We may be barely a month into 2025 but there’s already been much to ponder, from the inauguration of Donald Trump (alongside the ubiquitous Elon Musk) to soaring bond yields in the UK. Oh, and the small matter of Saba Capital launching a very punchy campaign to wrest control of seven investment trusts.

This ever-changing backdrop presents a considerable challenge for investors looking to position their portfolios for the year ahead. Will the inexorable share price rises of the Magnificent Seven finally run out of steam (or charge in the case of Tesla)?

It would certainly be fair to say that investors keeping their faith in unloved sectors will be hoping for their share of the spoils if the current concentration finally unwinds.

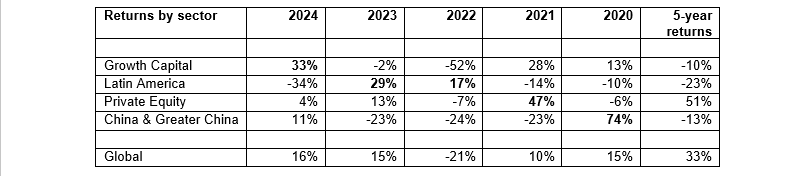

While long-term portfolio allocations remain the bread and butter of investing, there’s an undeniable thrill in managing to pick the best-performing sectors ahead of their time in the spotlight. With that in mind, let’s canter through the top-returning AIC sectors in each of the past five years (with the top-returning sector in each year shown in bold):

Source: FE Analytics, based on share price total returns in sterling by AIC sector (excluding sectors with a total net asset value of less than £1bn)

The results serve as a timely reminder that the Magnificent Seven (et al) are not the only show in town when it comes to impressive returns, with the Growth Capital sector overtaking North America to take the gold medal position last year. It was the turn of Latin America to take the lead in 2022 and 2023, with Private Equity and China taking top honours in 2021 and 2020 respectively.

However, unless you’re endowed with near-supernatural foresight, timing sector-specific investments to reap all of the upside and none of the downside would have been quite a feat.

It’s also a very different story over a longer time period, with three of the four sectors serving up negative returns over five years and even the technology sector experienced its own annus horribilis in 2022.

This highlights the risks of going ‘all in’ on individual sectors in preference to a diversified, all-weather portfolio. Back in the day, a global exchange-traded fund (ETF) was a simple way of enhancing portfolio diversification, but its function has been diminished by the dominance of the Magnificent Seven, which currently account for 20% of the MSCI ACWI Index by weight (and even more by returns).

With that in mind, might the ‘steady eddies’ ultimately outperform the sector stars over time? The answer is quite possibly in the case of actively managed global funds. They may not have topped the table for annual returns, but the AIC Global sector has delivered positive returns in all but one of the five years (and in fairness not many sectors finished 2022 in the black).

The global sector’s five-year return of 33% outperformed all but one of the top sectors in our table, showing the merit of leaving sector (and country) allocations to the professionals who can leverage considerable on-the-ground resources and local expertise.

One such option is the newly merged Alliance Witan which offers a one-stop option for global equities, with a small group of fund managers asked to submit a ‘best ideas’ portfolio of around 20 stocks. The trust typically has a highly active share against the benchmark and is currently underweight North America and overweight the UK and Europe.

Alliance Witan has delivered positive returns in all but one of the past five calendar years – which is no mean feat given the challenges posed by the pandemic, geopolitical conflict and soaring interest rates.

Although it made a modest negative return of 6% in 2022, this was the second lowest in the AIC Global sector and it has achieved a five-year return of 65% to the end of 2024.

Another consistent performer is Brunner, which aims to provide an all-weather global portfolio to deliver strong returns across a range of market conditions. Against the risk-on backdrop in 2020 and 2021 and bear market in 2022, the trust has delivered a five-year return of 80% by the end of 2024.

Brunner offers a differentiated exposure to global equity markets due to its UK weighting (which currently accounts for just under a quarter of the portfolio), together with exposure to mid-caps and private equity via its holding in Swiss-headquartered Partners Group.

Looking ahead, it could be an opportune time to consider whether an actively managed global fund might deliver superior returns to the merry-go-round of trying to pick the top-performing sectors in any given year.

As billionaire investor George Soros aptly observed: "It's not whether you're right or wrong that matters but how much money you make when you're right and how much you lose when you're wrong."

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.