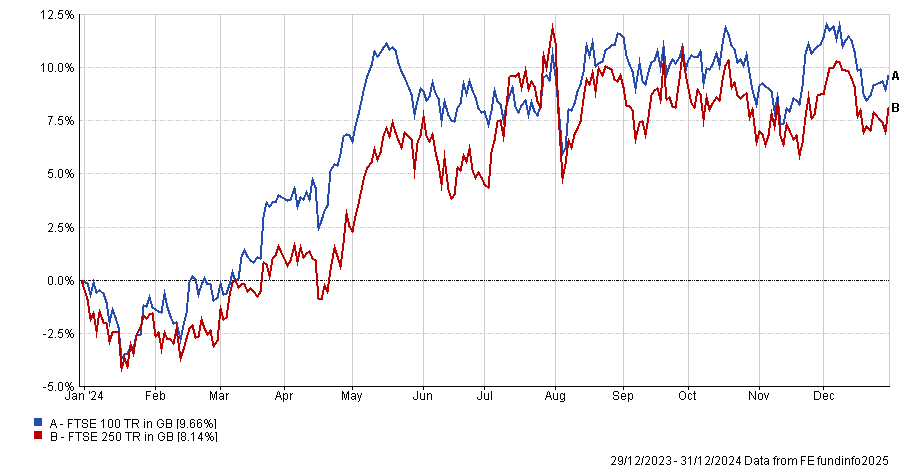

Mid-sized companies did not particularly stand out compared with their larger counterparts in 2024, judging by the average returns of the FTSE 100 and FTSE 250.

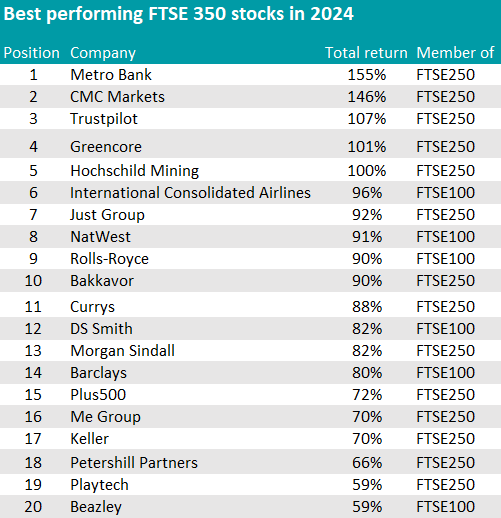

The two indices ran mostly parallel to each other last year, as the chart below shows, but medium-sized British businesses showed they are by no means inferior to FTSE 100 titans by taking over the top-20 list of the best UK companies for total return, which contains 14 from the FTSE 250 and only six from the FTSE 100.

Performance of indices in 2024

Source: FE Analytics

The year’s best was Metro Bank, which did not start 2024 with great prospects but overturned expectations by October, with net interest margins increasing as a result of the sale of £2.5bn worth of mortgages to NatWest. It joined the FTSE 250 in November and returned 155% over the year.

In a note published by Peel Hunt last December, Robert Sage and Stuart Duncan said Metro’s investment narrative is “turning”.

They added: “Rational management decisions in conjunction with positive external developments are smoothing the transition to sustainable profitability.”

Other banks did well too, such as NatWest (91% return) and Barclays (80%), which stood in eighth and 12th position, respectively.

Source: AJ Bell, ShareScope

The second-best performer was trading company CMC Markets, whose shares rose 146%. Given this success, Simon French, head of research at Panmure Liberum, said the company is now “more than up with events” and warned investors that its valuation may now be too high.

“Limited disclosures mean we cannot prove both product and customer diversification, which are key for generating sustainable revenues,” he said.

“Combined with low earnings quality and lower returns, but with greater volatility than peers, it is hard to justify the 12x price-to-earnings multiple; a 30% premium to peers.”

French wasn’t sold on Trustpilot either, which came in third position at 107%, up from last year, when it was in 18th position in this same list.

Its success was attributed to “beneficial network effects” and bookings growth in the US market, but decelerating growth in Europe was a reason for concern, among others.

“With an emerging forex headwind to contend with in 2025 and implied new business per annum required already 50% higher by 2026, we see risk of earnings momentum shifting in the coming year,” he said.

The triple-digits-returns bonanza continued with food company Greencore, a ‘hold’ for Peel Hunt’s Charles Hall and Andrew Ford, who find its contract wins in its ready meals business and contract renewals with key customers back in December “encouraging”, as they “provide an underpin for growth”.

Hochschild Mining, which doubled investors’ money in 2024 (on the back of a strong 2023, when it rose by 50%), concluded the top five and was a ‘buy’ for Peter Mallin-Jones, Alex Gorman and Andy Crispin at Peel Hunt. Lower grades than previously forecast drove lower 2025 estimates for the stock, but the analysts continue to see “significant longer-term value”.

The first FTSE-100 entry in the list is International Consolidated Airlines, which came in sixth place with a 96% return. For Peel Hunt analysts, it is becoming a higher-quality business with less cyclicality.

“The group is profitable in all quarters, has a balanced network and resilient routes,” they said three weeks ago, as they reinstated their ‘buy’ rating on the back of the stock’s potential to return an additional €4bn over the next three years.

Aerospace engineering firm Rolls-Royce was in ninth position this year with a 90% return – down from the 222% gain it made in 2023, when it was the absolute top performer.

After Citigroup downgraded its rating on the stock to ‘neutral’ from ‘buy’ on valuation grounds, the stock market darling is seeing its engines splutter, according to Russ Mould, investment director at AJ Bell.

“Rolls-Royce has been a runaway success for investors in recent years as its recovery story gained traction,” he said. “The turnaround opportunity is now looking like old news and investors increasingly want to hear about the next phase of the company’s growth, not simply what it is doing to get back on track as that looks to have already happened.”

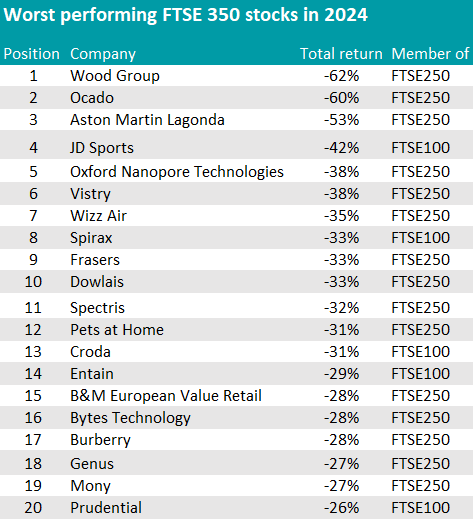

Source: AJ Bell, ShareScope

Moving to the foot of the table, the bottom stock among constituents of the FTSE 350 was engineering and consulting group John Wood (-62%).

It was followed by Ocado (-60%), which has been suffering after the decision by several clients in the US and Canada to scale back expansion plans involving its facilities, as AJ Bell investment analyst Dan Coatsworth noted.

“Setbacks have spread to the UK, as it is expensive to run a warehouse, get the goods in the van and deliver them to someone’s house. One has to consider whether the delivery fee paid by the customer is enough to cover wages, fuel, vehicles and so on,” he said.

“Fundamentally, supermarkets would probably prefer their customers to visit their stores.”

Computer software re-seller Bytes Technology had a fall from grace from 2023’s highs (62%) to last year’s lows (-28%).

Fashion house Burberry remained challenged last year, with executive officer Jonathan Akeroyd leaving abruptly in July after yet another profit warning, as did biotechnology firm Genus. Both have made losses for two years in a row.