Friday 31 January 2025 marked the five-year anniversary of the UK’s withdrawal from the European Union and the FTSE 100 celebrated by hitting an all-time high that morning.

But that news masks a tumultuous five years during which UK equity funds have suffered unrelenting outflows and significantly underperformed US stocks.

The Covid pandemic, which began just after Brexit, exacerbated the shock to the UK economy – as did the inflation spike of 2022 and subsequent aggressive interest rate hikes.

Last year marked the ninth consecutive year of outflows from UK-focused funds, according to Calastone’s Fund Flow Index. They shed £9.6bn in 2024, which was less than 2023’s £12.1bn. However, compared with the huge inflows other equity funds enjoyed, 2024 was the UK’s worst year for relative flows on record.

Ed Legget, manager of Artemis UK Select, thinks international investors didn’t understand Brexit or the subsequent state of UK politics and felt the UK was just too complicated to invest in, especially as it is such a small part of global benchmarks (3.1% of the MSCI All Country World Index as of 31 December 2024).

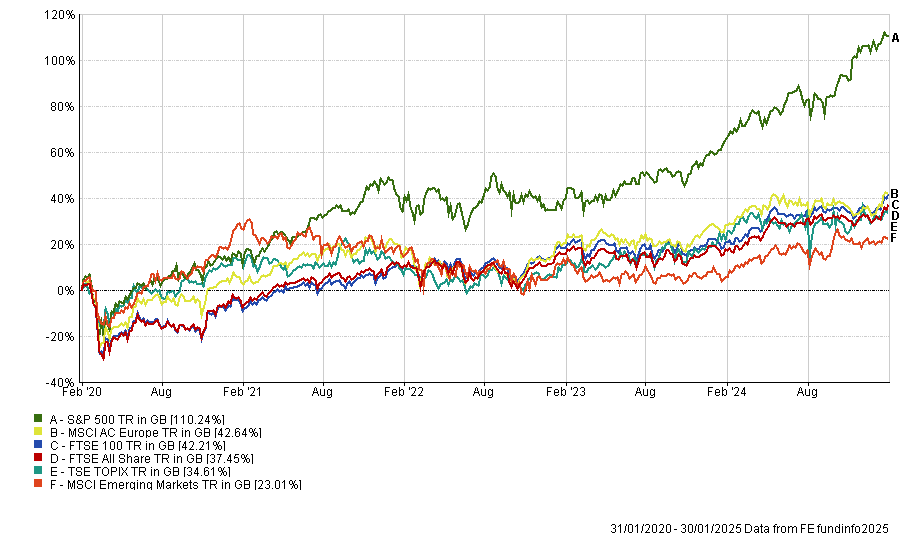

Investors pulling money out of the UK to invest in the tech-heavy US market would have been well rewarded, as the chart below shows.

Performance of UK equities vs other regions over 5yrs

Source: FE Analytics

Even so, the FTSE All Share’s compound annual return of 6.3% since 31 January 2020 is comfortably ahead of GDP growth and cumulative inflation, said Russ Mould, investment director at AJ Bell. “It is therefore quite possible to argue that UK equities have been fairly resilient during the five-year period, given uncertainty over what the outcome would be, the after-effects of Covid-19 (and the damage done to the public finances) and other global events during the period, notably wars in Eastern Europe and the Middle East,” he pointed out.

“Equally, sceptics could argue that the UK stock market has been held back. The Stoxx Europe 600 index has a provided compound annual return of 8.6% a year since 31 January 2020, Japan’s Nikkei 225 13.7% and America’s S&P 500 has more than doubled the returns from the UK with a compound annual total return of 14.9% a year.

“Sterling still trades below the $1.31 level at which it stood five years ago, although it is a fraction higher against the euro compared to January 2020 (but not June 2016). This suggests some overseas investors remain reticent about holding sterling-denominated assets.”

How has Brexit impacted the UK stock market?

