It was a busy year for best-buy lists, with several changes across all the main five publishers – Fidelity, AJ Bell, Hargreaves Lansdown, interactive investor and Barclays. More than 30 strategies lost their recommended status, as we highlighted earlier today.

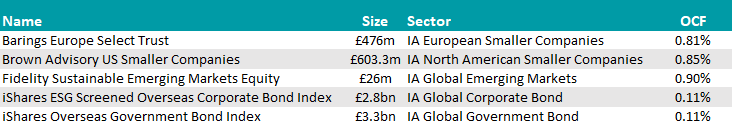

Below, we begin looking at the funds that gained a ranking across the past 12 months, starting with Fidelity’s Select 50 list.

The list is put together by Fidelity’s independent team of analysts and Fundhouse, an external fund research company, brought in “to add independence and enhance the fund selection process”.

North America, Europe and emerging market equity funds were the focus of attention for the analysts in 2024, with one fund added in each of these areas last July.

In the IA North America sector, the team agreed on Brown Advisory US Smaller Companies as a “useful addition to a diversified portfolio for investors seeking additional risk and reward”.

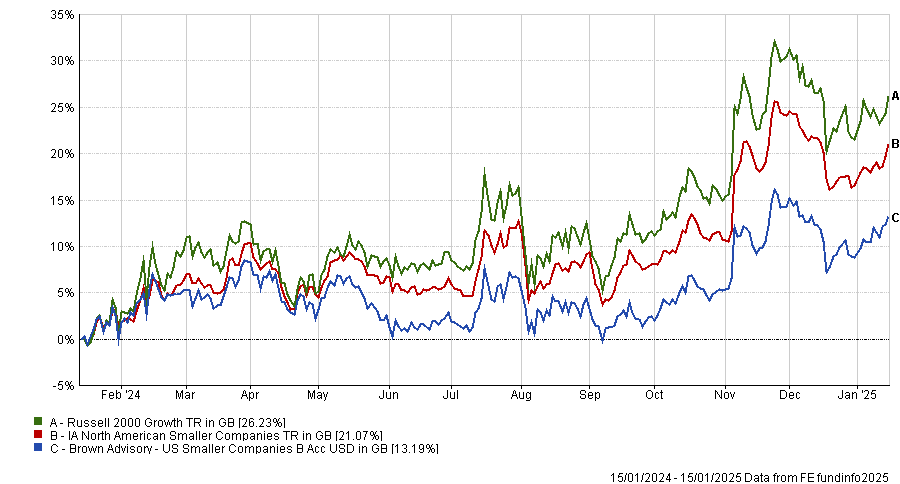

Performance of fund against sector and index over 1yr

Source: FE Analytics

The $736m fund invests in smaller companies and is managed by Christopher Berrier. While it remained behind its benchmark, the Russel 2000 Growth index, over the past five, three and one year, it did outperform both the index and its peers over 10 years, returning 218.2% against the sector average of 192.7%.

It makes sense therefore that the analysts recommended it for investors with a long investment horizon of 10 years or more, which should allow investors to benefit from the rewards that should come from an above-average-risk investment.

Brown Advisory’s “extensive team” dedicated to researching and investing in the demanding area of smaller companies was the main selling point.

“Following these companies – which there are simply lots of – requires ongoing dialogue with executives, and they are often riskier than their larger counterparts because they may have fewer products or operate in fewer regions,” they explained.

However, Berrier is “experienced at running a fund like this and US smaller company investing is a strength of the wider business”.

Fidelity also joined Hargreaves Lansdown and AJ Bell in highlighting another small- and mid-cap strategy, this time on this side of the Atlantic – Barings Europe Select.

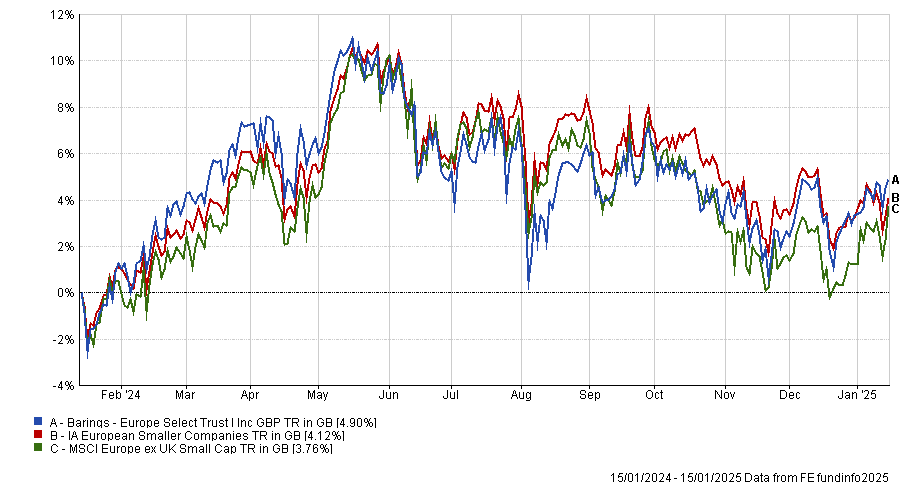

Performance of fund against sector and index over 1yr

Source: FE Analytics

It invests in companies across Europe (excluding the UK) which offer attractive growth potential at a reasonable price and has maintained a second-quartile performance track record over 10, three and one year – falling to the third quartile over half a decade.

