The world today seems to be the oyster of contrarian investors, with so few sectors and geographies unchallenged by events. But things sometimes turn out in a different way than one might have expected, as the case seems to be for Europe. Despite all odds – weak exports to China, political uncertainty and the spectre of US tariffs just to name a few – the region has grown almost 10% so far in 2025.

Below, Trustnet asked a number of experts if Europe can continue on its upward trajectory and which funds investors could consider to take advantage.

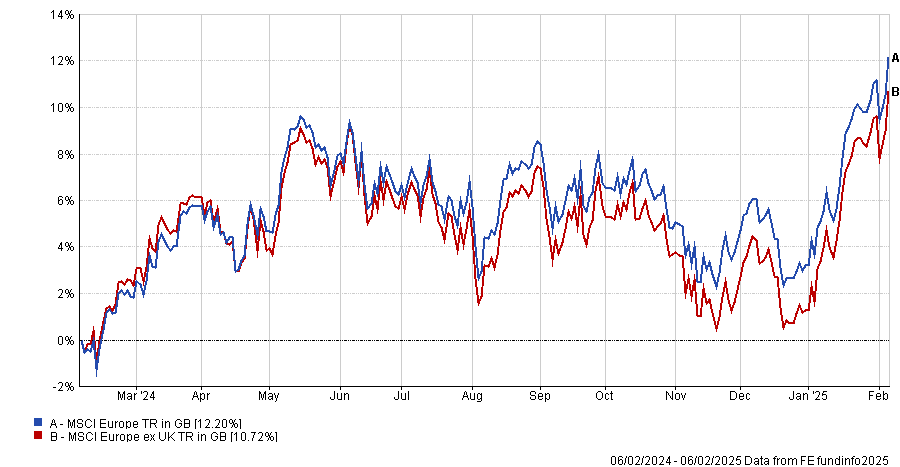

Performance of European equities over 1yr

Source: FE Analytics

The headwinds impacting Europe could begin to subside this year, according to Tom Wildgoose, global equities senior portfolio manager at Sarasin & Partners.

“The new UK government, despite a rocky start, has expressed a clear intention to strengthen ties with Europe,” he said. “Additionally, a potential resolution to the war in Ukraine, spurred on by President Trump, could unleash a wave of rebuilding efforts, further boosting economic prospects.”

Another key attraction is Europe’s valuation gap compared to the US, which could set the stage for a potential recovery. This is particularly evident in the industrials sector, where companies are currently trading at a price-to-earnings ratio discount that is four points lower than their US peers: “a significant shift from parity seen just four to five years ago,” Wildgoose said. A similar valuation gap exists in the consumer sector.

“Against this backdrop, European stocks present a compelling case for future outperformance, with improving sentiment and attractive valuations,” he said.

Also, Europe has a good track record of turning challenges into opportunities, according to Daniel Avigad, manager of the Lansdowne European Special Situations fund.

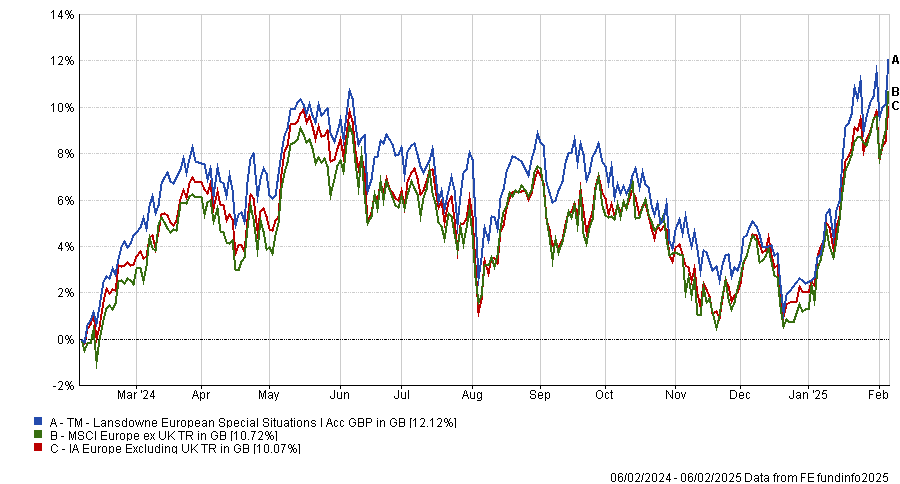

Performance of fund against sector and index over 1yr

Source: FE Analytics

He is seeing this at play in sustainable and circular technologies to tackle Europe’s natural resource deficit. As these solutions gain global relevance, he believes some of the world’s most influential companies in this field will emerge from Europe.