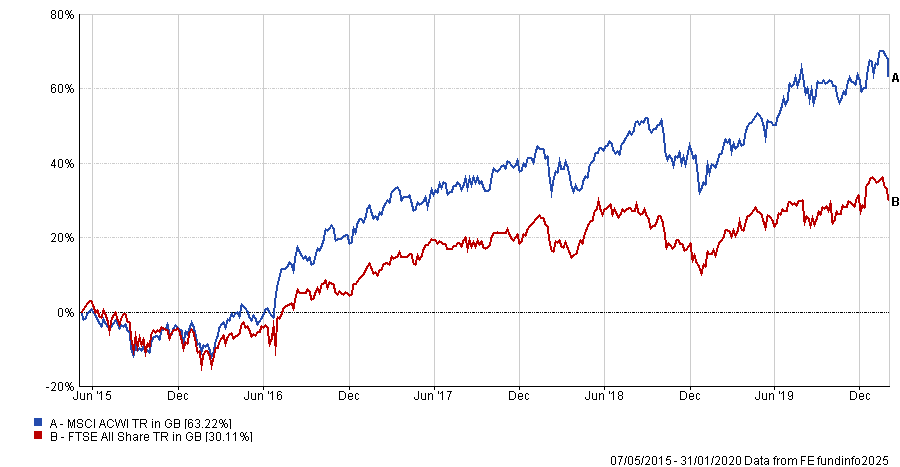

Brexit had a far more detrimental impact on the stock market during the period between the 2016 referendum and the UK leaving the EU, said Legget. Speculation about whether the UK would crash out of the EU without a deal caused volatility because “stock markets hate uncertainty”.

“You didn’t know what type of Brexit you were going to get. You didn’t know if everyone was going to walk out of the negotiating room at two minutes to midnight and borders would shut, so that wasn’t good for UK risk assets,” he explained.

The chart below shows the performance of the FTSE All Share from 7 May 2015, when David Cameron’s Conservative party won the election and he announced an in/out referendum in his victory speech, though the referendum itself on 23 June 2016, until the UK officially left on 31 January 2020.

Performance of UK vs global equities, 7 May 2015 to 31 Jan 2020

Source: FE Analytics

Brexit has been cited as a factor prompting companies to move their listings abroad. This and the dearth of initial public offerings are often “used as sticks with which to beat the London Stock Exchange”, Mould said, yet he feels Brexit is not the root cause.

“The number of stocks listed in the US has halved over the past 40 years and developed markets such as Singapore and Australia are also shrinking as firms are acquired and new floats prove relatively rare,” he noted.

“There are long-term trends at work here where Brexit has little or no influence, including how cheap debt has been relative to equity for companies for more than a decade, the rigours and regulation and reporting requirements of listed firms and the rise and rise of private equity, itself a beneficiary of cheap debt, which allows firms to find funding away from public arenas.”

Sectors that have flourished and struggled

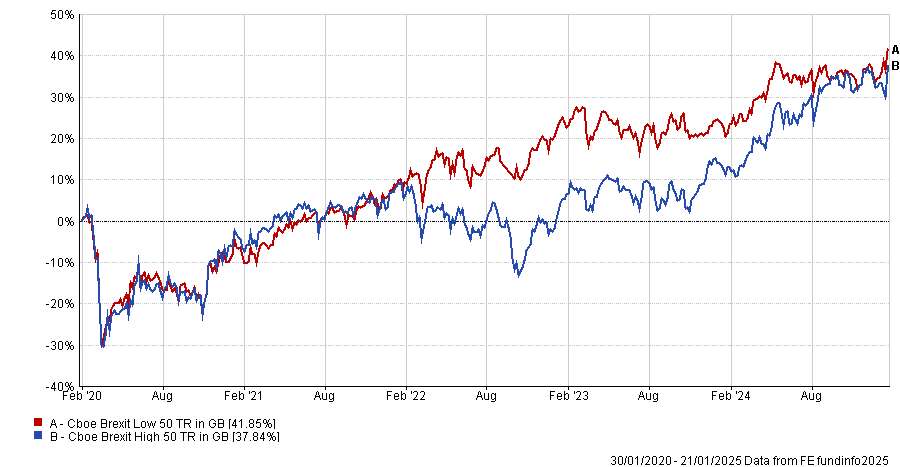

The Cboe Brexit High 50 and Low 50 indices, comprised of the 50 companies within the Cboe 100 UK index that derive the largest and smallest portions of their revenues from the UK, respectively, serve as a bellwether for how Brexit has impacted British companies.

As the chart below shows, companies earning more of their revenues abroad fared marginally worse between December 2020 and July 2021 but outperformed significantly between 31 January 2022 and 10 September 2024. The gap has closed in recent months however, with the Cboe Brexit Low 50 index finishing ahead by four percentage points.

