Global equities made close to 20% in 2024 and posted a positive return in each of its four quarters, according to FE Analytics.

The MSCI AC World index made a total return of 19.6% in 2024, outpacing government bonds, corporate bonds, cash and commodities. The market was led by the US, with the S&P 500 up 26.7%, and China, with MSCI China index gaining 21.6%.

Last year had its ups and down, as always, but the MSCI AC World’s annualised volatility was 10.4% - the lowest since 2019. Its maximum drawdown of 4.5% was also low when compared with recent years.

But the year was far from uneventful, so below we take a look at each quarter of 2024 to find out what was happening in each part of the global stock market.

Momentum and tech led in Q1

The year began with cautious optimism, as major indices continued their upward trajectory from 2023. The S&P 500 and Nasdaq posted gains, driven by strong performances in the technology sector, particularly companies involved in artificial intelligence (AI). Investor enthusiasm was fuelled by expectations of Federal Reserve interest rate cuts later in the year.

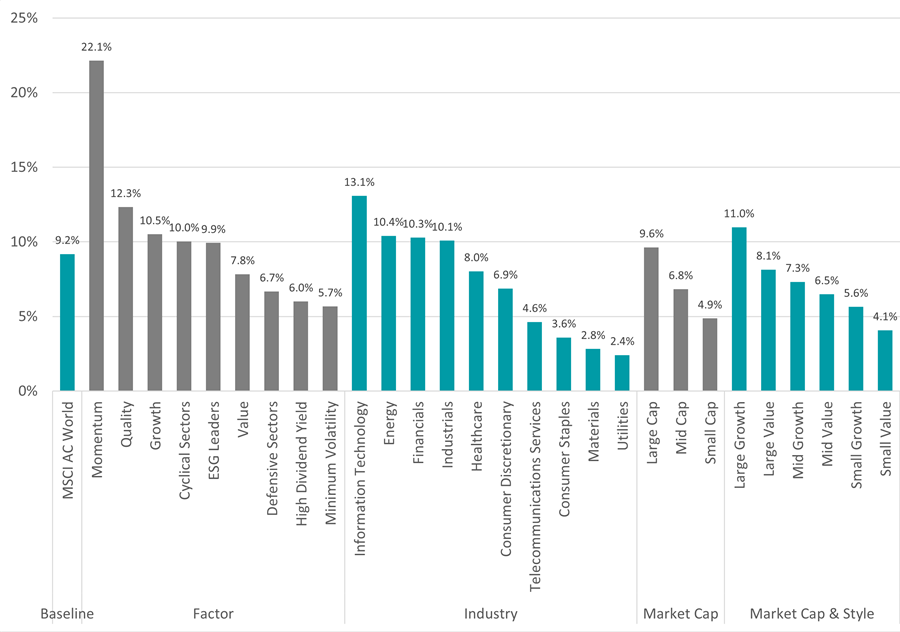

Global equity performance in Q1 2024

Source: FinXL. Total return in sterling between 1 Jan and 31 Mar 2024.

The MSCI AC World index posted a return of 9.2% with the momentum and quality factors outpacing other investment styles, delivering respective returns of 12.3% and 10.5%. This reflects investors sticking with the AI theme that started in 2023 and led to the rise of the Magnificent Seven (Amazon, Apple, Google, Microsoft, Meta, Nvidia and Tesla).

Because of this, the technology sector dominated during the quarter, returning 13.1% and outperforming other industries. This continued enthusiasm for tech also meant that large growth stocks returned 11%, outperforming value-focused counterparts and making significantly more than small-caps.

Meanwhile, defensive sectors, including consumer staples and utilities, lagged behind with returns of 3.6% and 2.4%, reflecting a reduced appetite for safety amid rising confidence in market recovery.

Selective gains amid Q2’s slower momentum

In the second quarter, the stock market rally persisted. However, much of the gains remained concentrated in companies benefiting from the AI boom. Economic data showed signs of softening, after US GDP growth slowed more than expected at the start of 2024. Despite this, the Federal Reserve maintained its stance on interest rates, keeping markets on edge.

