The pan-European STOXX 600 index closed at a record high on Wednesday 29 January after strong results from ASML reassured investors. Europe’s fortunes have improved this month, led by its largest companies including Novo Nordisk, which last Friday announced successful trial results for one of its next-generation obesity products.

This marks a reversal of fortunes after last year, when Europe’s largest companies pulled the whole market down, said Jamie Ross, portfolio manager of the Henderson European Trust. “2024 was a year of mega-cap failure in Europe,” he stated.

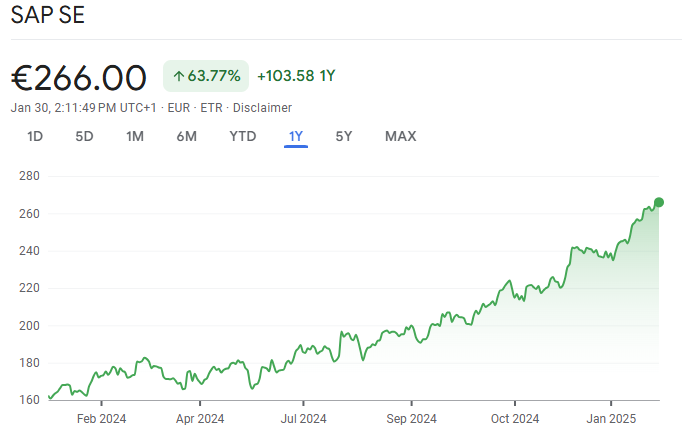

Of Europe’s five largest companies by market capitalisation, only SAP, the German software company, had a good year. Announcing its fiscal year 2024 results on 28 January, SAP reported a 10% increase in overall revenue and 25% growth in cloud revenue.

Performance of SAP over 1yr

Source: Google Finance

The other four mega-caps (ASML, Novo Nordisk, Nestlé and Roche) had an awful year, Ross said. “ASML effectively profit warned on a softer semiconductor equipment environment. Novo Nordisk had a trial failure in December as well as sentiment gradually worsening through the year in respect to the competitive environment it faces in obesity.

“Nestlé has really struggled to push through volume growth after several years of strong pricing and Roche had pretty sluggish performance, which has improved in recent months.”

The Henderson European Trust doesn’t own Nestlé but the other four mega-caps all feature amongst its top 10 positions.

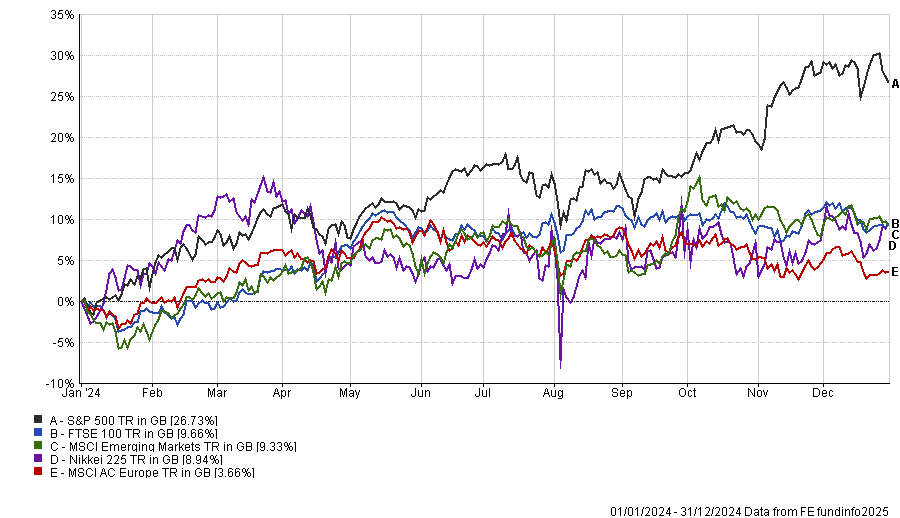

Europe underperformed all the other major regions last year, as the chart below shows, but there are signs of its fortunes reversing.

