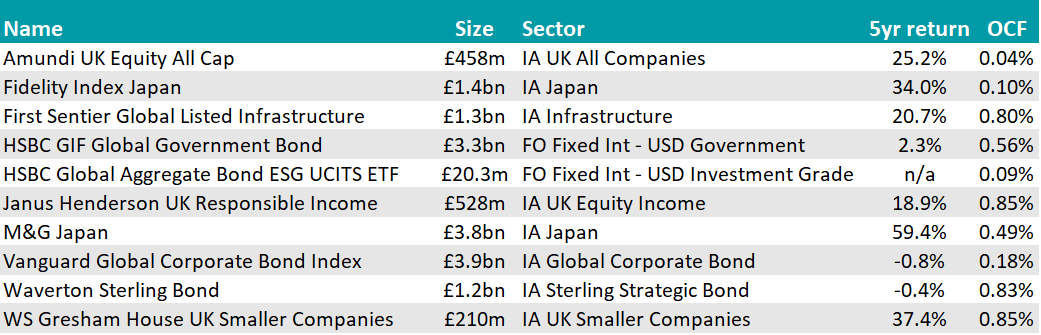

AJ Bell analysts made the most changes to their Favourite Funds list in 2024 compared with other major platforms with 11 new additions.

UK and fixed-income strategies dominated the list but Japanese equities also featured prominently. As for the management houses, Fidelity and HSBC appeared more than once.

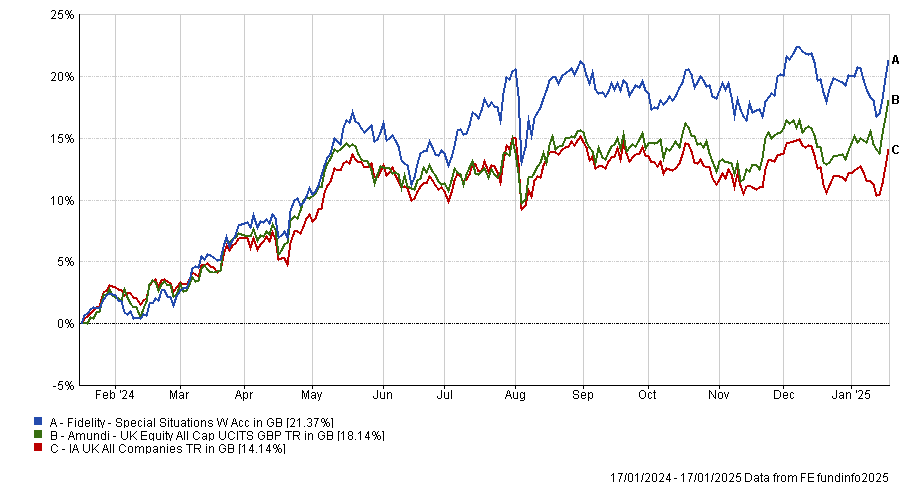

The Fidelity Special Situations fund collected its third recommendation with AJ Bell, having previously gained Hargreaves Lansdown and Fidelity’s approval.

What convinced the team was the contrarian investment approach of Alex Wright, the FE fundinfo Alpha Manager in charge of this strategy, who invests in overlooked or unloved companies with a catalyst for change.

“He finds potential that hasn’t been factored in by the market and has a long tenure at Fidelity investing in this style. He’s also supported by a large analyst team,” AJ Bell analysts said.

It wasn’t the only IA UK All Companies strategy to join the list, with the second catering for fans of passive investing – the Amundi UK Equity All Cap exchange-traded fund (ETF).

Performance of fund against sector and index over 1yr

Source: FE Analytics

This strategy tracks the Morningstar UK Index, covering 97% of the UK equity market (including both large- and mid-caps) by purchasing all of the underlying holdings in the relevant weights. It does so “in a very cost effective manner” while minimising the tracking error (the volatility of the difference between the return of the fund and that of the index), which is expected to be up to 0.50% in normal market conditions.

