Slow and steady investing might be better than risking it all on the latest fads. For Chris Elliott and James Knoedler, co-managers of the £443m IFSL Evenlode Global Equity fund, investing should be like following the rules on a golf course: “you want to stick on the fairway”, said Knoedler.

Instead of getting swept up in the excitement over megatrends like artificial intelligence (AI), Elliott and Knoedler argue that investors should prioritise companies with characteristics that can stand the test of time.

Good long-term investing, the team at Evenlode believes, should be about getting rich slowly. Knoedler said Evenlode would rather be “the broccoli of fund management” than failed sharp shooters. By contrast, investing in AI can be like “taking shots at a moving target”, he added.

For Evenlode, fundamentals and durability of earnings separate exceptional companies from those that are merely good. Quality companies should have characteristics that increase in value over time. For instance, with AirBnB, the ‘network’ effect means as more guests use the service and as more hosts add their properties, the entire offering becomes more valuable to all parties.

“At the heart of it, we want to identify something that gives you the assurance the good economics that you are getting today can persist out into the future,” Knoedler said. These characteristics should ensure that the best companies are insulated from the impact of market megatrends.

“We do not want to be sharpshooters. If you think about it, this is maybe a ‘broccoli’ approach to fund management. It is a bit of a snooze fest, but it is good for you,” Knoedler said.

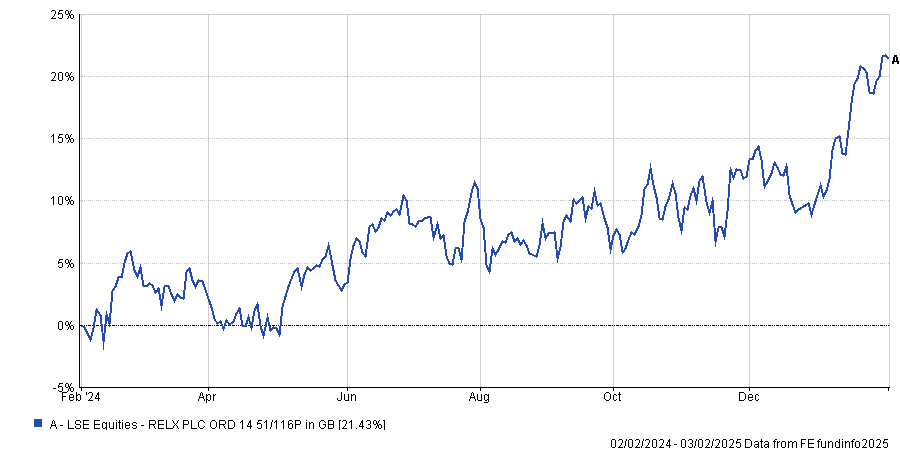

For example, Elliott pointed to RELX Group as a stock that has “compounded its sales and earnings at a healthy rate in the teeth of headwinds which have stalled the broader index”.

Share price performance of RELX over the past year

Source: FE Analytics

He explained that as a multi-national company, its revenue is internationally broad. As a result, it can endure geopolitical conflicts and upheavals better than a more domestically exposed business.

Additionally, while it benefits from developments in AI, it is not dependent on it. Elliott said: “Whether the generative AI model is there or not will not change the fact that people must buy the Lexus Nexus product to operate a legal office.”

Other holdings, such as Mastercard, follow a similar philosophy. It may be a technology company, but it is so tightly bound to its end market that Knoedler argued it was indifferent to AI. “If it [AI] does not show up, it can still make money the old-fashioned way,” he said.

For Elliott, while this does mean Evenlode will never participate in the full upside of AI implementation, it will never have to stomach the complete downside either.

This was a trade-off Elliott and Knoedler were “content to make”, prioritising risk control rather than getting into investments that may not stand the test of time.

This philosophy made it challenging for Elliott and Knoedler to justify investing in the Magnificent Seven (Microsoft, Nvidia, Apple, Tesla, Alphabet, Amazon and Meta).

"Developments like DeepSeek and AI are exciting, aren't they? They have a seductive effect,” Knoedler said. However, they argued that in the current investment cycle, AI companies could rise and fall rapidly.

Knoedler explained that this made it extremely difficult to determine what companies had durable earnings, which made betting on AI-focused companies risky.

“With AI, we would be taking shots at a moving target,” Knoedler said.

For this reason, Elliott and Knoedler own just three of the Magnificent Seven: Microsoft, Alphabet and Amazon. While these companies are at the forefront of semiconductors and AI implementation, they are multi-faceted and can approach AI in different ways. Knoedler said that this made them the best amongst the Magnificent Seven.

Elliott is cautious about Nvidia and other semiconductor companies. It is a highly cyclical industry, prone to rapid “changing of the guard”, he said. As a result, to bet on AI, “you have to be prepared to sit there and say this time it is different, that this time there is not a cycle anymore”.

Finally, they remained concerned about Magnificent Seven valuations. Elliott explained that every company has its price and the costs of AI-dependent companies are high, with the current adoption cycle set to put them even higher. “There must be a valuation point where you are unwilling to own anything in that sector. That is where we are right now,” he concluded.