Nevertheless, Yearsley described the fund as a “core holding for long-term investing”.

With equities, inflation-linked government bonds and gold all featuring prominently, the fund offers exposure to a diversified set of asset classes.

Moreover, he credited the fund for its “wealth preservation approach that aims to protect your wealth in real terms, hence the linkers”. Indeed, in the past five years, the fund achieved the second and fourth-lowest scores for downside risk and volatility in the sector, at 6.5% and 6.1%, respectively.

As a result, the fund provided strong downside protection, making it a solid defensive addition to investors’ portfolios.

Yearsley also identified the £1.4bn Columbia Threadneedle Universal MAP Balanced strategy as another favourite last year, praising it for its actively managed multi-asset strategy at a relatively low cost.

GQG Partners Global Equity

Alex Watts, fund analyst at interactive investor, identified GQG Partners Global Equity, as his favourite fund of the year.

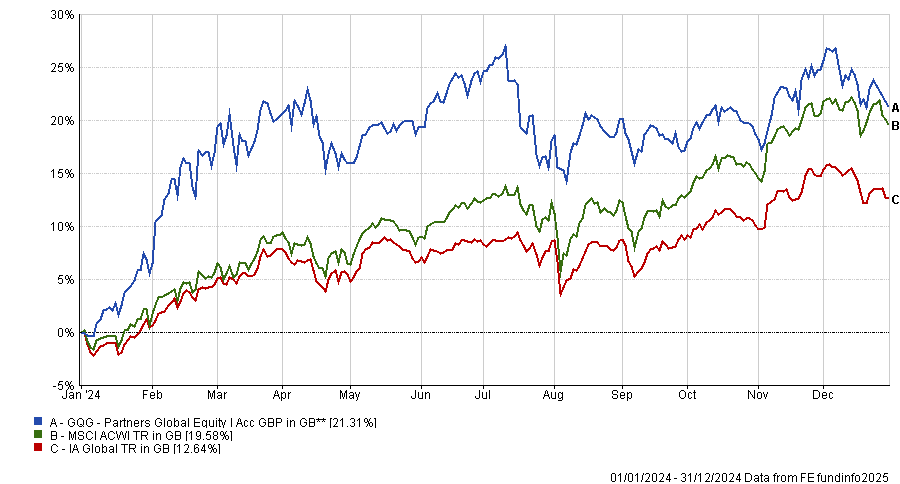

Managed by Alpha Managers Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, the fund delivered a top-quartile performance of 21.3% in 2024, surpassing the MSCI ACWI and the highly competitive IA Global peer group.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

In the long term, the portfolio has posted first quartile returns of 45.2% and 91% over three- and five-year periods.

Watts explained that the fund has a high-quality and growth philosophy. Jain and his team assess the financial strength, competitive advantages and valuations of businesses to determine how they might develop.

As part of this, the fund managers are willing to interpret economic and market data as evidence of structural growth or decline and “rotate the portfolio quickly to accommodate”, Watts added.

The past year was a great example of this in action. The portfolio started the year with 40% in technology but has substantially reduced its allocation since to 28% (which compares to a sector average of 24%).

Much of this capital was redistributed to utilities, energy and healthcare, the latter of which now represents 22% of the total portfolio.

Watts concluded: “The differentiated approach has proven its worth both over the long-term as well as through the volatile market environment of 2024.”

HarbourVest Global Private Equity

In the investment trust space, James Carthew identified the £1.9bn HarbourVest Global Private Equity trust as his favourite in 2024.

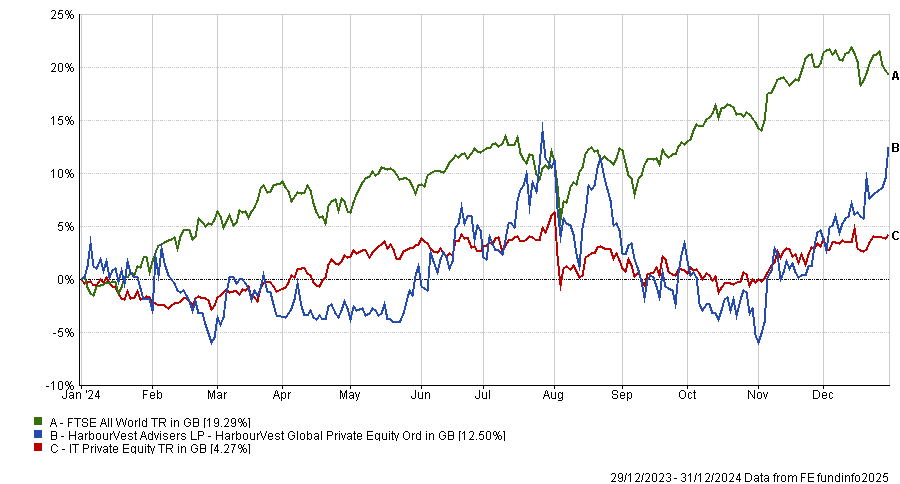

It was the third best-performing trust in the IT Private Equity sector in the past year, with a performance of 12.5%. However, its performance declined in the long term, with third-quartile results in the past three and five years, although it did rally back into the second quartile over 10 years.

Performance of trust vs sector and benchmark in 2024

Source: FE Analytics

Carthew explained that part of the appeal for private equity funds is that the sector itself has been “unloved”, meaning that trusts now trade at a discount. HarbourVest particularly stood out because it has a 41% discount to NAV, one of the widest in the sector, despite “great long-term returns”.

Moreover, Carthew argued that it has significant growth potential and could continue to rerate in 2025. The board “seems conscious” that it needs to address the discount and has plans to embark on a programme of share buybacks.

For a play in the renewable energy sector, Carthew also highlighted NextEnergy Solar, another trust he added to his portfolio in 2024.