Staying in the UK, income seekers might want to consider Janus Henderson UK Responsible Income, AJ Bell’s (and Hargreaves Lansdown’s) choice for a differentiated approach to responsible investing.

“This is a sector in which Janus Henderson has credibility and heritage. Lead manager Andrew Jones is an experienced investor who we believe is well placed to run a UK income mandate like this,” the analysts said.

“The exclusions-based approach means the fund has a diversified income stream versus many peers within the UK equity income sector.”

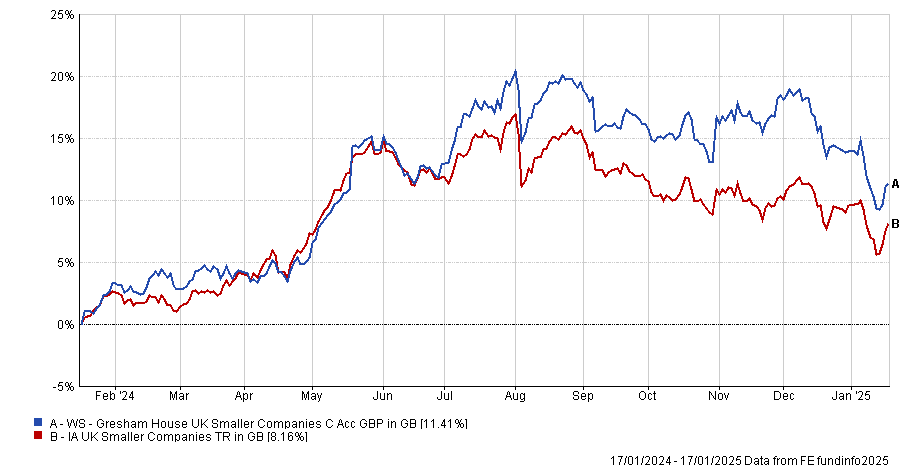

Small-cap specialist WS Gresham House UK Smaller Companies was also highlighted for its unique approach, deriving from manager Ken Wotton’s background in private equity.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Wotton utilises a network of external contacts who offer advice and insights to support the team’s own company analysis. This has helped generate first-quartile returns over five and three years and second-quartile results over 12 months.

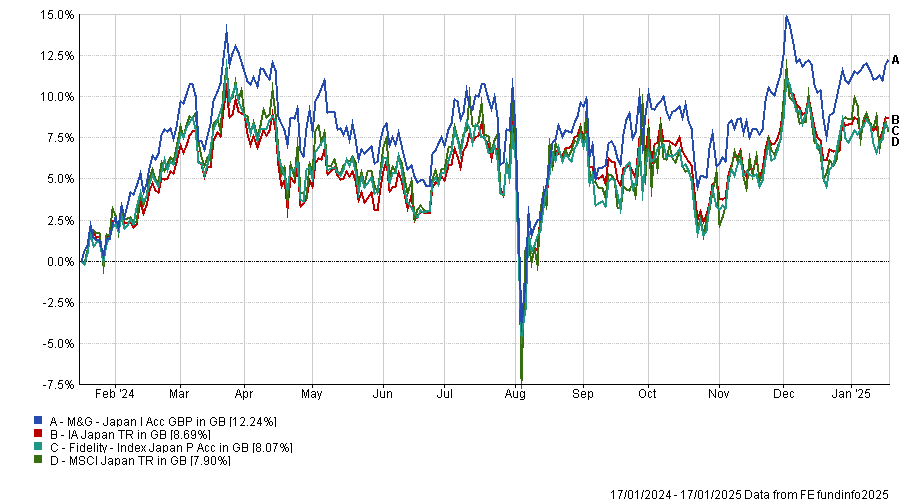

Two more equity strategies joined the AJ Bell fray, both from the IA Japan sector – Carl Vine’s M&G Japan and Fidelity Index Japan.

