Investors smashed the previous record of inflows into equity funds in 2024, adding a net £27.2bn to their equity holdings – a substantial increase from the 2021 record-high of £19.8bn.

The vast part of that sum (£19.5bn, or 72%) went into global equity funds, the favourite asset class for the ninth year in a row, while the UK remained the ugly duckling, recording its ninth consecutive year of outflows.

Investors particularly backed North American equities, which registered £11.9bn of inflows, up from just £5m in 2023. With £421m added in the December, last month was the weakest, but it was still strong judging by the standards of the past 10 years, according to Calastone head of global markets Edward Glyn.

“Stock markets had a terrific 2024, which tempted enormous amounts of new capital into equity funds. Global funds are dominated by US stocks already, but the additional focus specifically on that region shows that investors are doubling down on Wall Street,” he said.

“Purchases were very front-loaded in the year, however, and there has been greater wariness as markets have tested new highs. A correction in August and a wobbly December for global markets have reminded investors that risks abound.”

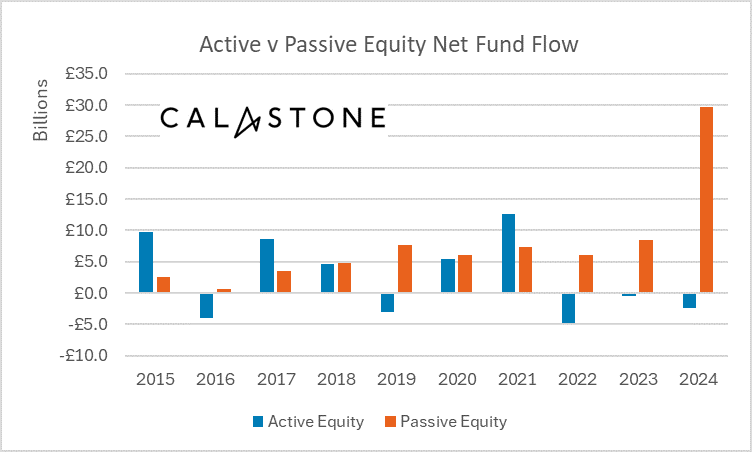

Passive strategies were strong winners, as investors withdrew a net £2.4bn from their actively-managed investments and committed a net £29.6bn to the index-trackers, more than in the previous four years combined.

“The difference in investor appetite for the two strategies was easily the largest on Calastone’s record,” Glyn said.

Source: Calastone

But there were even more records set. With £3.2bn worth of inflows (most of it concentrated in the first six months), European equity funds also had a record year. Emerging markets were also in vogue, scoring their second-best year on record, and investors also added a record £1.6bn to the Japanese market.

On the flip side, the domestic market continued to disappoint. The £9.6bn net outflow was smaller than that of 2023 (£12.1bn) but against the huge inflows to equity funds overall, it was the worst relative performance of the year. As the only positive note, December’s net selling of £221m was the lowest outflow since May 2021.

“The UK stock market badly underperformed most of its peers in 2024 and this has only intensified the extent to which UK-focused funds are being shunned by investors,” Glyn said.

“The last year to see significant inflows was 2015. Since then, £45bn has been withdrawn from the sector. UK equity valuations are clearly cheap but investors are capitulating, seemingly giving up hope that a long-awaited re-rating will occur.”

Among the other weakest areas was the Asia-Pacific sector, which suffered the worst outflows on Calastone’s record (£1.8bn), and funds investing in China, Taiwan and Hong Kong.

Fixed income was another unpopular asset class, and flexible bond funds were particularly out of favour, with outflows reaching £3.4bn.

The sector has been struggling with departures and retirements of a number of veteran managers, with experts lamenting a scarcity of “obvious replacements”, as reported by Trustnet in July.

“The bond markets are the place to look for distress signals,” said Glyn. “The summer saw fears rise over government deficits and inflation; this has pushed yields in many major bond markets back towards the 15-year highs we saw at the beginning of 2023 – and bond prices lower as a result. Consequently, equities look more exposed, especially in those parts of the world where they have raced ahead.”

Meanwhile, corporate bond funds easily garnered the largest share of new cash from investors in fixed income (£2bn).