The boards of Baillie Gifford US Growth and Keystone Positive Change achieved decisive victories today as Saba Capital Management’s proposals to unseat them were defeated.

The majority of Baillie Gifford US Growth trust’s shareholders made their voices heard, with votes cast representing 78.4% of total voting rights. Excluding Saba’s votes, 98.5% of the votes cast for US Growth and almost 99% for Keystone were against Saba’s resolutions.

Tom Burnet, chair of Baillie Gifford US Growth, said: “Faced with the threat to their investment posed by Saba's self-serving and destructive proposals, shareholders have mobilised and acted decisively to protect their investment. The result is unambiguous and conclusive.”

Saba had proposed replacing both trusts’ entire boards with two of its own nominees: its chief investment officer Boaz Weinstein and Miriam Khasidy, a legal and business professional, at Baillie Gifford US Growth; and Saba portfolio manager Paul Kazarian plus John Karabelas, head of US institutional sales at MUFG, at Keystone.

If successful, the new directors would have considered replacing Baillie Gifford with Saba as the trusts’ investment manager and changing their mandates to investing in discounted trusts.

Saba also said it would consider liquidity events, yet these are already underway at Keystone Positive Change. The trust has offered shareholders an uncapped cash exit and/or a rollover into a similar open-ended fund, Baillie Gifford Positive Change.

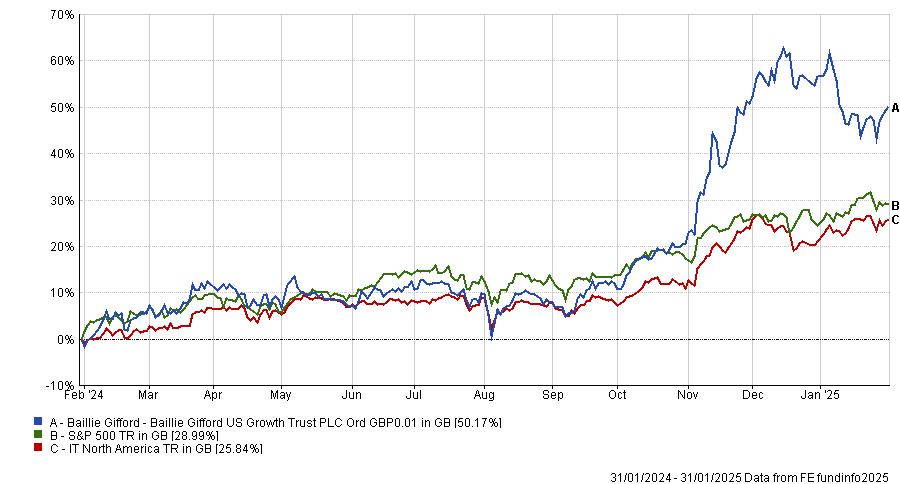

Saba’s campaign revolved around wide discounts and underperformance at seven companies, but the US Growth trust’s discount has narrowed significantly over the past few months as its share price soared. The trust’s total return in 2024 reached 56%, more than double the S&P 500’s 26.7% in sterling terms.

Performance of trust vs sector and benchmark over 1yr

Source: FE Analytics

Saba lost its battle to take over Herald on 22 January and faces the judgment of shareholders in Henderson Opportunities and CQS Natural Resources Growth & Income tomorrow.

The European Smaller Companies Trust will meet on Wednesday 5 February and Saba’s campaign concludes with Edinburgh Worldwide on 14 February.

Meanwhile, Henderson Opportunities announced proposals this morning to wind up. Shareholders will be able to choose between receiving cash, rolling their investment into a similar open-ended fund – Janus Henderson UK Equity Income & Growth – or a combination of both.

James Carthew, head of investment companies at QuotedData, said Herald's emphatic rejection of Saba's proposals last month gives him hope that Saba will lose all of these votes.

“One positive result may be that investors are better able and more likely to vote at company meetings in future,” he said. “Real change seems to be happening at some platforms and a change of company law to enforce shareholders' rights may not be far behind.”

Keystone Positive Change was the most bizarre of Saba's targets, he continued: “Why would an activist claiming to be acting in investors’ best interests seek to block a cash exit? The optics were dreadful and made us question from the start whether Saba really knew what it was doing.”