For investors such as Warren Buffett, buying stocks is a long-term commitment. As one of his well-known quotes goes: “Our favourite holding period is forever.”

However, while this approach remains popular, some equity managers have succeeded by straying away from it.

For example, the Liontrust European Dynamic fund, managed by Samantha Gleave and James Inglis-Jones, has benefitted from a more flexible approach to stock selection. “We are not buy forever and hold forever investors,” Gleave explained.

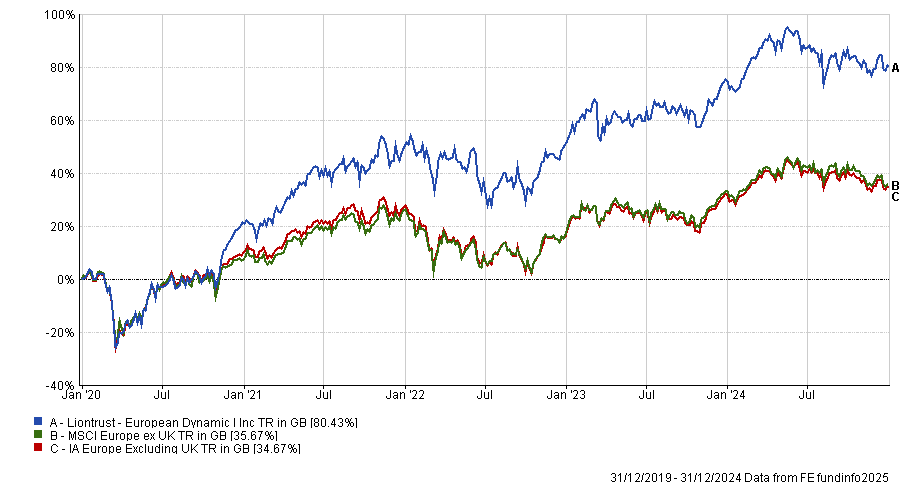

This approach made her fund the best-performing strategy in Europe between 2019 and 2024, with a return of 80.4%. Over wider time periods it has also performed well, with the second-best result in the peer group over the past 10 years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics, data to 31 Dec 2024.

The fund invests in ‘cashflow champion’ stocks with historically strong fundamentals, which Gleave and Inglis-Jones expect to perform well in the future.

However, Gleave said stocks do not remain cashflow champions forever. Poor results or market trends can indicate a former top-performing business might be due for a turnaround. “If a stock does deteriorate through the lens of our investment process, then we will sell it,” she said.

As a result, Gleave and Inglis-Jones are prepared to sell current winners to make room for new, more attractive opportunities.

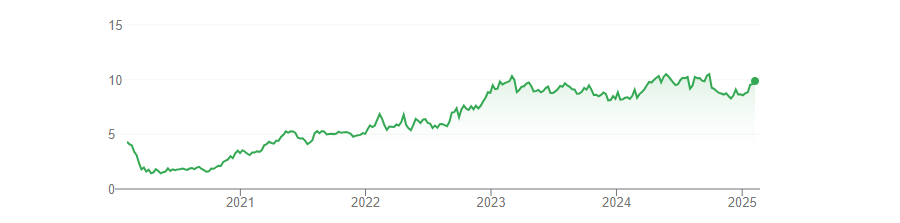

For example, the fund used to hold the European semiconductor company ASML. It had been one of their cashflow champions for many years, with high returns on capital and strong fundamentals. Over the past five years, its share price has surged by 156%.

Share price performance over past 5yrs

Source: Google Finance

However, “by the time we got to summer last year, our investment screens picked up deteriorating signs in its cash flows and balance sheet metrics, prompting us to sell it early”, she said. Gleave does not regret this choice, as ASML's share price has fallen by 16% over the past year.

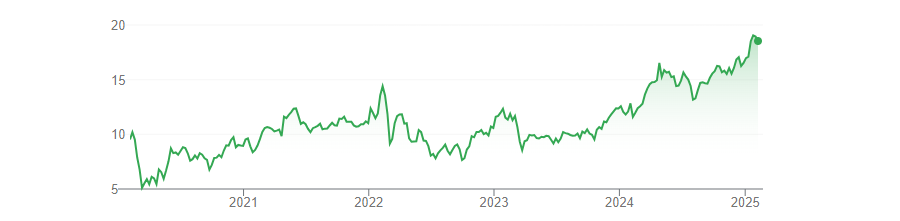

For another example, she pointed to the Bank of Ireland. Liontrust bought Bank of Ireland in 2020 on a price-to-book value of 0.3x. Like many banks, it had a strong balance sheet and was flush with capital, demonstrated by its announcement of a €520m share buyback plan in February 2024.

Despite this, it was trading on a cheap valuation because banks had been unloved since the global financial crisis.

Share price performance over past 5yrs

Source: Google Finance

“With Bank of Ireland, we were paid to take risks, and from a risk-reward perspective, the skew looked attractive. It rose four or five times in the years we owned it,” Gleave said.

However, she sold it last year despite conceding it has "not done badly since".

Some investors might find this surprising, but for Gleave, the decision to sell current winners such as ASML and Bank of Ireland early reflects a commitment to the fund’s investment process.

“This is a very disciplined, rules-based investment process and we will absolutely and persistently apply that process. When we designed our investment process, we wanted to ensure it was dynamic and flexible,” she added.

While the Bank of Ireland had recovered from Covid and valuations had moved slightly, “some of the positive momentum just faded”.

Additionally, the decision to sell Bank of Ireland offered an opportunity to refresh the portfolio and invest in other businesses such as Deutsche Bank, which is now the ninth-largest holding in the portfolio.

Deutsche Bank has experienced “all sorts of troubles over the past decade” but the current outlook is quite convincing, Gleave said.

She attributed this to new management, which has restructured the business and improved efficiency. It also has a strong balance sheet and is returning excess capital to shareholders through buybacks, including a €675m share buyback programme in July 2024.

“It moved onto our cashflow champions watchlist in 2023 and it had great secondary scores and good recovery value. From our perspective, it looked quite attractive,” she said.

When she initially bought it in late 2023, it was worth €10 euros but is now closer to €19.

Share price performance over past 12 months

Source: Google Finance

“There is always competition for space in the portfolio,” Gleave concluded. Embracing this, instead of holding the same stocks forever, has been crucial to the fund’s success.