Veteran investor Vine was described as “considered” by AJ Bell analysts, who said: “The balanced approach between thorough company analysis and pragmatic portfolio construction makes this an appealing proposition for investors who want exposure to Japanese equities without excessive style bias.”

Performance of fund against sector and index over 1yr

Source: FE Analytics

The fund should provide a higher total return than that of the MSCI Japan index over any five-year period. For investors who are content with returns that are in line with the market, Fidelity Index Japan is “a strong option” with a good record of tracking its index at a very efficient price point.

It works by tracking the performance of the MSCI Japan index before fees and expenses are applied. To reduce dealing costs it may not invest in every company share in the index or at its weighting within the index.

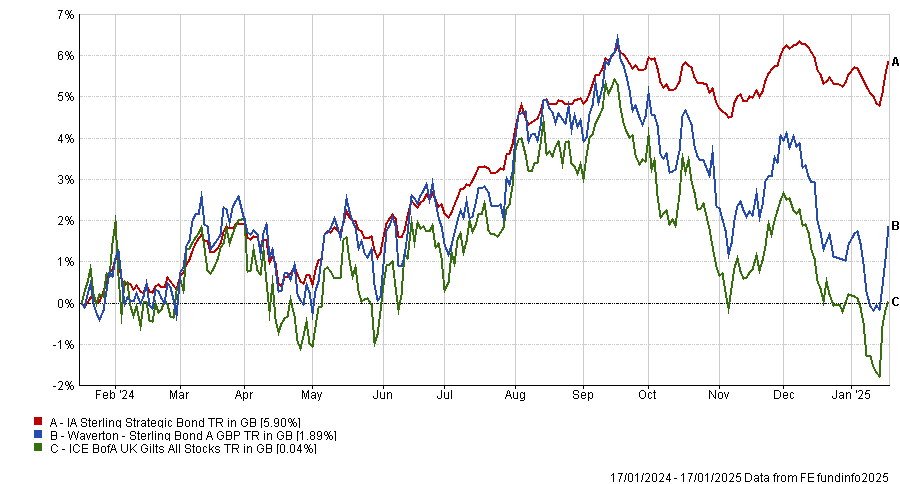

Leaving equities behind, global bond investors have been given active and passive strategies to look at. We begin with the former, where the Waverton Sterling Bond fund stood out.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The fund invests in fixed and/or floating-rate UK and international government corporate debt securities, and benefits from “carefully constructed investment parameters”.

This ensures its return profile correlates reliably with broader global bond indices, according to AJ Bell analysts. The strong management team, headed up by Alpha Manager Jeff Keen, was praised for “effectively combining top-down macro analysis with bottom-up credit selection”.

With fixed-income trackers becoming increasingly popular, AJ Bell expanded its coverage in this area too and pointed at the Vanguard Global Corporate Bond Index, which is also in Hargreaves Lansdown’s Wealth List.

The fund tracks the Bloomberg Global Aggregate Float Adjusted Corporate index, giving “very broad exposure” to global investment-grade corporate bonds.

For those interested in getting exposure to a mixture of fixed-rate sovereign and corporate bonds, AJ Bell chose the HSBC Global Aggregate Bond ETF, which moves in line with the Bloomberg Global Aggregate Total Return index.

Finally, the HSBC Global Government Bond ETF is another strategy aiming at regular income and capital growth by replicating the performance of the FTSE World Government Bond index, giving investors access to global investment-grade government bonds at a competitive cost.

These two funds by HSBC have ‘ETF’ within their names because of Central Bank of Ireland regulations, but there are both listed (ETF) and unlisted (index mutual fund) share classes of the strategies.

Source: FE Analytics

Earlier this week, we covered the funds approved by Fidelity, interactive investor, Hargreaves Lansdown and Barclays, as well as those that lost their best-buy status in 2024.