As Legget observed: “Weak sterling is a tailwind for anyone who’s got overseas earnings when they report that back into sterling.”

Performance of Cboe Brexit High 50 and Low 50 indices over 5yrs

Source: FE Analytics

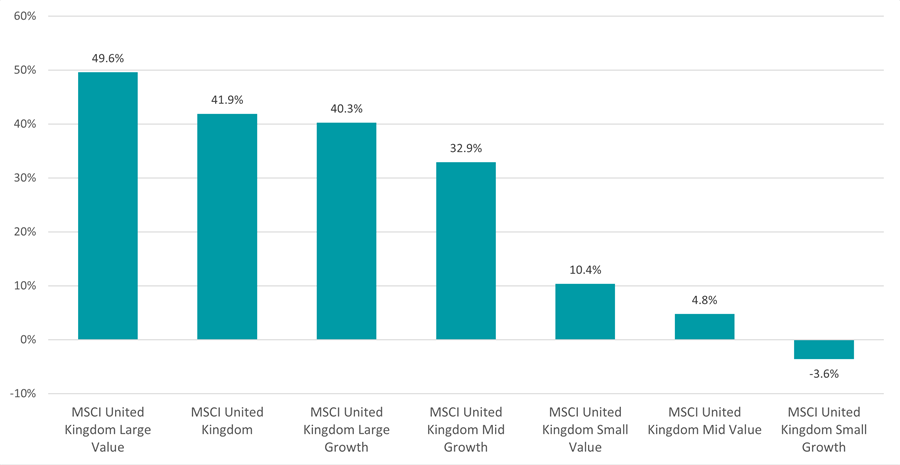

An additional dynamic has been the significant underperformance of small- and mid-caps, which are more exposed to the domestic economy than larger businesses.

Performance by market cap and style over 5yrs

Source: FinXL

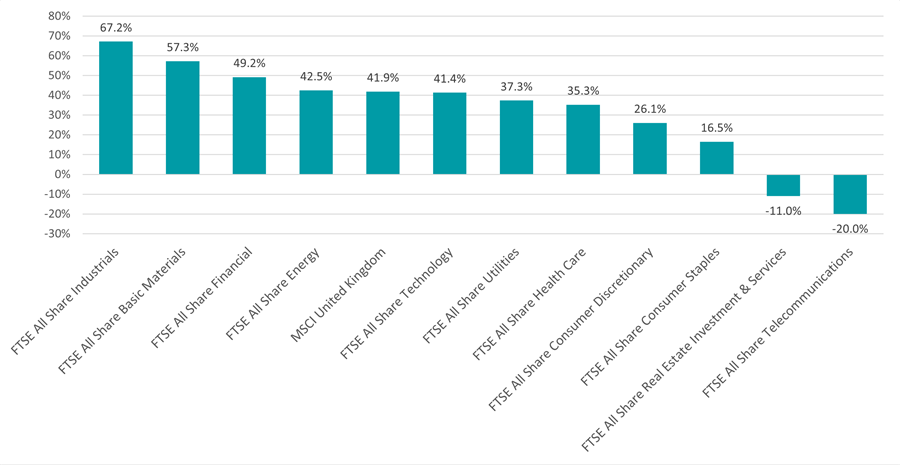

In terms of sectors, industrials, basic materials, financials and energy have all outperformed the broader market, as the chart below illustrates.

Performance of UK industries over 5yrs

Source: FinXL

Within industrials, Rolls-Royce had a management turnaround and a post-Covid recovery in its end markets. BAE Systems has benefited from defence spending becoming a higher priority for governments as geopolitical tension has escalated.

Elsewhere, Banks and energy stocks have performed well in an environment of higher interest rates and inflation, said Legget, whose Artemis UK Select fund is the best performer in the IA UK All Companies sector over the five years to 30 January 2025, up 77.8%.

Prior to Brexit, banks and energy companies endured 10 years of material headwinds during which they reduced their cost bases and transformed their businesses to make them more competitive. Now they are reaping the rewards of top-line growth combined with less debt and lower costs, he explained.

At the other end of the spectrum, telecommunications and property lost money. The consumer staples and discretionary sectors also underperformed, reflecting the impact of inflation, the cost-of-living crisis and higher mortgage rates on people’s propensity to spend.