Another challenge-turned-opportunity is the ageing population, which is amplifying the value of ‘productivity enabler’ companies and specialists in niche outsourcing markets, for example contract catering, construction equipment rental and pest control.

“Businesses operating in these markets have established formidable barriers to entry through deep expertise and specialised technology, making them resilient to disruption,” Avigad said. “As Europe's working-age population declines, reliance on these niche specialists will only increase, strengthening their pricing power and positioning them for long-term success, regardless of broader economic conditions.”

Furthermore, 2025 is going to be the year when Europe’s small and mid-cap stocks close their performance gap versus large-caps, which is currently at one of its widest points in history, according to Hywel Franklin, head of European equities at Mirabaud Asset Management.

This will also be the year when “exemplary yet unloved management teams” reap the fruits of their labour.

“Investors often focus too much on head and tailwinds affecting companies and markets, underestimating the impact of management action, which can often have a material impact,” he said.

“Some of the best management teams in Europe have been under pressure since the pandemic, but over the past few years have implemented so many efficiencies and cut costs so far that they are positioned for positive performance in 2025 almost irrespective of what happens around them.”

To maximise the opportunity set, the manager is focusing on true small-caps with a market cap below €2bn.

“The recovery of smaller companies will be aided by rate cuts and other abating macro headwinds,” he said. “Right now, we are finding many companies that offer significant upside for investors with a medium to long-term outlook”.

But not everyone was convinced. Raj Shant, managing director at Jennison Associates, offers a more bearish case.

“With key events ahead, starting with German elections in February, it seems likely that investors in European equities may have to be content with yet another year of modest returns, or work even harder to uncover areas of the market that can show some secular growth,” he said.

“We also doubt Beijing’s ability to turn around domestic challenges and provide a demand boost for European corporates.”

For investors who feel like it’s time to give Europe a chance, Darius McDermott, managing director at FundCalibre, picked the European Opportunities Trust, which offers investors access to a high-conviction portfolio of European equities with a bias towards medium and larger companies.

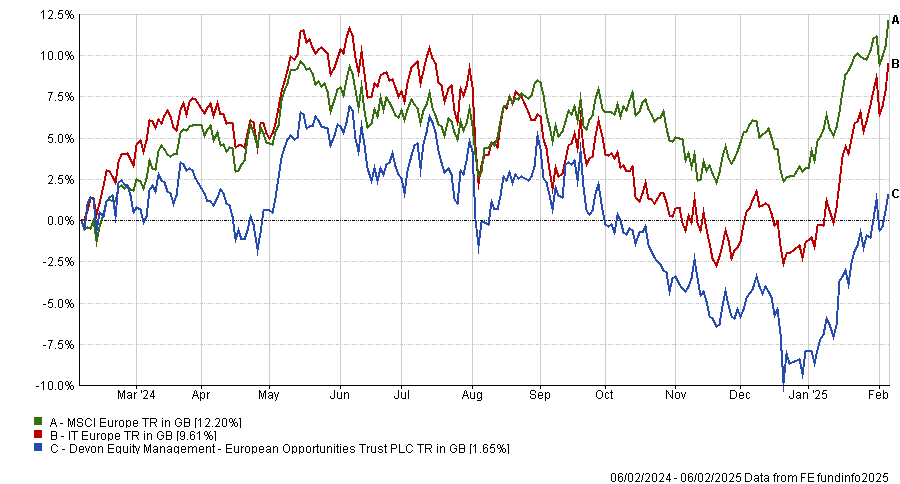

Performance of fund against sector and index over 1yr

Source: FE Analytics

“Manager Alexander Darwell has developed a real aptitude for recognising patterns of success in company business plans and management teams,” he said.

While performance has been soft over the past five years, McDermott appreciated Darwell’s skill which, combined with his patient and value-aware approach, has provided shareholders with excellent returns over the long term. “This strategy is well positioned for success going forward,” he concluded.

Meanwhile, European dividends are set to hit a record high this year, according to the latest Allianz Global Investors Dividend Study. Driven by robust performance in healthcare and information technology, dividends are forecast to grow 13% by 2026, reaching €496 billion.

To capitalise on this trend, McDermott suggested using vehicles such as Montanaro European Income and BlackRock Continental European Income.

Finally, for fans of smaller companies, he recommended the Janus Henderson European Smaller Companies fund. It focuses on growth but also applies a valuation lens, which is rare in the small-cap space.