Investors ditched active European funds in their droves across 2024, according to the latest fund flow data on FE Analytics, with passive trackers picking up the pieces.

Europe had been on a strong run in 2022 and 2023, with the Euro STOXX index the third-best performer among its peers when compared with the MSCI World, MSCI ACWI, S&P 500, FTSE All Share, MSCI Emerging Markets and TSE Topix indices.

However last year it dropped to the worst performer among these seven indices, as market volatility rose following the French split election and the collapse of Germany's coalitions in November and December.

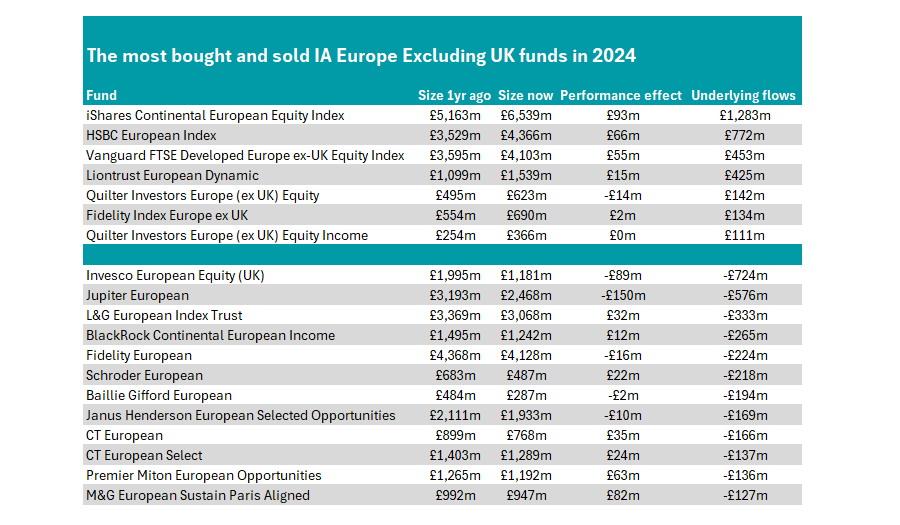

Investors were largely split on the asset class, however. Comparing fund flows, below we looked at all IA Europe Excluding UK funds with £100m or more of net inflows or outflows in 2024.

Some £3.3bn was added to funds that increased their assets under management by more than £100m, while £3.2bn was removed from those investors shunned.

Standing at the top of the table, iShares Continental European Equity Index was the most sought-after fund, with £1.2bn of new money added throughout the course of the year as investors showed a clear preference for passives.

It is overseen by Kieran Doyle and tracks the FTSE World Europe ex UK index, with large holdings in photolithography machine maker ASML, software firm SAP and healthcare provider Novo Nordisk.

iShares Continental European Equity Index sits in the second quartile of the IA Europe Excluding UK sector over one, three, five and 10 years, slightly ahead of the average peer over each period.

Passive funds were the order of the day in Europe, with HSBC European Index (£772m) and Vanguard FTSE Developed Europe ex-UK Equity Index (£453m) taking the second and third place respectively.

Source: FE Analytics

The first active fund on the list was Liontrust European Dynamic, run by James Inglis-Jones and Samantha Gleave, which took in £425m of net new money over the course of 2024.

Inglis-Jones and Gleave use the ‘Cashflow Solution’ process, which looks for companies that have significant operations in the European Economic Area and Switzerland and judges them based on their historic cash flows and how they are invested to support their forecast profits growth.

The fund sits in the top quartile of the sector over three, five and 10 years, slipping to the second quartile over the past 12 months.

Analysts at FE Investments rate the fund. They said: “The managers have put together a stellar performance track record, which is remarkably consistent regardless of the macroeconomic backdrop, illustrating the strength of their market regime indicators in calling market inflections.

“They have proven their ability to outperform independent of whether the ‘value’ or ‘growth’ style is in favour, providing a compelling core offering for investors in European equity.”

Turning to the other side, active funds are far more prevalent among those with £100m or more in net outflows, including behemoths such as Invesco European Equity (UK) and Jupiter European.

The Invesco fund has been a bottom-quartile performer over one and 10 years, while it climbed to the third quartile of the IA Europe Excluding UK sector over three and five years.

Managed by John Surplice and James Rutland since 2020, the large-cap fund shrunk from almost £2bn at the start of 2024 to £1.2bn by the end of the year.

Jupiter European was next, with assets under management dropping from £3.2bn to £2.5bn in 2024.

FE fundinfo Alpha Manager Mark Heslop and Mark Nichols took the reins from Alexander Darwall in 2019, when he left to set up his own firm. The fund managers inherited a large holding to Wirecard, which filed for insolvency amid an international financial scandal, but had begun to sell it down, minimising the impact.

Since, however, returns have been middling. The fund is in the bottom quartile over one and five years and is in the third quartile of the peer group over three years.

Other giant funds on the outflows list include BlackRock Continental European Income, Fidelity European, Janus Henderson European Selected Opportunities, CT European Select and Premier Miton European Opportunities, which all still have assets under management of more than £1bn despite investors pulling between £265m and £136m from these funds in 2024.

Elsewhere, FE Analytics does not hold fund flow data for the IA Europe Including UK sector, so it was unavailable in this study.

In the IA European Smaller Companies peer group, only one fund registered more than £100m in inflows or outflows. Here, investors pulled £174m from Barings Europe Select Trust, with its AUM falling from £646m to £474m by the end of 2024.

Managed by Nick Williams since 2005 with Colin Riddles and Rosemary Simmonds joining him in 2016 and William Cuss added to the fund in 2020, it remains a second-quartile performer in the sector over one, three and 10 years but has slipped behind the average peer over five years.

The fund remains rated by analysts at Square Mile, however, who said Williams has a “sensible approach to investing”, looking for quality companies that have “both growth potential and reasonable market valuations”.

“Historically, the smaller cap segments of the European stock markets have provided plenty of opportunities for active managers to add value. Whilst there will be times that the fund might lag the index, such as when riskier stocks are in demand or when sentiment is driving share prices, we believe the managers should be able to meet their objectives and deliver attractive riskadjusted returns over the long term,” they said.