Property programme ‘Location, location, location’ advised prospective buyers to find the cheapest house on the nicest street and Mike Fox, head of equities at Royal London Asset Management, has a similar nugget of wisdom for investors.

“When you find an exciting area to invest in, find the dullest company in it. Don't buy Moderna, buy AstraZeneca. Don't buy Zoom, buy Microsoft,” the FE fundinfo Alpha Manager said.

“The big mistake people make with innovation is that they find something exciting and buy very nascent businesses. You've got to invest in proper companies that benefit from these things, rather than early stage companies that may look genius for two years but then just disappear.”

Fox believes the prolonged compounding of returns is the best way to make money, so he isn’t interested in a stock that will jump by 50% one year, only to crash the next.

For instance, oncology is one of the fastest growing areas within healthcare and some biotechnology companies with blockbuster drugs could perform exponentially well. But it is hard to predict which companies will succeed or even be viable in five years’ time. By contrast, AstraZeneca is a safer pair of hands and has one of the leading oncology franchises, Fox said.

Similarly, investors can be confident Microsoft will still be around in 20 years’ time and it consistently delivers double-digit annualised returns, he continued.

For Fox, Nvidia is on the cusp of being a risky bet. He is confident the chip designer will still be in business in five years’ time but even so, Royal London Asset Management only holds it within its highest risk portfolios.

He prefers ASML, whose machines print advanced microchips, and Taiwan Semiconductor Manufacturing Company (TSMC). Both companies will continue to do well regardless of which chip designer, be it Nvidia, Broadcom or someone else, gains ascendancy. TSMC does carry more geopolitical risk, however, due to its location in Taiwan, he pointed out.

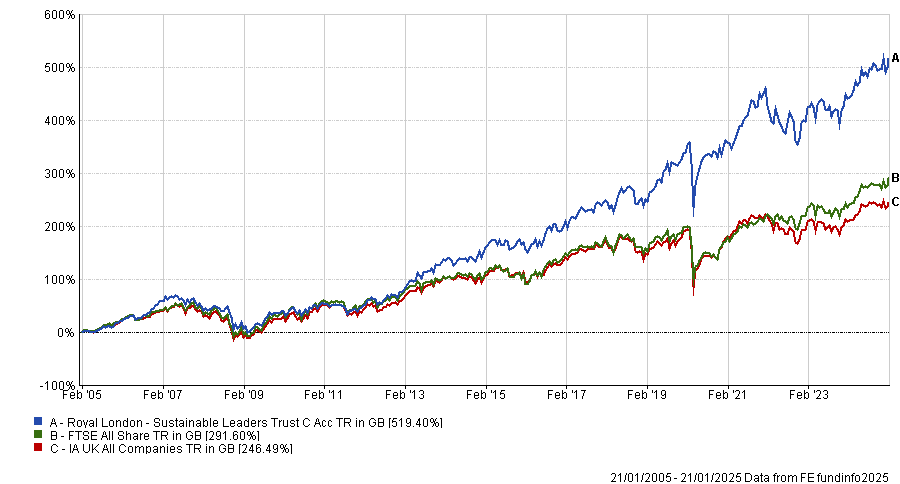

Fox has a proven track record over the past 20 years, with his Royal London Sustainable Leaders Trust fund outperforming the IA UK All Companies sector and FTSE All Share benchmark. Below, Trustnet looks at other lessons he has learned over his storied career so far.

Performance of fund vs sector and benchmark over 20yrs

Source: FE Analytics

Look where everybody else is avoiding

One lesson Fox has gleaned from a quarter-century of booms and busts is to focus on industries other investors have spurned.

“You have to have a mentality of looking at areas that are on the floor, that everybody's given up on. You might not buy them, but you have to see merit in doing some work on them,” he explained. Banks, for instance, were deeply unloved for years but performed well in 2024.

“And then equally on the upside, you have to think about which areas of the market could be extended, where all the optimism is discounted in the price.”

Quantitative easing and ultra-low interest rates following the global financial crisis briefly put an end to this way of thinking. “This counter-cyclical mentality, which you were taught as a fund manager in the late ‘90s and 2000s, was completely blown away in the 2010s because you just bought great companies. You didn't really worry too much about what price you paid for them and you made a ton of money,” he said.

“The 2010s do look increasingly anomalous, particularly from an interest rate perspective, and allowed low-value-add sectors to perform really well. Property would be a good example of that.”

Fox does not anticipate a crash anytime soon but he does think volatility will pick up and contrarians will be needed once again.

Optimists make more money but investors must prepare for the unexpected

Fox’s mentality has evolved since he began his career in 1999. “The two things I've noticed over the years is I’ve become more optimistic and more risk averse,” he said.

“Optimists make much more money” and are often proved right as equity markets trend upwards. Yet it is not always easy to be optimistic and having lived through a few market crashes, fund managers tend to become more risk averse as their careers continue.

The most important disruptions are those no one forecasts, such as Covid-19, Fox pointed out. So rather than trying to manage risk by speculating about possible scenarios, he thinks fund managers should prepare for the unexpected. Doing so has made him less inclined to own companies with a lot of debt.

Buy and hold investing is prone to getting clobbered

Fox thinks the buy and hold method of investing – “buy good companies and do nothing” – has been taken too far and will come under pressure, especially for managers with concentrated portfolios of 30 stocks or so. This is because the definition of a good company evolves.

For example, the rising popularity of obesity drugs has meant consumer staples – a stalwart of buy and hold portfolios – are under pressure. “Even if only 10% of the population takes obesity drugs, it blows a hole in alcohol, chocolate, a bunch of other things that we’d always assumed would be around in 100 years’ time,” he explained.