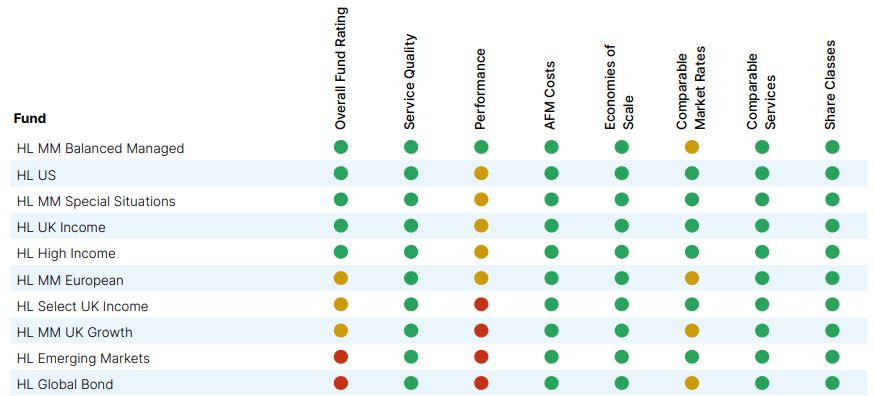

The HL Emerging Markets and HL Global Bond funds have been judged “poor value” and three more “require additional focus” in Hargreaves Lansdown’s value assessment.

In the latest edition of the annual report, which covered the 12 months from September 2023 to September 2024, the platform assigned a red, yellow or green tier to each of its funds with a track record of at least 12 months. Funds were scored in seven areas – service quality, performance, costs, economies of scale, market rates, comparable services and share class.

Of the 19 funds included, 10 were flagged as requiring some work in at least one of the above areas.

HL Emerging Markets didn’t pass the review for its poor performance – an improvement from last year, when it was also found lacking because of its high fees, which have since been reduced by 11 basis points to the current ongoing charges fee (OCF) of 1.16%.

Since then, the fund was repositioned towards “a more disciplined approach” with a focus on emerging markets rather than Asia and emerging markets and the then eight-strong portfolio management team was restructured with three removals and one addition.

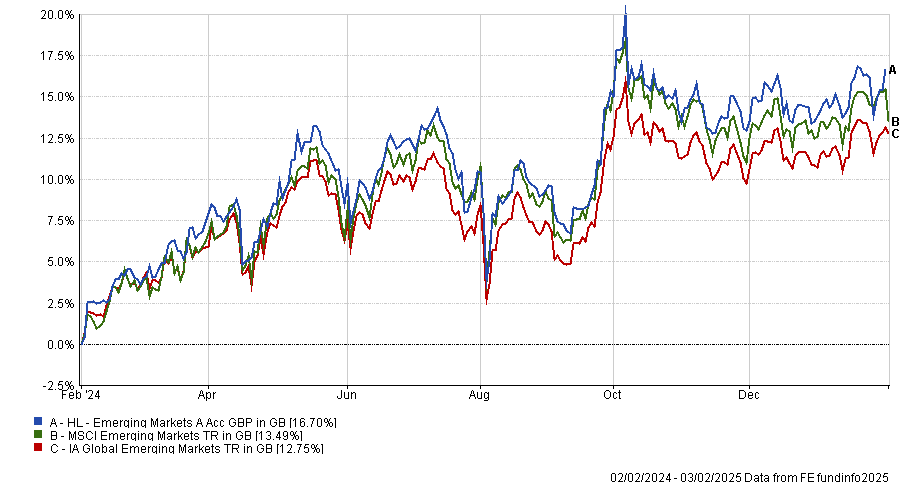

Performance of fund against sector and index over 1yr

Source: FE Analytics

The report read: “The short-term impact of changes has yielded positive results as we are now seeing a stabilisation in the performance numbers, though not enough to move to the amber tier.”

In the past 12 months, the fund has beaten its benchmark and sector, as shown in the chart above.

The second and last fund not worth investors’ money is HL Global Bond, which has been delivering poor performance for an above-market cost.

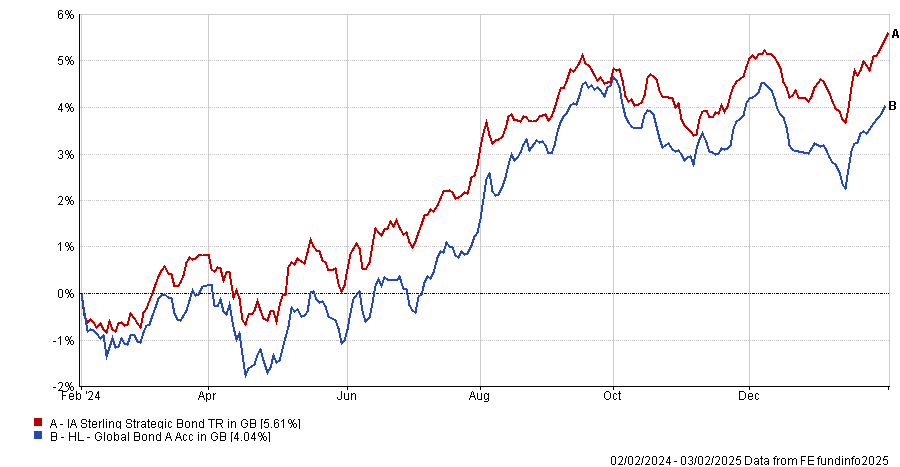

Reportedly, manager selection contributed positively, but the global allocation was a headwind against a peer group with a bias towards UK bonds. The underperformance has continued into the past 12 months, as the chart below shows.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Hargreaves’ policy has been to work towards a “more disciplined approach to asset allocation, a more global positioning as well as changes to manager selection”; it also reduced the allocation to total return funds and added “several global managers with clear track record” in delivering outperformance in specific markets.

HL Multi-manager European, HL Multi-manager UK Growth and HL Select UK Income are the three funds “in need of work”.

For the former, costs and performance have improved from red to amber since last year, as the platform’s ongoing monitoring has been focusing on “maintaining an appropriate blend of holdings, while always being on the lookout for ways to improve the portfolio”.

A number of changes have also affected the UK multimanager strategy, which became less sensitive to style rotations and re-thought some of its positions, including exiting a main holding within the fund following the departure of its manager.

Finally, the managers of the HL Select Income portfolio have been at work to increase diversification within the fund by raising the numbers of companies held and raising exposure to some faster-growing dividend-paying companies, such as Games Workshop, Kainos Group and Ryanair.

Eligible funds with red or amber ratings

Source: Hargreaves Lansdown