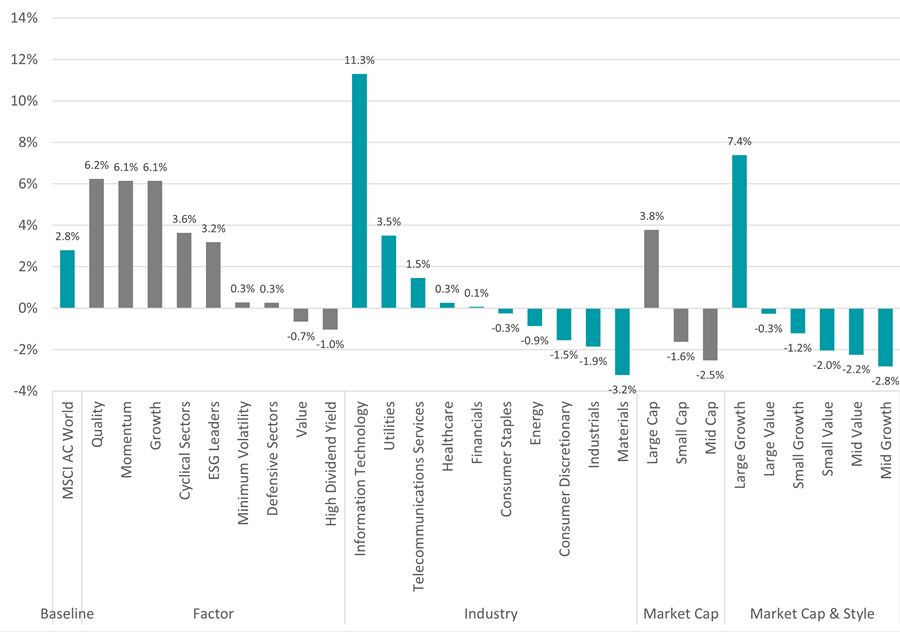

Global equity performance in Q2 2024

Source: FinXL. Total return in sterling between 1 Apr and 30 Jun 2024.

This marked a slowdown in the stock market, with the MSCI AC World returning 2.8% in a noticeable deceleration from the first quarter. Factors such as quality, momentum and growth continued to perform well, all returning over 6% and reflecting resilience in select market segments. In contrast, value-oriented factors dipped into negative territory.

Technology once again dominated sector returns, achieving an impressive 11.3%, far outpacing other industries. Utilities and healthcare also delivered positive results of 3.5% and 1.5%, respectively, while cyclical and economically sensitive sectors like energy, materials and industrials made negative returns. This uneven performance reflected a more cautious market mood amid mixed economic data and concerns over the health of the global economy.

Large-cap growth stocks stood out with a 7.4% return, driven by the ongoing appetite for innovation-driven companies. All the other indices in the global equity market cap/style series fell over the quarter; this highlighted the narrow market concentration that would be a theme for much of 2024.

Defensive sectors shine in Q3

Last year’s third quarter was marked by increased volatility as investors panicked in August about risks such as a potential US recession, expensive valuations for tech companies and the unwinding of the yen carry trade. The S&P 500 experienced a mid-quarter correction but rebounded to reach new highs by the end of September. The Federal Reserve implemented a 50 basis point rate cut, the first since March 2020, signalling a shift towards monetary easing.

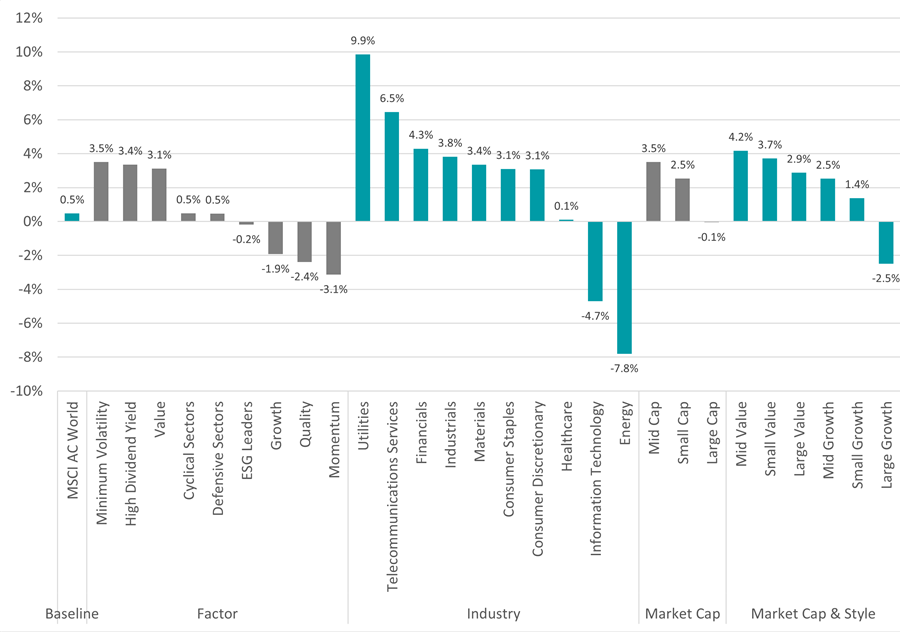

Global equity performance in Q3 2024

Source: FinXL. Total return in sterling between 1 Apr and 30 Jun 2024.