European stock market vs other regions in 2024

Source: FE Analytics

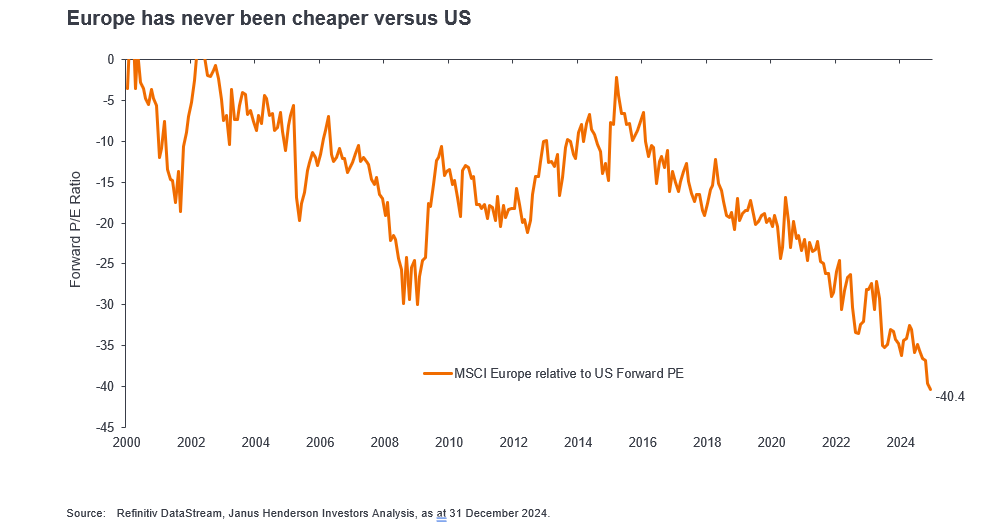

First, valuations look compelling. “It has literally never been cheaper in my entire career,” said Ross, who has 17 years of investment experience. Europe is trading on an average price-to-earnings (P/E) ratio of 13-14x versus 20-21x for the US. Generally speaking, valuations below the mid-teens are attractive, Ross explained.

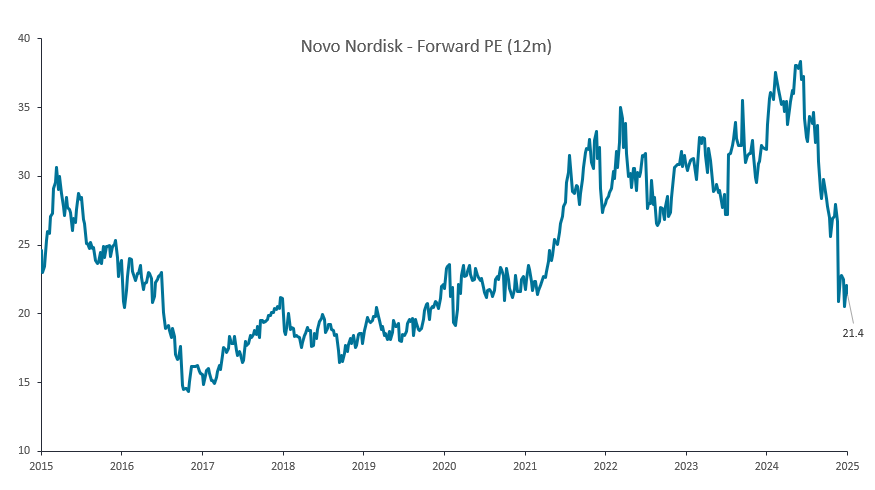

Novo Nordisk, which Janus Henderson Investors has owned since before 2017, is currently trading on a cheaper valuation than it has in years, he said. Novo Nordisk’s forward P/E is 21.4x compared to a 10-year average of 24.4x, as the chart below shows.

Novo Nordisk’s forward P/E over 10yrs

Source: Janus Henderson Investors

The pharmaceutical giant is the trust’s largest holding, worth 5.1% of the portfolio as of 31 December 2024.