Managers Nicholas Williams, Colin Riddles, Rosemary Simmonds and William Cuss carry out “detailed company research” and are considered “one of the most experienced teams in the sector”.

This is another riskier, long-term hold, and should work well in combination with Schroder European Recovery, as they invest using “quite different approaches”, Fidelity analysts suggested.

From Fidelity’s own funds stable, the analyst team recommended the Fidelity Sustainable Emerging Markets Equity fund.

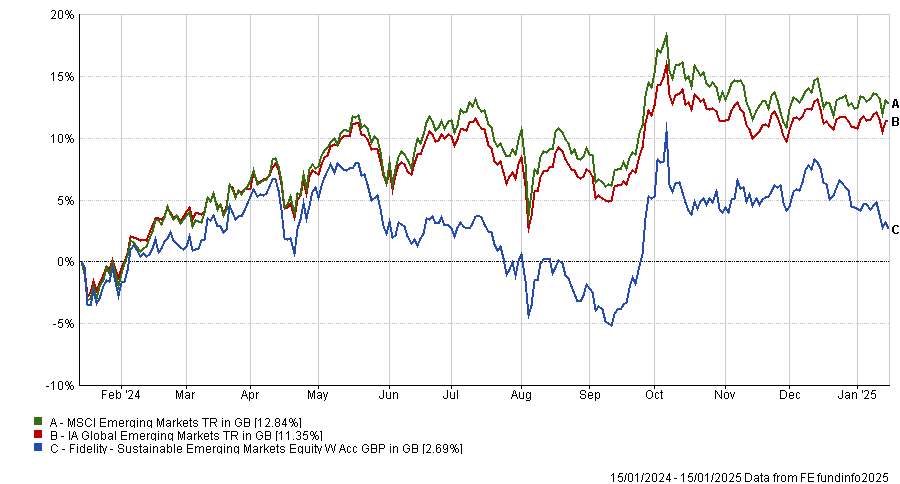

Performance of fund against sector and index over 1yr

Source: FE Analytics

Manager Amit Goel is an “experienced emerging markets investor, backed by one of the industry's largest emerging market equity teams”, but results haven’t come through in the short track record of the fund so far.

Returns hang back at 2.7% over the past 12 months – a bottom quartile performance against its average peers, which added 11.3%, and below the 12.8% of the MSCI Emerging Markets index.

Nevertheless, the analyst team like its concentrated quality-based approach, favouring companies that the manager believes have attractive characteristics, such as strong management teams and responsible management of environmental, social and governance (ESG) issues.

They said: “An emerging market equity fund should be a mainstay of most portfolios, but any allocation should reflect the slightly higher risk nature of the underlying investments and a long-term view (10 years or more) is needed.”

For those looking to blend this strategy with another emerging market fund, a value strategy such as Lazard Emerging Markets could be worth considering.

Two passive bond funds by iShares conclude the 2024 additions to Fidelity’s Select 50 – the ESG Screened Overseas Corporate Bond Index and its Government Bond sibling.

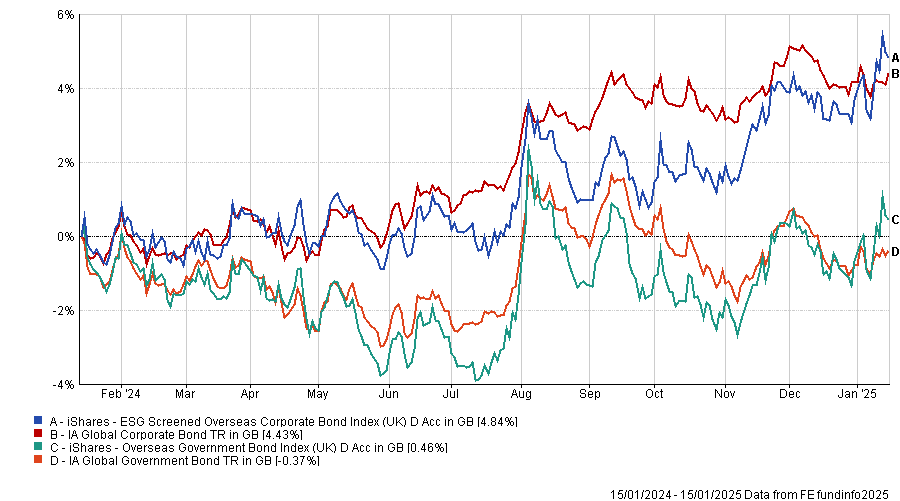

Performance of fund against sector and index over 1yr

Source: FE Analytics

The former, a global index tracker excludes a number of industries on environmental, social and governance (ESG) concerns, is indicated as “a sensible choice” on the riskier side of a portfolio for cost-conscious investors with a long-term horizon.

Although the fund can lend to higher-risk companies, the bulk of its loans are to medium and lower-risk companies, Fidelity analysts noted.

BlackRock has shown “good skill” in being able to track corporate bond indices and this vehicles also offers a modest income.

Finally, the Government Bond fund lends money to governments around the world – a low-risk enterprise which attract commensurately low interest payments, but was highlighted by Fidelity as it is likely to do well in an environment of falling interest rates.

Source: FE Analytics