Against this backdrop, the MSCI AC World eked out a total return of 0.5%. Defensive factors such as minimum volatility and high dividend yield performed relatively well as investors turned more cautious. In contrast, momentum and growth factors underperformed, with momentum falling by 3.1% as risk aversion grew amid heightened volatility.

Sector-wise, utilities outperformed with an impressive 9.9% return, benefiting from their defensive characteristics. Telecommunication services and financials also fared well, delivering 6.5% and 4.3%. On the other hand, technology, which led in previous quarters, declined sharply by 7.8%. This divergence highlights the market’s pivot toward safety and income-generating stocks.

Large-caps underperformed mid- and small-cap stocks. Large growth stocks were down 2.5% when investors tilted to more defensive positioning and away from high-risk, high-growth segments as global uncertainties weighed on sentiment.

Growth led the Q4 rally

The final quarter brought with it a US presidential election, a strengthening dollar and signs that inflation is more persistent than hoped. Despite these challenges, the year concluded with strong overall performance as the S&P 500 gained nearly 24% in 2024.

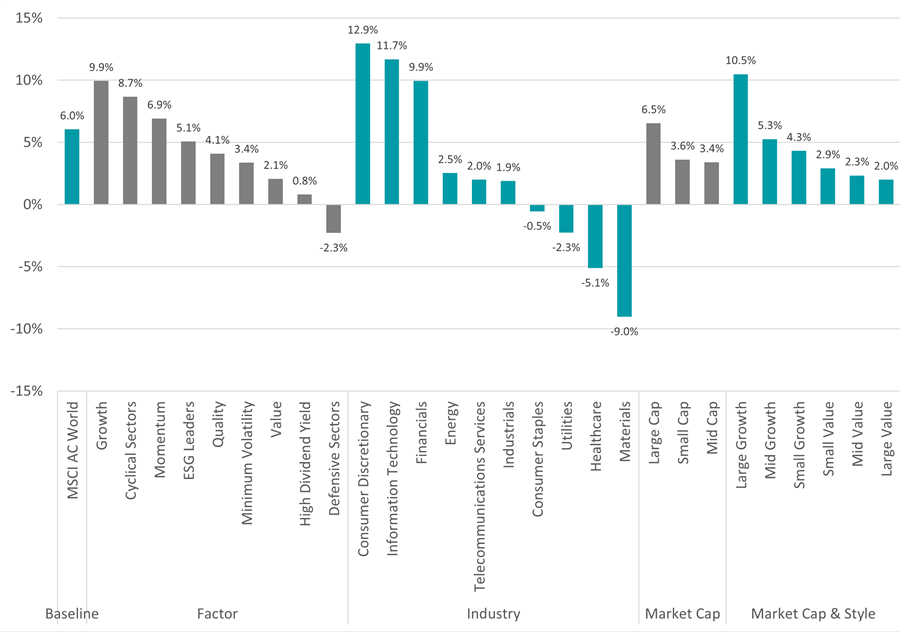

Global equity performance in Q4 2024

Source: FinXL. Total return in sterling between 1 Apr and 30 Jun 2024.

The MSCI AC World made a 6% return over the quarter, recovering from the slower Q3. The election of Donald Trump as US president and China’s economic stimulus were the main factors behind the optimism, even if this did start to peter out in December.

Growth style led the way with a 9.9% total return, reflecting renewed investor confidence in innovative sectors. But defensive styles such as minimum volatility lagged as risk appetite improved.

Consumer discretionary made a robust 12.9% return and put tech stocks into second place after their challenging third quarter. Financials also posted healthy returns, benefiting from favourable economic conditions.

Larger companies once again beat smaller and medium-sized business, with large-cap growth stocks returning as top performers with a 10.5% total return. This contrasts with the 2% made by the large-cap value index over the quarter.