The Henderson European Trust itself is trading on a 9.5% discount to its net asset value “so you are buying a discounted play on a discounted market with fund managers who, over time, have added value,” he pointed out.

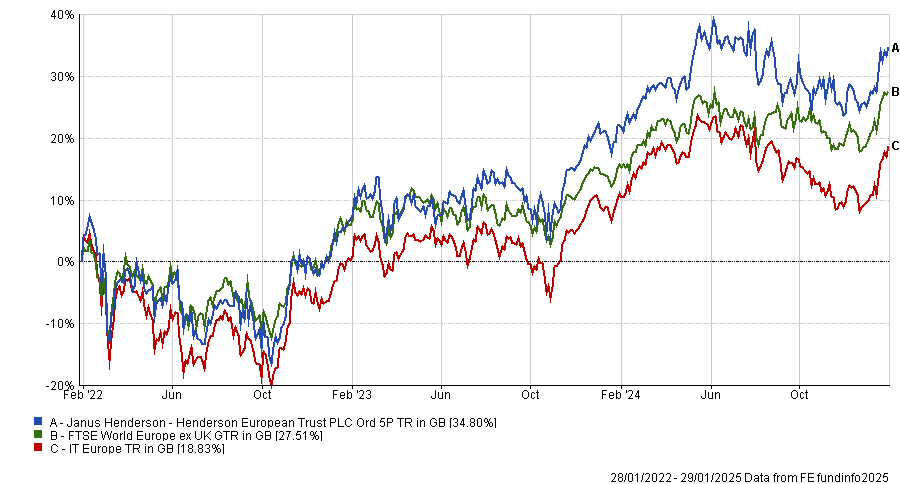

The trust was the second-best performer in the six-strong IT Europe sector over one and three years to 29 January 2025 and came third over five years.

Performance of trust vs benchmark and sector over 3yrs

Source: FE Analytics

Meanwhile, Ross is bullish on ASML, whose lithography machines are used to make advanced chips. He believes the market has underestimated the potential demand for artificial intelligence (AI) and robotics, which he thinks will be the next leg in the AI race.

Performance of ASML over 5yrs

Source: Google Finance

The European equity market offers broad, diversified exposure to the AI capex theme, he continued, from suppliers of building materials used to construct data centres to electrical engineering companies such as Siemens and Schneider (which are both top 10 holdings for the Henderson European Trust).

A revival amongst the index’s largest names such as ASML might encourage investors to choose passive strategies, but Ross countered that market concentration is less severe in Europe where the top five companies account for about 10% of the benchmark, compared to 27% for the S&P 500.

In the US it has been difficult for fund managers to beat their benchmarks if they are underweight the largest names, but that is not so much of an issue in Europe.

In addition to cheap valuations, AI capex and a large-cap turnaround, a fourth factor working in Europe’s favour is “decent signs of a consumer recovery”. For this reason, Ross initiated a position in Ryanair in June and July 2024.

“We look at airlines as an instant signal on the consumer”, he said, because airlines adjust their pricing according to demand. “That’s really come through in spades over the past few months and its actually quite US-centric but not exclusively. So we’ve seen really strong results from US airlines and we’ve seen improving results from European airlines.”

The luxury goods industry has been in the doldrums for the past 12-18 months, largely due to China’s economic slowdown. However, in the run up to the US election, improving confidence led to higher US demand for luxury goods. For instance, Burberry reported strong consensus-beating numbers last Friday.

Ross now expects the recovery in airlines, luxury and US credit card data to spread to other areas such as spirits and cars.

Meanwhile, he does not think tariffs will be as large a headwind as markets initially feared and expects US president Donald Trump to take a steady, targeted approach, rather than a blanket imposition of high tariffs on day one.

“The market [had] assumed that Trump’s bite on tariffs will be just as bad as his bark,” he said, but post-inauguration, sentiment has becalmed somewhat with an unwinding of tariff trades.