abrdn is overhauling its MyFolio Managed range of multi-asset strategies with a broader investment universe, more externally managed funds, lower fees and a rebrand to MyFolio Core.

The five funds in the range mainly invest in other abrdn vehicles, allocating a minimum of 60% to abrdn's actively managed products. There is also a maximum 40% cap on passive funds.

Both of these restraints will be lifted from 1 April 2025, giving co-managers Katie Trowsydale and Robert Bowie more flexibility and a licence to ‘go anywhere’ with their investment ideas, be it in-house or third-party active and/or passive funds.

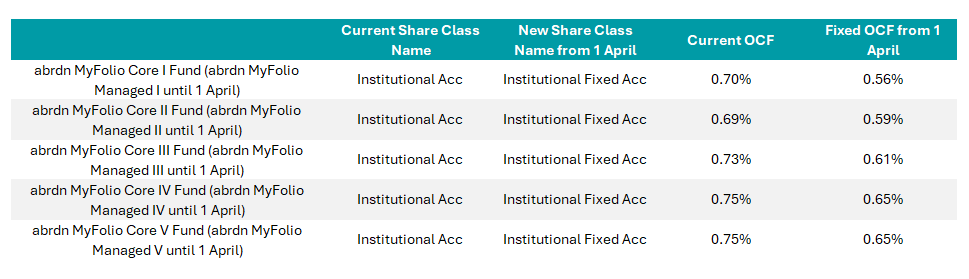

Fees will also be lowered, with the ongoing charges figure (OCF) dropping from 0.69%-0.75% to 0.56%-0.65%, as the table below shows.

Fee changes for institutional accumulation range, the primary share class

Source: abrdn

Bowie stressed that the new range will continue to be managed with the same philosophy and risk requirements as before, but “with more tools in the box to add value”.

Trowsdale added: “These changes will mean the new range will be able to benefit from more external managers in which we have high conviction, while making use of passive funds in markets where we believe this strategy is well suited.”