The start of 2025 has been eventful with the inauguration of US president Donald Trump and the emergence of a new artificial intelligence model from China’s DeepSeek.

We start with Trump, where an unprecedented number of executive orders during his first few days in office set the tone for what could be a busy four years for the US government.

Ben Yearsley, director at Fairview Investing, said: “The first 10 days or so of the second coming have been a whirlwind of histrionics, hyperbole and tariff threats.”

Trump has “wasted no time offending countries/continents/Democrats” while also threatening, imposing, rescinding and reimposing tariffs, he noted.

“The tariff question is the obvious elephant in the room. Colombia buckled rather quickly at the threat of them, what will Canada, Mexico and China do in response to being the first countries to be hit. And how long before Europe gets the tweet?” Yearsley asked.

Trump has also weighed into the tech space, telling US companies to improve in the face of the new DeepSeek threat, which has launched a new artificial intelligence (AI) model that requires much less computing power than incumbent products. “This hammered US tech for a few days with Nvidia losing $600bn in a day,” Yearsley said.

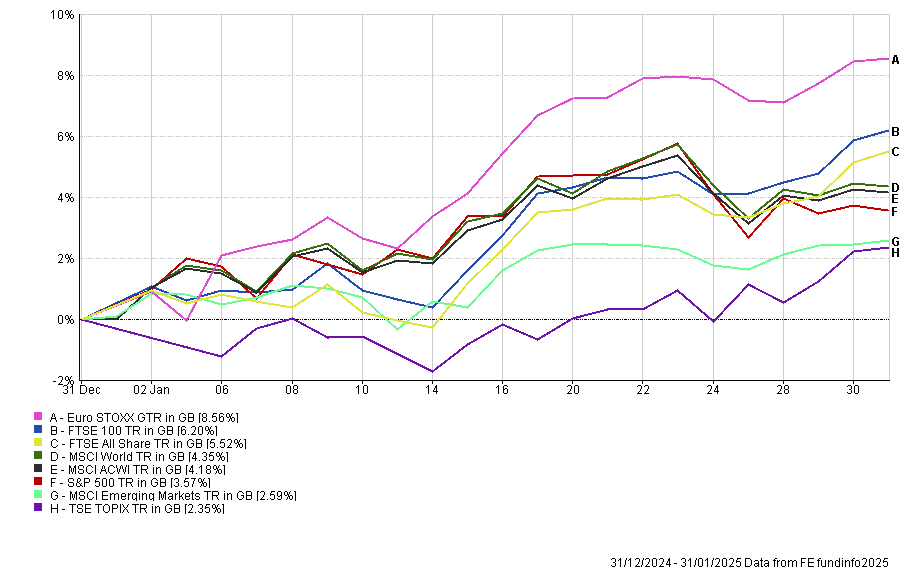

Despite all of this, equity markets held up well, with all major indices up in the month of January. The FTSE 100 hit several all-time highs, although Yearsley noted it remains “cheap compared to history”. However, it languished behind the “surprise January package” that was European markets, which topped the tables.

Performance of indices in January

Source: FE Analytics

“Maybe it’s the actions of the European Central Bank with another rate cut that is helping propel markets,” said Yearsley. The EuroStoxx gained over 8.6% in January, despite myriad issues including the threat of tariffs from Trump, ongoing war in Ukraine and political uncertainty overhanging from elections in 2024.

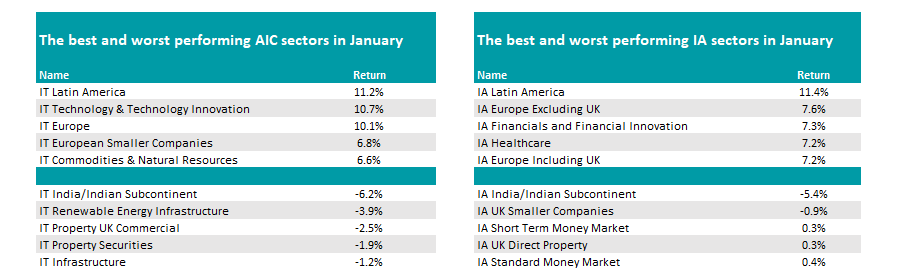

In terms of how this impacted funds and investment trusts, Latin America was the place to be invested, with the relevant Investment Association and Association of Investment Companies (AIC) sectors topping their respective lists.

“After a poor 2024 when Latin American funds propped the tables falling 25% on average January feels somewhat of a rebound – is it a dead cat bounce though?” asked Yearsley.

Among fund sectors, this was followed by IA Europe Excluding UK, alongside thematic specialists IA Financials and Financial Innovation and IA Healthcare.

Source: FE Analytics

On the investment trust side, IT Technology & Technology Innovation still performed well despite the DeepSeek tech sell-off, with IT Europe, IT European Smaller Companies and IT Commodities & Natural Resources rounding out the top five.

The latter may hint to why Latin American funds and trusts also performed well. The region is synonymous with mining and price rises are often seen as positive for the region.

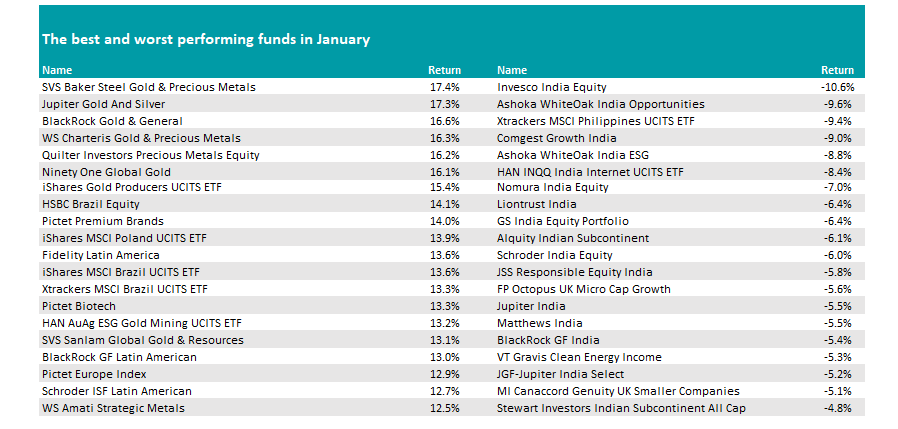

This can also be seen in the list of top-performing funds, where the top seven are all related to gold and other precious metals.

They were joined by Latin America specialists, while there were no European funds in the top 20, despite the market performing well.

Source: FE Analytics

In the Investment Association it was almost a clean sweep of gains, with 47 of the 49 sectors delivering a positive return last month. India the worst sector falling 5.4% while UK small-caps were the only other group in the red, down 0.9%.

Like the list of winners, the table above shows 16 of the 20 worst funds in January were India specialists, with Invesco India Equity down the most, registering a 10.6% loss.

Outside of India, FP Octopus UK Micro Cap Growth and MI Canaccord Genuity UK Smaller Companies both made losses of more than 5% as the UK minnows continue to be hit harder than the rest of the domestic market.

In the investment trust space, Ground Rents Income topped the table after it received an offer to go private at a substantial premium to the prevailing share price but below the last published net asset value.

“This could be the trend for 2025 – an esoteric trust being taken over topping the tables each month,” said Yearsley.

Other names of note including Scottish Mortgage, which rose 13.7%, making it one of the month’s biggest gainers, as well as Baillie Gifford European Growth Trust, which was up 12.1%.